Bank Of England - Monetary Policy Report And Financial Stability Report - August 2020

6th August 2020

Covid-19 is reducing jobs and incomes in the UK. It has also put a big strain on UK businesses' cash flow, and is threatening the livelihoods of many people.

Our role is to ensure UK monetary and financial stability. We set monetary policy to influence spending in the economy and to ensure inflation (the pace of price rises) returns to our 2% target sustainably. Low and stable inflation supports jobs and growth and helps people plan for the future. We ensure the UK financial system is resilient to, and prepared for, a wide range of risks - so that the system can serve UK households and businesses in bad times as well as good.

We have put in place a package of measures that will support households and businesses, help the economy recover and keep the financial system safe and stable.

Since January, we have cut interest rates and are supporting the UK economy through £300 billion of quantitative easing. This reduces borrowing costs for households and businesses and will help the economy to recover.

Households and businesses need help from the financial system to weather the economic disruption associated with Covid-19. Actions we took to strengthen the UK financial system since the global financial crisis mean UK banks are strong enough to be able to keep lending to households and businesses even in very severe situations. By expanding lending, banks will support the economy and limit losses to themselves.

We will continue to monitor the economy closely including how the UK financial system is serving UK households and businesses during this shock. We stand ready to take further actions to help the economy recover, ensure that inflation returns to our 2% target, and support financial stability to promote the good of the people of the United Kingdom.

Covid-19 is reducing jobs and incomes in the UK

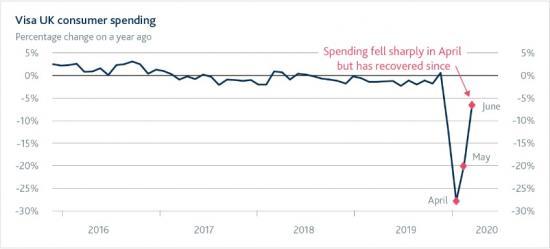

During lockdown, many businesses have been unable to produce or sell their goods and services.

Many households had less money coming in, and some people lost their jobs.

As restrictions have eased, production and spending have begun to pick up.

But jobs and incomes will be lower than they were before Covid-19 for some time.

That is why we have been taking action to support the UK economy.

We are keeping interest rates low...

We have put in place a package of measures to help households and businesses.

Since January, we have cut interest rates to 0.1%.

Lower interest rates mean cheaper loans for businesses and households. That reduces the costs they face.

To encourage banks and building societies to pass this cut on to you we are offering them long-term funding at very low rates.

We are also supporting the UK economy through £300 billion of quantitative easing. This mainly involves us buying large quantities of government bonds. When we do this, the interest rates on those bonds go down. This helps to keep the interest rates on mortgages and business loans low.

....and ensuring the financial system can support UK households and businesses.

During the Covid-19 pandemic many businesses and households have been able to rely on the financial system for support. We are working to ensure they can continue to do so.

Since the financial crisis, we have made UK banks and building societies increase the financial resources (capital) they have set aside to act as a shock absorber for bad times. To help them keep lending during the pandemic we are letting them use the resources they have set aside.

Working with the Government, we are supporting large businesses and their employees by offering them loans for up to twelve months. This will help them to keep paying wages and their suppliers, even if they have serious cash flow problems. And it will help banks focus on lending to small and medium sized companies.

We are offering more long-term funding to banks that increase their lending, including extra funding to banks that offer more lending to small and medium-sized companies. These firms often need more support in times like these.

We will support the economy to promote the good of the people of the United Kingdom

Our tests of the major UK banks show that the banking system is strong enough to keep lending to UK households and businesses, even if the economy continues to face very severe difficulties.

The major UK banks and building societies have a crucial role to play in providing loans to UK businesses and households and by providing payment holidays. Doing so will support economic activity and limit longer‐term economic damage.

Markets were heavily disrupted in March. This meant some firms couldn't get finance. We will investigate weaknesses and continue to take actions to strengthen the system for the future, including how the financial system can support the recovery in the long term.

Our measures will help the economy recover and keep the financial system safe and stable.

And by maintaining monetary and financial stability we are promoting the good of the people of the United Kingdom.