Blowing Away The Competition - What To Make Of Britain's 2024 Renewable Energy Auction Results

4th September 2024

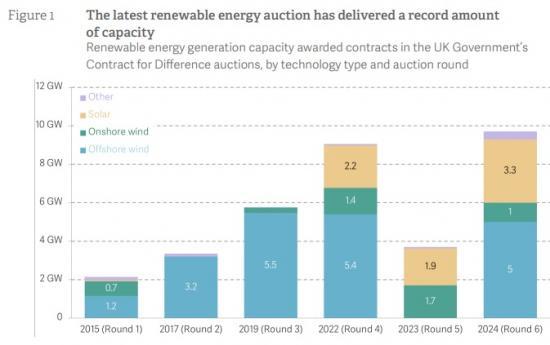

The latest round of renewable energy auctions procured a record 9.6 gigawatts (GW) of low-carbon energy, of which the majority (5 GW) was offshore wind. This represents a much-needed acceleration towards the new Government's ambitious decarbonisation targets and was essential given the failure of last year's auction.

This is good news: as well as quickly moving the UK towards a zero-carbon electricity system, more renewable energy reduces the risks to household finances and to the wider economy from the UK's on-going reliance on natural gas, which remains subject to volatile market pricing.

But scaling up the auction has come at a cost, with contracts for offshore wind signed at £54 per megawatt hour (in 2012 prices, or £75 in today's prices), a 45 per cent increase over the record lows (£37.35 in 2012 prices) seen in 2022's auction. This partly reflects economic factors outside the Government’s control - including high interest rates, high prices in commodity markets, and supply chain constraints - but also a reduction in competitive pressures from providers.

There are signs that these external pressures will ease, but a combination of high demand from Government and relatively slow-moving supply is likely to mean that competitive pressure remains weak, at least in the short term.

Looking ahead, higher prices in one auction will not make a material difference to family spending: securing 5 GW of offshore wind capacity for £10/MWh less would save less than £5 annually from a typical energy bill. And at this point it is easy to justify a small extra cost to reduce the exposure to future gas price spikes.

But with cheap electricity vital for both household living standards and accelerating decarbonisation in other parts of the economy, policy makers need to ensure that costs are kept as low as possible in future auctions. This means taking steps to keep competition tight, using the public balance sheet to reduce the cost of borrowing and avoiding adding extra costs and levies onto renewable contract prices.

The latest renewable auction has been the biggest yet, but this increased ambition has come at a cost.

The new Government has made decarbonising the electricity system one of its main policy priorities, but will not attain a zero-carbon grid without a rapid increase in the volumes of energy procured through the Contracts for Difference (CfD) auction process.

This is a task made harder by the disappointing 2023 auction, in which no offshore wind projects were successful. In this context, today’s auction results revealed a record 9.6 GW of renewable energy was procured.[1] Most of this is for offshore wind (5 GW), as shown in Figure 1.

This is good news. It represents a big step towards the Government’s 2030 decarbonisation target, and will reduce carbon emissions as well as cut the UK’s reliance on global gas markets, which remain highly volatile. This is important because the risk of a gas price spike is both more apparent in the short term - as demand is inelastic - and asymmetric, as potential supply shocks mean risks of higher prices are more likely than those associated

with a supply glut. The results also hint at a change in strategy from that employed by the previous Government, which largely prioritised price over volume through the use of small budgets (less than £300 million in 2022), resulting in high levels of competition between

developers and costs significantly undercutting expectations.

Read the full Resolution Foundation report HRE

Pdf 5 Pages