Scottish Income Tax: 2019-2020

12th December 2018

Rates and bands for Scottish income tax in financial year 2019-20.

Scotland Act 2016 provides the Scottish Parliament with the power to set all income tax rates and bands (except the personal allowance, which remains reserved) that will apply to Scottish taxpayers' non-savings, non-dividend (NSND) income for tax year 2019-20.

While the Scottish Parliament has the power to set the Scottish income tax rates and bands, HMRC will continue to be responsible for its collection and management. As such, Scottish income tax remains part of the existing UK income tax system and is not a devolved tax.

How the Scottish income tax works

The income tax rates and bands payable by Scottish taxpayers will be those set by the Scottish Parliament. Receipts from Scottish income tax will be collected by HMRC and paid to the Scottish Government (via HM-Treasury).

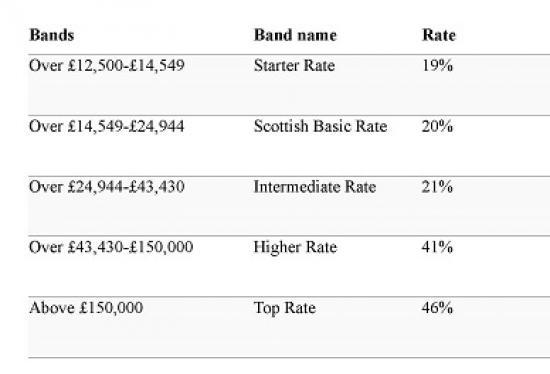

Scottish rates and bands for 2019-20

On the 12 December 2018 the Scottish Government announced the following income tax rates and bands for 2019-20 in the Scottish Budget 2019-20. These will be considered by the Scottish Parliament, and an agreed Scottish Rate Resolution will set the Scottish income tax rates and bands for the tax year 2019-20.

2018/19 Rates

Taxable income Band Tax rate

£11,851 to £13,850 Starter rate 19%

£13,851 to £24,000 Basic rate 20%

£24,001 to £43,430 Intermediate rate 21%

£43,431 to £150,000 Higher rate 41%

Over £150,000 Top rate 46%

Personal Allowance is reduced by £1 for every £2 earned over £100,000.

Tax Rates in England and Wales 18/19

Tax rates in England and Wales are now lower in certain bands.

Income Tax Rates and Brackets for 2018/19?

Taxable Income Tax Rate (Band) Tax Rate

Up to £11,850 Personal allowance 0%

£11,851 to £46,350 Basic rate 20%

£46,351 to £150,000 Higher rate 40%

Over £150,000 Additional rate 45%