Scottish Private Sector Returns To Growth In August - Royal Bank Purchase Managers Index

14th September 2020

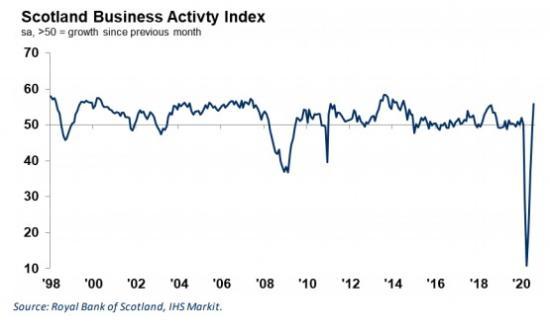

According to the latest Royal Bank of Scotland PMI® , the Scottish private sector returned to growth during August, with business activity rising at the quickest pace for more than six years amid the fastest uptick in new work since late-2018. The seasonally adjusted headline Royal Bank of Scotland Business Activity Index - a measure of combined manufacturing and service sector output - rose from 49.3 inJuly, to 55.8 in August, to signal the first increase in Scottish private sector output since February. Moreover, the latest figure was the highest for over six years.

• Business activity expands at quickest rate since July 2014.

• Fastest increase in new business for nearly two years

• Underutilised capacity leads to further job cuts.

According to the latest Royal Bank of Scotland PMI® , the Scottish private sector returned to growth during August, with business activity rising at the quickest pace for more than six years amid the fastest uptick in new work since late-2018. The seasonally adjusted headline Royal Bank of Scotland Business Activity Index - a measure of combined manufacturing and service sector output - rose from 49.3 inJuly, to 55.8 in August, to signal the first increase in Scottish private sector output since February. Moreover, the latest figure was the highest for over six years.

Growth was broad-based at the sector level, although uneven, as manufacturers registered noticeably sharper increases in both output and order book volumes than service providers.

Adjusted for seasonal factors, the New Business Index posted above the 50.0 threshold for the first time in six months during August to signal an increase in new work at Scottish firms. Moreover, the rate of expansion was the quickest since

October 2018. The easing of lockdown measures and improved client demand were frequently associated by panellists to the rise.

The 12-month outlook for activity among Scottish private sector firms remained positive for the fourth month running during August. Anecdotal evidence linked confidence to improved demand conditions amid looser lockdown restrictions, alongside hopes of a timely recovery from the economic blow dealt by the pandemic. Sentiment moderated from July, but remained historically strong.

Across the 12 monitored UK areas, only the North East of England and Northern Ireland registered a weaker outlook than Scotland, however.

August data highlighted a seventh consecutive monthly reduction in private sector employment across Scotland. There were further reports of redundancies and layoffs in anecdotal evidence, with respondents in some sectors linking job cuts with still-muted demand and a weak outlook. The rate of job shedding was the slowest since February, but still sharp.

At the sector level, the reduction in staff numbers was broad-based. Services firms again registered a sharper reduction than manufacturers. Scottish companies signalled another reduction in the level of outstanding business during August, extending the current sequence of contraction to nine months.

According to respondents, the rapid falls in sales during April, May and June meant there was ample capacity to deal with new orders. The rate of backlog depletion, albeit still sharp, was the slowest since February. Across the 12 monitored UK areas, Scotland recorded the second-quickest reduction in outstanding business during August, ahead of only Northern Ireland.

Cost burdens facing Scottish private sector firms rose again in August, extending the current sequence of increase to three months. Respondents cited greater fuel and staff costs, unfavourable exchange rates and higher prices at suppliers as the main drivers of inflation in August. The rate of increase slowed from July, but was still solid overall.

Average input prices also increased at the UK level in August, at a broadly similar rate as in Scotland.

A sixth consecutive monthly reduction in average charges levied by Scottish private sector firms was recorded during August. Elevated competitive pressures had led firms to discount in attempts to attract clients, according to panellists. That said, the latest reduction in charges was the softest in the current sequence and only mild.

At the sector level, services drove the overall decline, as a modest reduction in charges levied by service providers outweighed a further increase in selling prices at Scottish manufacturers.