Year-to-date borrowing rises by less than anticipated

29th January 2020

The latest report form the Office of Budget Responsibility to December 2019.

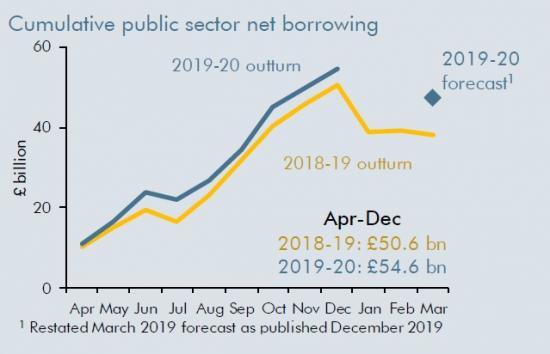

Borrowing has risen so far this year, but at a slower rate than anticipated in our restated March forecast. With three months of the year to go, a number of uncertainties remain. January is a big

month for receipts, while bonus season and end-year departmental spending are always sources of uncertainty.

Headlines

• We compare latest outturns with our restated March 2019 forecast, which reflects several recent ONS statistical changes and means comparisons are now on a like-for-like basis.

• Public sector net borrowing (PSNB) is estimated at £4.8 billion in December, £0.2 billion lower than a year earlier. Despite the fall this month, borrowing has risen in five out of nine months so

far this year.

• Year-to-date borrowing was up £4.0 billion (7.9 per cent) on the same period last year. Our restated PSNB forecast for 2019-20 implies a £9.6 billion (25.4 per cent) full-year rise.

• The ONS has revised down borrowing so far this year by £1.0 billion in this month's release.

This follows successive downward revisions to borrowing in recent releases. Borrowing over the first six months of the year is now £6.0 billion lower than the first estimate released in October.

• Central government receipts (excluding PSNB-neutral transfers related to ‘quantitative easing')

were up 3.7 per cent in December. Year-to-date receipts growth of 2.8 per cent is above our

restated March forecast of a 2.3 per cent rise in 2019-20 as a whole.

• Central government spending (excluding PSNB-neutral grants to local authorities) was up by 2.9 per cent in December and up 3.3 per cent for the year to date. Year-to-date spending is a

little above our restated March forecast of a 3.2 per cent rise in 2019-20 as a whole, where several factors only partly offset stronger growth in departmental spending.

• Net debt was 0.9 per cent of GDP lower in December 2019 than a year earlier.

Full commentary

1. The Office for National Statistics and HM Treasury published their Statistical Bulletin on the December 2019 Public Sector Finances this morning, covering the first nine months of 2019-20.

1

Each month the OBR provides a brief analysis of the data and a comparison with our most recent forecast. This is currently from the March 2019 Economic and fiscal outlook (EFO), which we have restated to be on a consistent basis with the substantial classification and other statistical changes that were incorporated into September's Public Sector Finances release.

2

Our restated forecast for borrowing in 2019-20 is £18.3 billion higher than the original one.

2. Our next forecast will be published on 11 March alongside the Chancellor's Budget.

Public sector net borrowing

3. Public sector net borrowing (PSNB) was £4.8 billion in December, £0.2 billion lower than last year and £0.5 billion lower than market expectations. Central government (CG) borrowing fell on a year earlier, thanks to a £2.2 billion rise in total CG receipts being only partly offset by a £1.8 billion rise in total CG spending. Borrowing by local authorities and public corporations both rose by £0.1 billion on a year earlier.

4. The deficit for the first nine months of 2019-20 is up £4.0 billion (7.9 per cent) on a year earlier. To meet our restated forecast of £47.6 billion for 2019-20 as a whole requires a £9.6 billion (25.4 per cent) rise over the full financial year. This would require a materially

worse performance for the public finances over the rest of the year than was the case last year, when a surplus of £12.7 billion was recorded across the final three months of the year. But last

year was boosted by particularly strong self-assessment receipts and risks remain around prospects for borrowing through the rest of this year: January is a big month for receipts, while bonus season and end-year departmental spending are always sources of uncertainty.

5. Borrowing across the first eight months of 2019-20 was revised down by £1.0 billion in this month's release. This follows repeated downward revisions in recent months - borrowing over the first six months of the year is now £6.0 billion lower than the first estimate released in October. Much of these revisions reflect lower estimates of CG spending, the strength of which had been the main reason for year-to-date borrowing apparently running ahead of our March

forecast in earlier data releases. This picture has now reversed, with a simple extrapolation based on year-to-date outturns pointing to full-year borrowing well below our restated forecast.

To Read the full report go HERE