Ineffective Savings Accounts - Isas

5th September 2024

6 April 2024 marked the beginning of a new ISA (Individual Savings Account) year with savers able to squirrel away up to £20,000 over the next year, with the returns being completely tax free. This is the Government's flagship policy to promote saving - with around 12 million adults benefiting in 2021-22.

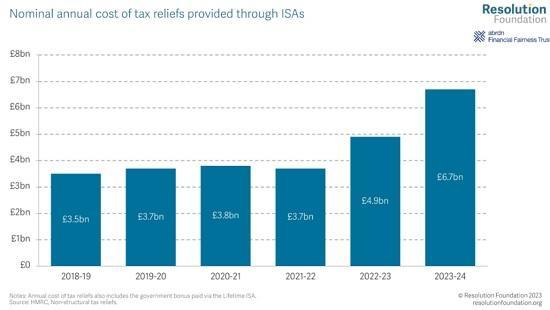

But while the policy is well intentioned - one-in-three working-age adults live in families with savings of less than the £1,000 - it is expensive and growing in cost. The tax relief offered through ISAs is expected to cost the Treasury £6.7 billion in 2023-24, up from £4.9 billion in 2022-23.

Furthermore, ISAs are poorly targeted. Vastly more tax-relief is given to those on higher incomes as they are more likely to have an ISA and more likely to have substantial ISA savings. In 2018-20, 1-in-2 (54 per cent) working-age families in the top 10 per cent of the income distribution had an ISA, compared to less than 1-in-5 (18 per cent) in the bottom 10 per cent. Similarly, nearly half (48 per cent) of ISA holders with incomes over £150,000 had ISA savings exceeding £50,000, whereas the vast majority (65 per cent) of ISA holders with incomes less than £10,000 had savings of less than £5,000 in their ISA.

Finally, ISAs are also ineffective at raising long-term saving - for example, when the ISA allowance was increased between 2013-14 and 2014-15 this had no noticeable impact on aggregate household saving.

Despite this, Government is doubling down on its existing approach to boosting savings by announcing that it intends to introduce a ‘UK ISA', with an extra £5,000 of tax-free savings going to those investing in UK-based assets.

This additional tax-free allowance will only benefit those that have more than £20,000 to save. In 2020-21, only 7 per cent of ISA holders (1.6 million people) maxed out their annual ISA allowance. Given the relatively small amount already saving £20,000 a year, the new UK ISA is unlikely to shift the dial on aggregate household saving.

Happy new ISA year, to all those who celebrate! For those lucky enough to be saving up to £20,000 this year, today is a significant date as it fires the starting gun on the opportunity to receive interest income and capital gains without having to pay tax.

As ISAs are the primary way the Government is tackling UK families' chronic lack of savings - one-in-three working-age adults live in families with savings of less than £1,000 - it is important to ask whether this policy is working as it should. So in this Spotlight we put the new ISA year in context by setting out the key facts on their costs and benefits, along with how the Government's new ‘UK ISA' might change the picture.

ISAs are expensive

ISAs are hugely popular: there were over 22 million holders in 2020-21 – meaning that around 2-in-5 (42 per cent) UK adults had an ISA. ISAs work by offering a tax-free method of saving or investing money, with individuals exempt from paying tax on any income (i.e. dividends, interest and bonuses) or capital gains they receive from their ISA savings and investments. Millions take advantage of this tax relief every year: in 2021-22, £67 billion was deposited into 12 million adult ISAs.[1]

The cost to the exchequer from foregone tax revenue on ISAs is large. Figure 1 shows that the value of this tax relief has risen steadily risen over time. 2023-24 is expected to be an expensive year for Treasury, with HMRC projecting that the cost will rise to £6.7 billion, up from £4.9 billion in 2022-23. This increase in cost is largely the result of higher interest rates boosting returns on savings. However, policy decisions, such as decreasing the dividend allowance from £2,000 to £1,000 and capital gains tax-free allowance from £12,300 to £6,000, also boosted the amount deposited into ISAs and the cost of tax reliefs provided through ISAs.

Note

Frozen ISA allowance

The government has frozen the ISA allowance for the 2024/25 tax year at £20,000. This is the same as the previous tax year.

Junior ISA allowance

The Junior ISA allowance will remain at £9,000 for the 2024/25 tax year.

James Blower, founder of website Savings Guru said: 'I don't expect the Isa allowance to be cut under a Labour government. 'I think, at worst, allowances will continue to be frozen, as they have been under the Conservatives since 2016/17.

Read the full report HERE