Is It Time To Stop Drinking? - Minimum Unit Pricing For Alcohol Increases On 30 September 2024

24th August 2024

It may be for health reasons that Minimum Unit Price for alcohol is being raised again but it adds to the profits of sellers as it is not a tax. The Scottish Government is pressing ahead with the increase even though it will add to the cost of living. Good for health but not for some people's personal budget.

It comes at almost the same time as increase to energy prices as the CAP is about to increase.

For pensioners the heating allowance is to cease unless you are entitled to pension credit (If you are a pensioner get it checked soon)

Inflation has fallen significantly since it hit 11.1% in October 2022, which was the highest rate for 40 years.

However, that doesn't mean prices are falling - just that they are rising less quickly. Overall the cost of living is still increasing. Minimum pricing for alcohol may just be small increase but it adds to all he other increases.

Minimum unit pricing sets the lowest price an alcoholic drink can be sold for. By law, alcohol cannot be sold cheaper than this.

The minimum price for alcohol is currently 50p per unit. From the end of September 2024 this will increase to 65p per unit.

How minimum unit pricing works

The more alcohol a drink contains, the higher the minimum price for that product will be.

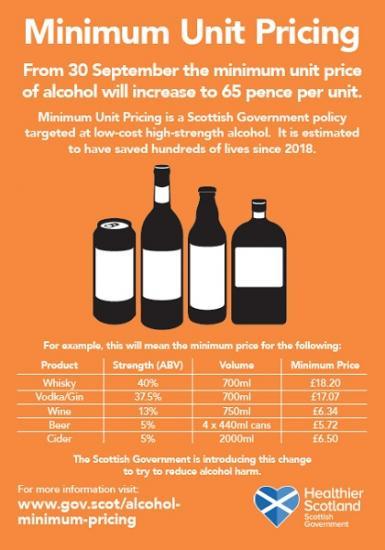

For example, from 30 September 2024 this will mean the minimum price for the following:

whisky (700ml bottle at 40% strength) - £18.20

vodka/gin (700ml bottle at 37.5% strength) - £17.07

wine (700ml bottle at 13% strength) - £6.34

beer (4 average-sized cans at 5%) - £5.72

Why we have minimum unit pricing

Minimum unit pricing aims to reduce alcohol-related harm by making alcohol less affordable. Research into minimum unit pricing has shown that this has helped reduce alcohol-related deaths and hospital admissions.

It is not a tax and does not generate income for the government.

Minimum unit pricing was introduced in 2018. In April 2024, the Scottish Parliament voted to keep minimum unit pricing and increase the minimum unit price from 50p to 65p per unit.

There is already lots of tax and duty on alcohol

In the UK, alcohol is subject to both standard rate VAT and alcohol duty:

VAT

As of September 2023, the standard rate VAT on alcohol is 20%, which has remained unchanged since 2011.

Alcohol duty

As of August 2023, the alcohol duty rates for different types of alcohol are:

Beer: £21.01 per litre of alcohol for products with a strength between 3.5% and 8.5% ABV

Cider: £9.67 per litre of alcohol for both still and sparkling ciders with a strength between 3.5% and 8.5% ABV

Spirits or spirit-based products: £24.77

Wine, including sparkling wine: £24.77

Products less than 3.5% ABV: £9.27 per litre of alcohol

The government announced in Spring 2023 that it would increase alcohol duty rates in line with the Retail Price Index (RPI) from August 1, 2023. However, the Conservative government froze duty rates at their 2023 levels in Autumn Statement 2023 and Budget 2024, and they are expected to remain unchanged until February 2025.

Abroad

Wine can be up to 60% cheaper in France than the UK, because we pay so much in taxes that the French don't pay.

UK consumers pay 43% more for alcohol than the European average.