Car Insurance Price Rollercoaster For Scottish Motorists

16th October 2018

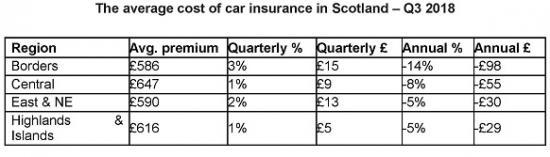

The cost of car insurance in Scotland increased up to +£15 (+3%) over the past quarter, following a short burst of decreasing prices.

The Scottish Borders saw one of the biggest increases of all UK regions, with prices creeping up by +£15 (+3%).

Motorists can find the average cost of premiums for their age and region using Confused.com's car insurance calculator.

Motorists in Scotland are already seeing the cost of the car insurance creep up, with over half (55%) saying their most recent renewal notice was £35 more expensive than the previous year(1), on average.

SAVING TIP: data shows 8am is the cheapest time to buy car insurance(2), with UK drivers saving up to £783(3).

The price of car insurance in Kirkwall (Scottish Highlands and Islands) increased an eye-watering +£130 (+22%) in just three months.

The cost of car insurance in Scotland has started to creep up once again, after a short period of falling prices earlier in the year.

Car insurance prices in some Scottish regions increased as much as +£15 (+3%) in Q3 2018, reaching up to £647, on average. That's according to the most comprehensive car insurance price index in the UK based on more than six million quotes a quarter from Confused.com and powered by Willis Towers Watson.

In particular, the Scottish Borders saw the largest quarterly rise in Scotland and among the biggest increases seen across the UK. Prices in the region crept up by £15, equivalent to +3%, over three months, leaving motorists facing premiums costing £586, on average. However, despite this increase, the Scottish Borders is still the cheapest region in Scotland for car insurance.

Prices in East & North East Scotland also took an upwards turn, adding +£13 (+2%) to the average cost of car insurance (£590), taking it just -£45 (-7%) below the most expensive premium paid by drivers in the region.

Motorists in Central Scotland and the Highlands and the Islands saw the smallest increases of the Scottish regions, but this U-turn on last quarter suggests prices are on the up. Both regions saw the cost of their car insurance increase by +£9 and +£5 respectively, both equivalent to a +1%.This leaves drivers in Central Scotland paying £647 for their car insurance, on average - the most expensive of all Scottish regions. Meanwhile, those in the Highlands and Islands are paying £616, on average.

And it seems motorists in Scotland have already started to see the cost of their car insurance creep up. In fact, further research by Confused.com found that more than half (55%) of drivers in the region said their last renewal price was £35 more expensive than the previous year, on average(1).

Looking at the cost of car insurance in Scotland over the long term, it is still cheaper than 12 months ago, despite the increases seen this quarter. In fact, the cost of car insurance in the Scottish Borders is -14% (-£98) cheaper year-on-year - the second biggest percentage decrease across the UK.

Scotland saw the first decrease in premiums across all regions in over three years in Q2 (April - June 2018). But the new data suggests that this brief period of relief for motorists could be short lived, if prices continue to rise.

And the small increases in Scotland are reflective of the current direction of car insurance prices across the UK, which has crept up by +£8 (+1%) over the past quarter, on average. This is the first increase in over 12 months (Q2 2017), with the average cost now at £760. However, the last time prices took a similar turn, the cost of car insurance soon started to accelerate again. The price of premiums crept up from £591 in Q1 2015 to £600 (+£9) the following quarter, with prices going on to increase +£115 (+19%) over the following 12 months (Q2 2016 - £715).

To help motorists in Scotland see how these increases have impacted their own premiums, Confused.com has created a car insurance calculator. The tool allows users to input their region, age and gender to find out the average cost of premiums for their demographic, compared to 12 months ago.

But there are many ways motorists can save money on the cost of their insurance, and this includes being savvy about the time they shop. In fact, Confused.com data reveals motorists shopping around online at 8am received the cheapest price on average(2) and could save up to £783(3) (UK average) compared to those browsing in the early hours of the morning (2am), when car insurance is at its most expensive, according to the data. Overall, the morning (6am - 9am) appears to be the optimum time to get the best prices, while buying car insurance in the evening could add on a few extra hundred pounds.

No doubt any tip or trick would be welcomed by Scottish motorists, who have faced a tough year when it comes to the cost of car insurance. In early 2018 (Q1), prices across Scotland increased year-on-year, despite the cost of premiums dropping across the rest of the UK. Although it seems drivers in Scotland have been suffering with inflating car insurance prices for as long as two years. In fact, the average price of car insurance in all four Scottish regions has increased more than any other region over the past two years. Whereas prices in some regions in the UK saw prices get cheaper over the same period. In particular, motorists in the Scottish Borders have been hit the hardest, with the average price of car insurance increasing +13% over two years. Drivers in the other three regions all saw the cost of their premiums increase +11% over the same period.

But the recent increases seen over the past quarter will no doubt leave Scottish motorists grumbling when shopping for car insurance, given prices dropped over the previous three months. And some have been hit harder than others – particularly those in Kirkwall, in the Highlands and Islands. The cost of car insurance in the area accelerated a whopping +£130 (+22%) in just three months, taking the average premium to £712. This is just -£22 cheaper than the highest premium paid by motorists in the area.

Kirkwall was also one of the only three postcode areas in the UK to see premiums increase year-on-year, with prices now +£8 (+1%) more than 12 months ago. Although this isn't the biggest annual increase in the UK. Drivers residing in the Hebrides will have seen an additional +£15 (+2%) added to their car insurance bill, compared to this time last year.

Meanwhile, there may be some motorists in the Scotland who are left feeling bitter, as the average price of car insurance in other areas saw some dramatic decreases this quarter. Shetland, the Hebrides and Perth, all in the Scottish Highlands and Islands, saw the biggest drop in prices this past quarter of all areas in the UK, ranging from -15% (-£126) to -7% (-£40). Motorists in Galashiels have also seen their premiums getting much cheaper compared to last year, with the average price -£147 (-20%) cheaper compared to 12 months, costing £605, on average.

While car insurance prices across most of Scotland are showing signs of increasing, both male and female drivers in some of the regions might be relieved to learn they are paying among some of the lowest prices in the UK. In fact, female drivers in the East & North East are paying the second cheapest premiums of all UK regions, paying out £552, on average. Similarly, men in the Scottish Borders have the second cheapest premiums of all male drivers from across the UK, paying £598 on average. However, this is following a +£16 (+3%) quarterly increase – among one of the biggest compared to other regions.

And it’s no secret the cost of car insurance can depend on a driver’s age, and it is generally younger motorists across Scotland who are bearing the brunt of sky-high prices. In particular, male motorists aged between 17 and 20 in Central Scotland are the only demographic in Scotland paying more than £2,000 (£2,046) for their car insurance. However, this is significantly less than the £3,007 paid by men of the same age in Inner London. On the other hand, male drivers of this age in the East and North East of Scotland have the lowest premiums of this age bracket across the UK, paying just £1,905 in comparison.

And it seems drivers will have to wait until they hit retirement before they start to see their premiums drop to lower levels. In particular, female motorists aged 66 to 70 in the Scottish Highlands and Islands, and the East and North East Scotland pay among the lowest premiums of any demographic across the UK, paying £259 and £260 respectively. However, women of the same age living in the Scottish Borders might not be as pleased with the price of their car insurance quote, given that it is +£17 (+5%) more expensive than quarter.

As car insurance prices begin to creep up again, motorists are being left out of pocket by the rising cost of motoring. And it isn’t just car insurance prices Scottish drivers are having to contend with, as the average cost of petrol has risen by 11.8p from 119.5p to 131.3p(4), according to the Confused.com fuel price index. It is a similar picture for diesel, which is now 14.2p more expensive than 12 months ago, costing 135p on average per litre(4). And if car insurance prices continue to increase it looks like could be an expensive year for motorists.

Amanda Stretton, motoring editor at Confused.com comments: "Motorists in Scotland were offered a very brief period of respite when it came to climbing car insurance costs, and now it seems prices are on the rise once again, with some drivers being hit harder than others.

"These increases are already being seen by motorists in Scotland, who were asked to pay an extra £35 on average on top their previous years’ price by their current insurer, suggesting loyalty really doesn’t pay. This goes to show how important it is that motorists should be shopping around when their car insurance is due for renewal to find the best deal.

“The secret to getting the best price could depend on when motorists are shopping around for car insurance online. Our data found that between 6am and 9am is in fact the prime time for cheapest prices. If we still can’t beat the renewal price their current insurer is quoting, we’ll give them the difference, plus £20(5)."

Notes -

More than six million quotes are used in the construction of each quarter’s insurance price index - this makes it the most comprehensive insurance index in the UK. Unless otherwise stated all prices referred to are for comprehensive cover.

The following web pages will be updated to reflect the new figures and can be linked to: http://www.confused.com/car-insurance/price-index

1. Statistics obtained from a nationally representative survey of 2,000 UK motorists carried out by One Poll on behalf of Confused.com. The survey ran between 04/10/2018 and 09/10/2018.

2. According to Confused.com data, prices quoted between 8am and 9am (8am timestamp) were the cheapest - £929. Based on a sample of 1,000 UK-wide quote requestors. Data gathered between July and September 2018.

3. According to Confused.com data, prices quoted between 2am and 3am (2am timestamp) were the most expensive - £1,712 leaving a £783 difference between the cheapest and most expensive. Based on a sample of 1,000 UK-wide quote requestors. Data gathered between July and September 2018.

4. Confused.com’s fuel price index collates prices from 7074 out of 8496 fuel stations across the UK. Prices are updated every week: https://www.confused.com/on-the-road/petrol-prices/fuel-price-index. Prices correct as of 10/10/2018

5. https://www.confused.com/beat-your-renewal. Must be a like-for-like policy.