Highland Council Does Not Go For Maximum Council Tax Increase

14th February 2019

Highland council today agreed at the budget meeting not to apply the 4.79% increase recently allowed by Scottish Government in their budget but instead are restricting it to 3% increase for 2019/20.

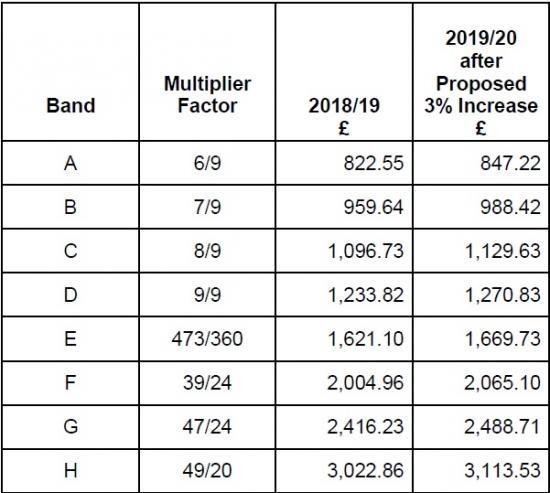

Council Tax is charged on all domestic properties and each property is banded in one of 8 bands (A to H) based on the assessed value of the property. The actual level of Council Tax charged is based on a proportion of the rate, the ‘multiplier', for a band D property.

Band D properties will rise from £1233.82 to £1270.84 an increase of £37.02 per annum or less than 72 pence per week.

As part of the revenue grant settlement from the Scottish Government the Council will have the flexibility to increase Council Tax by up to a maximum of 4.79%. Previously this increase has been capped at 3%.

Recognising the demands it would place on local taxpayers the Administration does not intend to use this additional power to raise Council tax by the maximum permitted amount. The Administration considers it appropriate to increase Council tax by 3% to reduce the budget gap. Such an increase is anticipated to deliver additional income of £3.602m in 2019/20.

Increasing the Council Tax by the maximum permitted 4.79% would generate an estimated £2.150m more income than the proposed 3% increase. By not taking the full increase the council has had to make more saving in its budget for 2019/20.

At this stage Council is only being asked to approve a 3% Council tax increase for 2019/20. An assumed increase of 3% in 2020/21 and 2021/22 has been factored in to reduce the budget gap in those years but any changes to Council Tax rates for those years will require approval by Council at a later date.

The Council Tax Reduction Scheme (CTRS) will continue to offer support to individuals and families on low incomes. The income increase shown above is net of the impact of any increases in the cost of CTRS as a result of the 3% rise.

The Council will review funding options for investment to the Landbank Fund through a combination of capital and revenue finance to ensure that the total level of investment is maintained at its current level in compliance with current regulations. However, we will continue to allocate the equivalent of the full sum generated from Council Tax charged on second homes towards affordable housing, as required by government guidance.

To see the full range of cuts and changes in the budget go to -

https://www.highland.gov.uk/meetings/meeting/4084/highland_council

Related Businesses

Related Articles

Council welcomes Visitor Levy flexibility plan

The Highland Council welcomes moves by the Scottish Government to introduce greater flexibility on how it could design a Visitor Levy Scheme for consultation. The Visitor Levy (Scotland) Act 2024 currently provides local authorities with discretionary powers to implement percentage-based levies following statutory consultation.Highland Council is reaching out for views to shape its next 26/27 budget.

As it looks to set out its forthcoming priorities, the council is seeking involvement from members of the public, including businesses, community groups, parents, and young people. All their opinions are going to be crucial in deciding how Highland Council will take on its budget challenge for 2026-2027.Have your say in Thurso's future £100million investment by attending public consultation events

Thurso is to benefit from £100m investment in education and community facilities and are rolling out the first phase of public consultations on 9 and 10 December 2025. The Highland Council is inviting people that live, work, or study in Thurso, to come along to the public consultation events to have their say; this is an opportunity to help shape the future of Thurso, to gather views and ideas.Finding new owners for empty homes - Scheme launched to help return more empty homes to active use

A new online portal has been launched to bring empty homeowners together with prospective buyers or developers with the aim of facilitating more properties to be used as homes again. Covering the whole of Scotland, this builds on the success of local pilots, referred to as "matchmaker schemes".Consideration for short term let control area in Skye and Raasay

Steps towards introducing a short term let control area have been considered by Highland Council's Isle of Skye and Raasay area committee. On Monday (1 December 2025) the committee heard evidence to justify the grounds for the introduction of a Short Term Let Control Area covering all or part of Skye and Raasay.Workforce North event spotlights Highland economy

EMPLOYERS and educators from across the Highlands have gathered to hear how a new initiative is aiming to transform the region's economy. Workforce North - A Call to Action brought together business leaders and teachers from primary and secondary schools from across the Highland Council area with a wide range of partners geared towards education, learning and skills development at Strathpeffer Pavillion.

Council calls for meaningful engagement from Home Office Over 300 Asylum Seekers Being Sent to Inverness

The Highland Council continues to call for meaningful engagement from the Home Office over its plans to temporarily accommodate up to 300 adult male asylum seekers at Cameron Barracks, Inverness. It follows an email on Monday from Alex Norris MP, Minister for Border Security and Asylum, to Council Leader, Raymond Bremner, which failed to answer questions raised by the Council or address community concerns.SSEN Transmission becomes first signatory to Highland Social Value Charter

SSEN Transmission has become the first company to sign up to the Highland Social Value Charter (HSVC), marking a significant milestone in delivering long-term socio-economic benefits for communities across the Highlands. Investment commitments from the company include funding for roads, new homes, jobs, and work for local contractors in addition to a local and regional fund for communities to apply to.Wick - Aberdeen PSO - Update issued 24/11/2025

The Highland Council continues to work through the procurement process for the provision of the Wick Public Service Obligation for the Highland Council. We have now entered the preferred bidder stage and have entered a standstill period.Highland Council winter road condition and school closure report for 25 November 2025

Maps of the Council's gritting routes by priority and policy are available online at www.highland.gov.uk/gritting (external link) The information provided is a summary of reports from operational staff and is intended to give a general indication of typical conditions in each area at a point in time. It is not intended to imply that any individual route is entirely snow and ice free and drivers must be aware that conditions can change rapidly and make their own assessment of conditions for travelling.