Public Sector Finances UK - September 2024 - Increases Again

22nd October 2024

Borrowing - the difference between public sector spending and income - was £16.6 billion in September 2024, £2.1 billion more than in September 2023 and the third highest September borrowing since monthly records began in January 1993.

The interest payable on central government debt was £5.6 billion in September 2024, £4.6 billion more than in September 2023. This was owing to the interest payable in September 2023 being exceptionally low at £0.9 billion because of movements in the Retail Price Index around that time, rather than September 2024's interest being unusually high.

Borrowing in the financial year to September 2024 was £79.6 billion, £1.2 billion more than at the same point in the last financial year and the third highest year-to-September borrowing since monthly records began in January 1993.

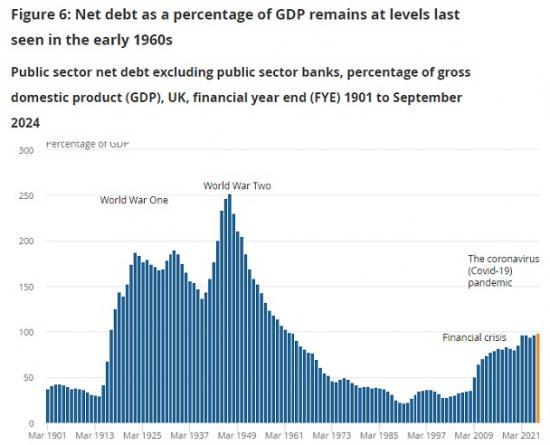

Public sector net debt excluding public sector banks was provisionally estimated at 98.5% of gross domestic product (GDP) at the end of September 2024; this was 4.0 percentage points more than at the end of September 2023, and remains at levels last seen in the early 1960s.

Excluding the Bank of England, debt was 91.2% of GDP, 5.0 percentage points more than at the end of September 2023 but 7.3 percentage points lower than the wider debt measure.

Public sector net worth excluding public sector banks was in deficit by £731.3 billion at the end of September 2024, a £128.4 billion larger deficit than at the end of September 2023.

Central government net cash requirement (excluding UK Asset Resolution Ltd and Network Rail) was £13.2 billion in September 2024, £1.9 billion less than in September 2023.

Central government borrowing

Central government forms the largest part of the public sector and includes HM Revenue and Customs, the Department of Health and Social Care, the Department for Education, and the Ministry of Defence.

The relationship between central government's receipts and expenditure is an important determinant of public sector borrowing. In September 2024, central government borrowed £13.0 billion, £2.2 billion more than in September 2023.

Central government receipts

Central government's receipts were £80.7 billion in September 2024, £3.3 billion more than in September 2023. Of this £3.3 billion increase in revenue:

central government tax receipts increased by £3.9 billion to £60.5 billion, with increases in Income Tax, Corporation Tax and Value Added Tax (VAT) receipts of £1.8 billion, £0.8 billion and £0.6 billion, respectively

Central government expenditure

Central government spending data for September 2024 are provisional. There is uncertainty around these estimates until more detailed departmental information becomes available later in the year.

Central government's total expenditure was £93.7 billion in September 2024, £5.5 billion more than in September 2023. Of this overall £5.5 billion increase in spending:

interest payable on central government debt increased by £4.6 billion to £5.6 billion, largely because the interest payable on index-linked gilts rises and falls with the Retail Prices Index (RPI)

central government departmental spending on goods and services increased by £2.6 billion to £35.9 billion, as pay rises and inflation increased running costs

payments to support the day-to-day running of local government increased by £0.5 billion to £10.6 billion; being both central government spending and a local government receipt, these intra-government transfers have no impact on overall public sector borrowing

current grants abroad decreased by £0.9 billion to £0.4 billion, largely because there were no payments due to the European Union this month; payments are scheduled to resume in October 2024

Net social benefits paid by central government decreased by £2.0 billion to £25.7 billion, where the usual increase caused by the annual uprating of inflation-linked benefits was more than offset by reduced spending on Winter Fuel Payments, partly because of the absence of one-off cost-of-living payments, which were included in September 2023 and partly because of the change in eligibility.

Winter Fuel Payments are recorded (on an accruals basis) each September when the eligibility of claimants is determined, although the cash will not be paid until November.

Interest payable on central government debt

In September 2024, the interest payable on central government debt was £5.6 billion, an increase of £4.6 billion compared with September 2023. This was because the interest payable in September 2023 was exceptionally low at £0.9 billion, rather than that of September 2024 being unusually high.

compulsory social contributions decreased by £0.9 billion to £13.9 billion, largely because of the reductions in the main rates of National Insurance in early 2024

The large monthly changes in the Retail Price Index (RPI) since early 2021 have led to considerable volatility in debt interest payable, with the largest three months on record occurring in 2022 and 2023. The additional interest caused by RPI inflation is described as "capital uplift" and affects the value of the gilt principal.

Capital uplift was £0.2 billion in September 2024, largely reflecting the 0.1% increase in the RPI between June and July 2024. This increased the capital uplift on the three-month lagged index-linked gilts (as shown on the UK Debt Management Office website), which make up around 95% of the index-linked gilt stock.

Between June and July 2023, the RPI decreased by 0.6% causing the inflationary impact on index linked gilts in September 2023 to be negative and so reducing the impact of the underlying interest by £3.2 billion, rather than adding to it as is usual when prices are rising.

A monthly time series of capital uplift on the index-linked gilts in issue is available as series identifier code JNYY. This series is illustrated as the blue portion of each bar in Figure 2 and excludes the uplift payable at the time of an index-linked gilt redemption. These redemption payments are already recorded as accrued interest payable across the life of each index gilt.

Borrowing in the financial year to September 2024

The £16.6 billion borrowed in September 2024, combined with a downward revision of £1.1 billion to our previously published financial year-to-August 2024 borrowing estimate, brings our provisional estimate for the total borrowed in the financial year to September 2024 to £79.6 billion.

This was £1.2 billion more than was borrowed in the same six months last year, and £6.7 billion more than the £73.0 billion forecast by the Office for Budget Responsibility for this period. It is the third highest year-to-September borrowing since monthly records began in January 1993.

Central government receipts

Central government's receipts were £490.6 billion in the financial year to September 2024, £16.4 billion (3.5%) more than in the same period last year. Of this £16.4 billion increase in revenue:

central government tax receipts increased by £18.9 billion to £372.6 billion, with increases in Income Tax, Corporation Tax and Value Added Tax (VAT) receipts of £9.7 billion, £5.0 billion, and £2.4 billion, respectively

compulsory social contributions decreased by £5.2 billion to £82.1 billion, largely because of the reductions in the main rates of National Insurance in early 2024

A detailed breakdown of central government income is presented in our Public sector current receipts: Appendix D dataset.

Central government expenditure

Central government's total expenditure was provisionally estimated as £588.3 billion in the financial year to September 2024, £18.4 billion (3.2%) more than in September 2023. Of this overall £18.4 billion increase in spending:

central government departmental spending on goods and services increased by £10.1 billion to £209.6 billion, as pay rises and inflation increased running costs

net social benefits paid by central government increased by £7.7 billion to £154.2 billion, largely because of inflation-linked benefits uprating

payments to support the day-to-day running of local government increased by £5.6 billion to £75.0 billion; these intra-government transfers have no impact on overall public sector borrowing being both central government spending and a local government receipt

central government net investment increased by £2.7 billion to £56.8 billion, and includes the regular payments from HM Treasury to the Bank of England APF Fund, which decreased by £0.5 billion compared with a year earlier

current grants abroad decreased £4.0 billion to £2.5 billion, largely because of the timing of payments made to the EU

subsidies paid by central government decreased by £3.3 billion to £13.9 billion, largely because of the closure of the energy support schemes that remained active until June 2023

interest payable on central government debt decreased by £2.9 billion to £44.2 billion, largely because the interest payable on index-linked gilts rises and falls with the Retail Prices Index (RPI)

Local government

Initial estimates suggest that local government was in surplus by around £3.2 billion in the six months to September 2024, a £0.5 billion larger surplus than in the same period a year earlier. Our provisional monthly estimates for the UK are currently based on published budget data for England, Scotland, and Wales, with estimates included for Northern Ireland.

Borrowing in the financial year ending March 2024

The public sector borrowed £121.9 billion in the financial year ending (FYE) March 2024. This was £1.4 billion less than the £123.3 billion borrowed in the FYE March 2023, but £7.8 billion more than the £114.1 billion forecast by the Office for Budget Responsibility (OBR).

Our borrowing estimate for the FYE March 2024 remains provisional; it is likely to be revised further over the coming months as we replace our provisional estimates of both receipts and expenditure with finalised data.

Read the full ONS report HERE