The Rush To Sell Property And Other Assets Speeds Up With The Threat Of Changes To Capital Gains Allowances

21st September 2024

Although not a stampede to sell assets such as houses there is no doubt many more are getting out before the chancellor changes the rules on Capital Gains Tax.

The push to equalise income tax and capital gains tax rates has been well trailed for sometime. With the Labour government indicating there will be hard choices much speculation has pointed that an easy win for the government finances would be on Capital Gains and Inheritance taxes.

A record amount of capital gains tax (CGT) was paid last month as landlords and investors rushed to sell up ahead of the Budget.

HM Revenue & Customs (HMRC) have taken £197m amid the speculation that Rachel Reeves could align CGT with income tax bands next month.

So far this year, landlords and investors have paid £76m more than in 2023, according to HMRC.

The Chancellor has refused to rule out capital gains reforms in the Budget on 30 October.

With many people expecting a rise in capital gains tax, there has been a surge in sales of assets in recent weeks."

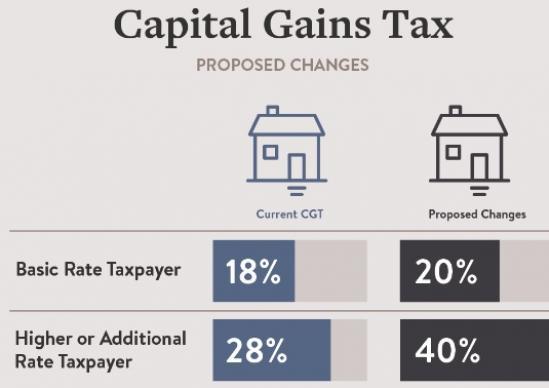

Under the current rules, higher-rate taxpayers are charged 24pc on profits made from the sale of second properties and 20pc for other assets. Basic rate taxpayers pay 18pc and 10pc respectively.

If capital gains tax were aligned with income tax rates, then a higher rate taxpayer sitting on a £50,000 profit from shares would see their tax bill double from £9,400 to £18,800.

Landlords looking to sell properties they bought before 2005 would have to pay £90,000 under a reformed system, up from an average of £54,000 today.

Of course speculation has been rife and only some of it will prove to be correct.

Another area for the chancellor to raise significant sums is the relief given for pension contributions that significantly helps higher rate taxpayers rather than basic rate tax payers. Many say this is another unfair aspect of the tax system. A change here would net huge amounts for the Treasury to help fill the so called £22billion black hole.

Read a more detailed article from Burns and Webber HERE