PwC Report - Store Openings And Closures H1 2024

12th September 2024

According to PwC, in 2023, there were 14,081 store closures in Great Britain, which is an average of 39 closures per day. This is higher than the 11,530 store closures in 2022, but lower than the years between 2017 and 2021. However, there were also 9,138 new stores opened in 2023, which is the highest number since 2019.

The majority of new store openings were located in retail parks and other out-of-town locations, rather than on high streets.

PwC also conducts research in partnership with The Local Data Company (LDC) to track over 200,000 outlets in more than 3,500 locations. The research aims to provide insights into the changing landscape of retail parks, shopping centers, high streets, and stand-alone outlets.

Net store closures have now been running at a near-stable level for three years. Have we reached a more predictable environment for retail and leisure operators? There are reasons to be cheerful. Compared to H1 2023, 13 fewer outlet categories are in decline, and half of all net closures are concentrated in just three categories. But there's caution ahead for some.

As we approach autumn, operators will need to navigate continued pressures: operating costs remain high and energy price inflation is expected. The long term trend of consumers moving online will continue to take its toll, primarily at the expense of the high street. We explore what these findings mean for retailers, leisure and service operators in locations across GB.

Overall trends stabilising, but the devil is in the detail

While net closures are up slightly this half-year, the trend remains broadly stable with a similar number of net closures for each of the last three years. It appears some much needed stability may have returned after the pandemic volatility, but churn has increased, and once we delve into the details, it's not a stable picture for all.

In the first six months of this year, a total of 6,945 shops belonging to multiples and chains (those with five or more outlets) exited Great Britain's high streets, shopping centres and retail parks, equivalent to 38 shops per day. This marks a slight rise in closures when compared to the first six months of 2023, when 36 shops closed each day.

Openings also grew slightly, up from 24 to 25 per day. While the uplift in both openings and closures means slightly more churn, it does signal some level of stability for shop vacancies when we look back over the last three years; the net decline has stayed around the 1% mark every six months, suggesting a slow but steady decline in physical outlets as consumers increasingly undertake more transactions online, whether that's shopping or other service transactions like banking.

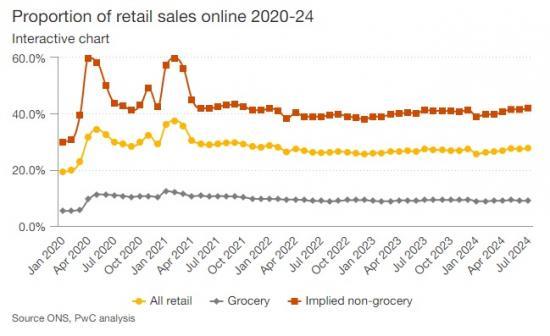

In fact, retail chain store closures almost exactly mirror the decline of in-store shopping and the corresponding rise of online retail sales, something we noted in the 2023 full year data. Online retail penetration has increased further in H1 2024 - partly explained by the unseasonably wet weather - and returned to the long-run pre-pandemic growth trend. In fact, non-food online retail penetration is at its highest since October 2021, the tail end of the pandemic.

However, with overall net closures remaining relatively stable at between 11 and 12 outlets per day for the last three years, there are reasons for operators to be optimistic. For many operators, this level of predictability gives time to reset and focus on consumer needs and behaviour. When we look more closely at the data, it's clear where the pressure points are.

Carefully curated retail parks and shopping centres win customers

Across the country, net store closure rates have been broadly similar from one region to another: as we identified this time last year, no UK region has been more than 0.3% different from the national average for the third year running. Therefore no one region is dragging down the national average or being ‘left behind' in the evolution of physical high streets. Instead, there has been an emergence of cycles within each region. Areas that saw higher-than-average closures in previous years are now starting to level off, and vice versa, suggesting that each region is simply adjusting at its own pace to macro nationwide trends. For example, the South East had two years of comparably slower decline, whereas this half-year it has seen a sharper exit of stores, falling in line with other regions over a three year period.

While there's little difference between regions, that's not to say closures are uniform within regions. Operators are continuing to move out of high streets in favour of retail parks. And carefully curated shopping centres are pivoting to different uses, such as leisure, entertainment and hospitality, in order to fill the voids left by pandemic-era closures.

Footfall is a significant part of the explanation for this trend. Currently 15-20% lower than before the pandemic, the decline in numbers of shoppers has dampened sales and the profitability of some stores and hospitality operators. High streets in particular have continued to suffer, with a decline in footfall in every month of 2024 so far, except for March, explained by the earlier Easter holidays. They have not been helped by both a higher-than-national-average net closure rate of 1.5% in the first six months of the year, and have been more vulnerable to the unseasonably wet weather.

Shopping centres have also seen a fall in numbers of customers. However, for the first time since the pandemic, they have seen slightly fewer net closures (1.0%) than the national average (1.1%). Compared with high streets, shopping centres typically benefit from a single, unified landlord, which means they can act more quickly - and more strategically - to the challenge of vacant properties. Astute landlords are able to curate a coherent destination experience that does not necessarily rely on like-for-like replacement of one retailer with another, but instead pivot to hospitality and leisure or alternative uses to attract different types of footfall.

Retail parks are the only location-type bucking the declining trend, and showing an improvement in footfall in each of the last twelve months except for April, due to the earlier timing of Easter. This is reflected in chain outlet numbers, which were actually in growth (by 0.4%) on retail parks in the first half of 2024. With limited public transport in much of the country and increasing restrictions on driving and parking in many town centres, retail parks offer easier accessibility and plentiful free parking; they are also often anchored by the big supermarkets, making them a regular and necessary visit - and a consistent spending priority according to successive PwC Consumer Sentiment surveys.

Retail parks have continued to develop their offer with additional leisure amenities, with a growth in hospitality venues and drive-throughs which we noted this time last year. And this increase in footfall and outlet numbers comes despite the impact of weaker recent demand for home and DIY stores during the cost-of-living crisis, which are typically stalwarts of the retail park.

Read the full PwC report with much more information and graphs HERE