Devolved Governments Need More Flexible Funding And Greater Borrowing Power To Tackle Coronavirus Effectively

27th March 2020

Institute For Fiscal Studies

David Phillips - Observation.

The press briefings by the Prime Minister are a daily reminder that addressing the public health and economic impacts of coronavirus are by far the biggest immediate policy challenges the UK government has faced for decades.

But it is not only at the UK level that government needs to respond urgently and in unprecedented ways. Councils right across the country face a massive task in keeping vital social care services operating in order to protect some of the most vulnerable in society. And the devolved governments in Scotland, Wales and Northern Ireland have responsibility for many vital policy areas including support for businesses via the business rates system, the NHS and public health, and funding for councils in their jurisdictions.

Councils often have some reserves they can dip into for a couple of months - although in a few instances, reserves levels are already very low. The financial resilience of local government is an issue we will return to in the coming weeks.

Perhaps of more immediate concern is that as it stands, the funding arrangements for the devolved governments may not be appropriate for the task at hand. This is because they have limited reserves, constrained borrowing powers, and the funding flowing to them as a result of the Barnett formula may not reflect the challenges that they face. As a result, their ability to respond effectively may be delayed or compromised, and vital funding misallocated across the UK. There is a case to give them access to greater borrowing powers and to consider bypassing the Barnett formula - at least for now.

Reserves and borrowing powers

The fiscal frameworks for the Scottish, Welsh and Northern Irish governments place limits on the amounts they can put into reserves and borrow, and set out rules on when these powers can be used. Previous analysis by IFS researchers has suggested the limits looked sufficient for both Scotland and Wales to smooth revenues and spending, even in the face of economic shocks like recessions. But they were not designed to deal with situations like now, when:

There is a need to develop, cost and announce new measures very rapidly;

There is the potential for the nations to be affected by coronavirus in very different ways.

For example, the Scottish Government is able to hold reserves of up to £700 million in total, and draw down up to £250 million a year for day-to-day spending, plus up to £100 million for capital spending. In the current financial year, it was already planning to draw down £234 million for day-to-day spending meaning it only has £16 million of leeway: just £3 per person. In the coming financial year (2020-21), forecasts suggest there could be around £100 million of unallocated reserves that could be drawn down, which might sound sizeable but is less than 0.3% of the Scottish Government's budget and less than 1% of the Scottish NHS's budget. In the case of the Welsh Government, its budgets for 2019-20 and 2020-21 already involve drawing down reserves by the maximum £125 million a year it is allowed.

Some borrowing is allowed if tax revenues are lower than forecast, for example. But the rules preclude borrowing to cover the day-to-day costs of new policy measures - such as responses to the Coronavirus (some additional borrowing is allowed for capital investments, although much of this will also already be allocated).

Taken together, these constraints mean that the devolved governments are very reliant on funding from the UK government in order to be able to fund additional policy measures – such as tax holidays and cash grants via the business rates system, and extra funding for the health and social care systems. If there is not good communication by the UK government in advance of its own announcements, the devolved governments could find themselves having to play catch-up once they know how much funding they will receive as a result of those announcements. This risks additional uncertainty for residents of the devolved nations and even delays to implementation of policies.

There is therefore a case for giving the devolved governments greater access to borrowing via the National Loans Fund, at least for Coronavirus related measures. This would allow them to develop, cost and announce plans more quickly than if they have to wait until UK government plans for England have been announced. Effective communication and coordination between the UK and devolved governments should also be a priority.

The potential for a mismatch between funding and needs

Unless policies announced by the UK government apply directly across the UK as a whole, as with the wage subsidy package announced on Friday 20th March, devolved governments receive funding in proportion to their populations under the Barnett Formula. For example, for each £100 spent on measures in England, the Scottish Government will receive around £9.70, the Welsh Government £5.90 and the Northern Irish Executive around £3.40.

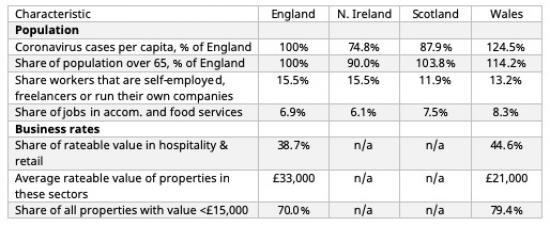

The Barnett formula is simple and automatic. But there are many reasons why the share of spending needed in each nation may differ from the share of the population in each nation, as suggested by the figures in Table 1.

Table 1. Selected characteristics of England, Scotland, Wales and Northern Ireland

Sources: Authors calculations using ONS population estimates, DHSC coronavirus case figures, Labour Force Survey, and VOA stock of properties data.

Notes: The VOA's data shows each property and businesses may occupy multiple properties which have a value of over £15,000. The final set of figures in Table 1 therefore does not provide an estimate of the number of businesses entitled to small business rates relief in each nation. But it does provide an indication that more properties have low values in Wales than England.

The prevalence of coronavirus may differ significantly, putting differing degrees of pressure on the health service, for example. By way of illustration, Northern Ireland’s share of the confirmed cases so far is less than 75% of its population share, while Wales’ is 125%.

Demographic and health differences may mean the population of each nation is more susceptible to the disease. For example, the fraction of the population aged 65 or over in Wales is 114% of the level in England, while it is 90% of the English level in Northern Ireland.

Differences in the composition of the labour force may affect the cost of a range of policies and the importance of different types of support. For example, a higher share of jobs are in food and accommodation services in Scotland and Wales than England. But a higher fraction of workers are self-employed in England than in both of these countries.

Differences in tax bases may affect the cost of providing support through the tax system. For example, a higher fraction of the business rates taxbase (‘rateable value’) is in the retail and hospitality sectors in Wales than England, and a higher share of properties in Wales have rateable values below the £15,000 threshold that has been chosen to determine eligibility for £10,000 of grant funding – both of which would push up the cost of support in Wales relative to England. However, the average rateable value of properties in the retail and hospitality sectors is lower in Wales than England, reducing the cost of the business rates holiday for these sectors.

If needs differ, using the Barnett formula to allocate funding could therefore mean relatively too little or too much funding being given to the devolved governments in Scotland, Wales and Northern Ireland. When combined with limited borrowing powers, this could mean the devolved governments have insufficient funding to fund necessary expenditures and/or an inefficient allocation of scarce funding across the nations of the UK. Wales’ older population, higher reliance on the hospitality sector, and relatively higher number of diagnosed coronavirus cases relative to the rest of the UK may mean it is at particular risk.

The UK government should therefore consider bypassing the Barnett formula, especially if it is clear that the coronavirus is having very different impacts in different parts of the UK or the cost of particular policy responses will vary significantly. Where ex-ante assessment of likely needs is infeasible it could consider funding via cost reimbursement if the devolved governments follow the same policies as the UK government in England, subject to appropriate checks on expenditure.

Concluding thoughts

Any reforms should probably be planned to be temporary: it is important not to rush into making new long-term fiscal arrangements in the midst of a crisis.

However, as may be the case in other areas of public policy, this crisis can be a prompt to consider the suitability of elements of the fiscal system – like the Barnett formula – that have long been subject to calls for reform. And it will surely lead to further heated debate about the constraints placed on the devolved governments as the five yearly review of Scotland’s fiscal framework continues.