This site uses cookies, by continuing to use this site you accept the terms of our privacy policy

Feed 2.0 Loading...

Banks & Finance News

23/5/2021

World Council Launches The Global Credit Union Podcast

World Council of Credit Unions is excited to launch a new monthly podcast that will provide the international credit union community with an in-depth look at some of the interesting and important stories it has to tell, particularly in the areas of international advocacy, international projects, education and networking, and digital transformation. The Global Credit Union Podcast will also be telling stories about the work credit unions across the world are doing on behalf of their members.

30/4/2021

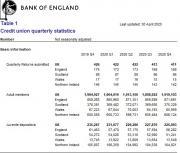

UK Credit Unions Has Reached Its Highest Reported Value At £3.98 Billion

The latest quarterly report by the Bank of England shows UK Credit Unions continue to increase in strength. The report published on 30 April 2021 showed - Adult membership of credit unions increased in 2020 Q4 after decreasing in 2020 Q3.

30/4/2021

New Partnership Supports International Credit Union Community

This new project aims to share research and resources with credit unions in the UK and Ireland. Filene Research Institute announced an exclusive partnership with the Dublin, Ireland-based CMutual to expand research and resources available to credit unions in the United Kingdom and Ireland.24/2/2021

Launch Of £15 Million Scottish Community Lenders Fund

A new £15 million fund has been announced to support affordable lending services. It will support Credit Unions and Community Development Financial Institutions (CDFIs) which offer financial help to those who have poor credit and are often turned away from high street banks.15/10/2020

International Credit Union Day - Join Hi-Scot Credit Union

International Credit Union (ICU) Day celebrates the spirit of the global credit union movement. The day is recognized to reflect upon the credit union movement's history, promote its achievements, recognize hard work and share member experiences.

27/9/2020

Employers Can Help Workers Save With Payroll Deduction

If your business would like to support employees in building a regular saving habit, call HI-Scot Credit Union..

18/9/2020

Saving In The Time of Pandemic - Check Out The Credit Union

2020 has not been the easiest of years and, for many people, saving has been the last thing on their minds - but there's never been a more prudent time to think about putting money aside for a rainy day. Or a global pandemic.

20/8/2020

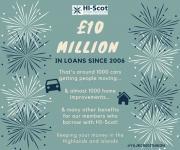

Over 1000 Cars Bought By Hi-Scot Credit Union Loans

A Hi-Scot credit union loan is now easier than ever to arrange for members. Cars are a popular reason to borrow but loans can be arranged for a wide range of things.

5/8/2020

Save With Your Credit Union - Hi-Scot

Hi-Scot Credit Union is a membership organisation covered by the Financial Services Authority who guarantee savings in credit unions. It makes sense to save with us Everyone benefits from regular saving, as it allows us to work towards our financial goals and gives peace-of-mind should an emergency arise.

5/8/2020

Get A Loan With Your Credit Union - Hi-Scot

Hi-Scot Credit Union covers the Highland and Islands and is membership organisation covered by the Financlal Services Authority Directors are elected each year and are unpaid volunteers with professional staff running the day to day business. Online banking has recently become available for members.

22/4/2020

Royal Bank Launches Card For Carers

Royal Bank of Scotland is introducing a new ‘companion card' - a supplement card to an existing current account that enables vulnerable customers and those in extended isolation to give trusted volunteers a way to pay for their essential goods. New card offers quick & easy way for vulnerable customers to pay for essentials through a trusted carer or volunteer.17/3/2020

Hi-Scot Credit Union - Ready For Coronavirus

COVID-19 (coronavirus) information. We're here to help We're here to support you in a number of different ways.

26/2/2020

HI-Scot credit union is on a mission - to get the Highlands and Islands saving in 2020

"As we enter our fourteenth year of business, we'll be spreading the word about the benefits of saving with the credit union," said HI-Scot's General Manager, David Mackay. "HI-Scot is member led and member run and we offer a range of services." HI-Scot is well established in the Western Isles, where the credit union is based.

6/2/2020

Why Payroll Deduction? - Check Out Hi-Scot Credit Union

In 2020, HI-Scot credit union's focus is on making saving and borrowing easier for our members, particularly through the use of payroll deduction with businesses across the Highlands and Islands. Thousands of employees already have access to payroll deduction with HI-Scot, something the credit union wants to build on in the coming year, promoting the service to employees who work with existing partners and showing other businesses the benefits of offering payroll deduction to their staff.

30/1/2020

Hi-scot Credit Union Offers Payroll Deductions

HI-Scot, the credit union for the Highlands and Islands, has vowed to make 2020 the year when saving and borrowing are even more accessible. With a focus on payroll deduction, allowing people to save directly from their pay packet every month via their employer, the credit union offers a viable alternative to high street banking in 2020.23/12/2019

Record-breaking fraud prevented in run up to Christmas

Royal Bank of Scotland prevents over £11.64million of fraud in run up to Christmas (29 Nov to 19 Dec 2019). A record-breaking number of transactions are being processed in the run up to Christmas as shoppers rush to finish last minute shopping.23/12/2019

Best Year Ever For Hi-Scot Credit Union

As 2019 draws to an end, the staff and volunteers at HI-Scot credit union are reflecting on a successful year for the organisation. "We are pleased to report that 2019 was another twelve months of growth for HI-Scot," said Margaret Ann MacLeod, Chair of the Board of Directors, "This is good news not only for the credit union, but for our members and the communities we serve across the Highlands and Islands." At the recent HI-Scot AGM, the members attending approved a 0.5% dividend.

28/11/2019

Hi-Scot Credit Union Savers Ready For Christmas

Christmas came early across the Highlands and Islands for members of HI-Scot credit union. Canny savers received their Christmas savings in November, leaving plenty of time to get their Christmas shopping done.

30/10/2019

Hi-Scot Credit Union Is 13 Years Old And Still Growing

The number thirteen might be unlucky for some, but not HI-Scot credit union who are celebrating thirteen years of serving their members across the Highlands and Islands of Scotland. From humble beginnings as an idea conceived by hard-working volunteers determined to bring an ethical, community-minded option for saving and borrowing to the islands, Western Isles credit union (HI-Scot's original incarnation) opened its doors in 2006.

11/10/2019