Higher Education Finances - How Have They Fared, And What Options Will An Incoming Government Have?

23rd June 2024

The next government faces difficult choices on higher education funding, with tuition fees frozen and international student recruitment falling.

1. Excluding volatile pension cost adjustments, the higher education sector posted a surplus of 3.7% of its income in 2022/23 (£1.5 billion), down from 6.1% of income (£2.5 billion) in 2021/22. Over the same period, the proportion of higher education providers in deficit, weighted by their total income, increased from 1 in 10 to 1 in 5.

2. The 2022/23 surplus was lower than in most years since 2015/16. Teaching-intensive providers, which historically have had larger surpluses, posted their smallest surplus in at least eight years.

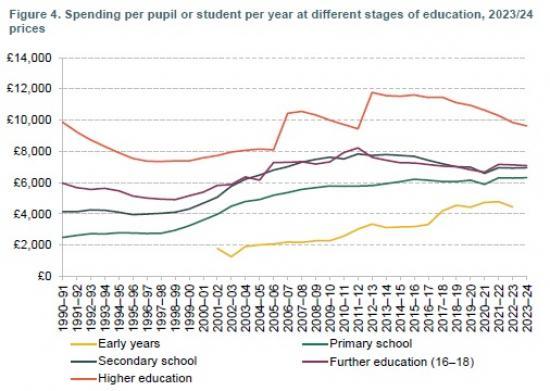

3. The main factor behind the sector's worsening financial performance was the nominal freeze in undergraduate tuition fees for domestic students. Since it was raised to £9,000 in 2012, the cap on domestic undergraduate fees has only increased once, to £9,250, in 2017. Per-student funding for teaching home undergraduate students has now fallen by 18% in real terms since 2012/13 but is still slightly higher than in 2011/12.

4. Real-terms falls in undergraduate fee income were partly offset by higher income from international students. Yearly fee income from non-EU international students nearly doubled in real terms from £4.7 billion in 2016/17 to £8.9 billion in 2022/23. If income from non-EU international students had remained at its 2017/18 level, the sector surplus would now plausibly be around 3 percentage points lower at around 0.7% of income.

5. According to data from the Office for Students, providers in aggregate expected only a tiny surplus of 0.8% in 2023/24. This may still turn out to be optimistic, as it is predicated on continuing strong growth in the number of non-EU international entrants (16%), when Home Office data on study visas suggest a decline. However, with overall sector net assets worth around 16 months of expenditure (15 months for teaching-intensive providers), the sector is well placed to withstand any temporary shortfalls.

6. The cheapest and most straightforward option for an incoming government to address the sector's worsening finances would be to allow the cap on tuition fees to expire at the end of the 2024/25 academic year. This would be worth £270 million to the sector in the first year and £1.8 billion by 2029/30 compared to a continued freeze. Only about a quarter of the cost would be borne by the taxpayer (and this would be capital spending). The rest would be borne by students, mostly in the form of higher student loan repayments in their 40s and 50s.

7. An alternative would be to increase per-student teaching grants for universities. Greater grant funding for teaching would give the government more control over what subjects were taught but would be much costlier for the taxpayer than increasing fees.

Read the full IFS report o one page HERE

Download the IFS report HERE

Pdf 29 Pages