Old Age Tendencies - The Impact Of Tax And Benefit Changes On Intergenerational Fairness Ahead Of The 2024 General Election

27th June 2024

Molly Broome, Alex Clegg, Sophie Hale & Charlie McCurdy at the Resolution Foundation look at how older age groups have fared since 2010.

In this Spotlight we look at the impact of spending, tax and benefit decisions taken since 2010 through the lens of intergenerational fairness. What stands out in this context is the increase in the generosity of the State Pension, which has led to a £44 billion increase in spending, benefiting older age groups.

By contrast, working-age households have seen benefits cut. And although recent cuts to National Insurance (NI) have offset the extent to which policy decisions have tended to favour older age groups, it is clear that households with children have been left worse off by tax and benefit changes made since 2010.

Looking ahead, both main parties are implicitly committed to personal tax increases baked into plans for the next parliament, as well as to the continuation of benefits policies from the 2010s. These include an additional three years of freezes on the main Income Tax and personal NI thresholds, freezing Local Housing Allowance (LHA) and the benefit cap, continuing to roll out the two-child limit, and continuing the triple lock for pensions.

Overall, the impact of implementing these policies would reinforce the long-term trend of the personal tax and benefit system favouring pensioners.

Perhaps recognising this imbalance, both main parities' manifestos include pledges that could benefit working-age households. The Conservatives have pledged further NI cuts that would benefit workers below the pension age, although the burden of the proposed £12 billion of welfare cuts would likely fall overwhelmingly on working-age households.

Labour's offering to those of working age has centred around promises to reform the world of work. Both parties have made pledges to support home ownership and improve access to education and training, which will be of particular benefit to younger adults. And the Conservatives have proposed mandatory National Service, a policy that is popular with those aged 65 plus, but not among young adults. While such measures can help redress a growing imbalance, achieving intergenerational fairness requires policy that looks beyond measures for specific age groups and instead grapples with our long-standing problem of weak growth that has led to a reversal in generational pay progression.

Demographic pressures have shifted the age profile of how the state allocates resources since 2010

As we have discussed in previous work, societal ageing has already shifted our politics. So, as we approach polling day, we take an intergenerational lens to the big decisions made by successive Conservative governments on spending, tax and benefits and ask how they have affected different age groups since 2010. And, looking ahead, we also consider what the main parties have to offer younger generations.

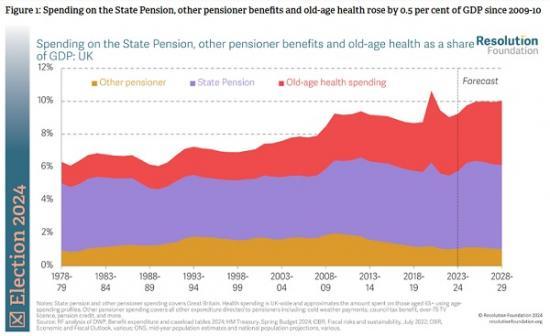

We start with public spending, where there has been a substantial increase in spending on those over the pension age. Spending on the State Pension, other pensioner benefits and old-age health is expected to amount to £270 billion in 2024-25, equivalent to 9.8 per cent of GDP.[1] Since 2009-10, such spending on pensioners will have increased by 0.5 per cent of GDP, up from 9.3 per cent, as shown in Figure 1.

What stands out is the increase in spending on the State Pension: between 2009-10 and 2024-25, spending on the State Pension is expected to have increased by £44 billion in real terms. Over this period a large cohort of ‘baby boomers' has moved into retirement: even with changes that pushed back the State Pension age, the number of people claiming the State Pension will have increased by around 570,000 (from 12.4 million to 13.0 million) between 2009-10 and 2024-25, and is set to rise to 13.2 million by 2028-29.

But more of the rise in spending has been driven by the increased generosity of the State Pension.[2] Meanwhile, an older population has increased demands on the healthcare system. Between 2009-10 and 2024-25, real health spending will have grown by an estimated 36 per cent, with about half of that explained by demographic changes.[3]

Changes to benefit policy since 2010 have favoured older age groups

Policy decisions since 2010, particularly in the area of social security, have played a key role in the shift in spending towards older generations.

Our previous work has detailed the negative impact of all social security changes since 2010 on working-age household incomes. This has been characterised by three distinct phases: narrowing benefit eligibility and cuts to needs-based support between 2010 and 2015; freezes to most non-pensioner benefits between 2015 and 2019; and changes between 2019 and 2024 that raised average incomes for many low-income working households, but not by enough to offset the previous cuts.[4]

But the story was very different for pensioner benefits over the same period. Pensioners have benefited from the implementation of the triple lock policy, which increases the State Pension by the highest of growth in average earnings, prices, or 2.5 per cent, and the introduction of the new State Pension, a more generous flat-rate pension that is paid to men born from April 1951 and women born from April 1953. The triple lock is the most important single policy decision directly affecting pensioner incomes taken by Conservative governments since 2010 and has led to the value of the State Pension rising by 60 per cent between 2010-11 and 2023-24, faster than growth in average earnings (46 per cent), double the increase in the basic rate of working-age benefits over the same period (30 per cent), and equivalent to a real-terms rise of 16 per cent. Figure 2 shows that benefit changes have favoured older age groups, resulting in non-pensioners being on average £1,400 a year worse off by 2024-25 compared to 2010-11, with pensioners over £900 better off.[5]

Read the full Resolution foundation article HERE

Download the full report HERE

Pdf 11 Pages