Overview Of The November 2020 Economic And Fiscal Outlook

26th November 2020

From the Office of Budget Responsibility.

1.1 The coronavirus pandemic has delivered the largest peacetime shock to the global economy on record. It has required the imposition of severe restrictions on economic and social life; driven unprecedented falls in national income; fuelled rises in public deficits and debt surpassed only in wartime; and created considerable uncertainty about the future. The UK economy has been hit relatively hard by the virus and by the public health restrictions required to control it.

1.2 During the first wave of infections, the UK locked down later and for longer than some of its European neighbours and experienced a deeper fall and slower recovery in economic activity. A resurgence of infections is now in progress across Europe and North America, prompting the tightening of public health restrictions and reimposition of national lockdowns and taking the wind out of an already flagging recovery. That includes the UK, where GDP is set to fall by 11 per cent this year - the largest drop in annual output since the Great Frost of 1709.

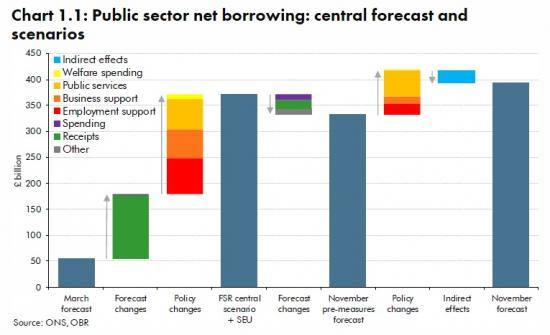

1.3 The virus has also exacted a heavy and mounting toll on the public finances. In our central forecast, receipts this year are set to be £57 billion lower, and spending £281 billion higher, than last year. The Government has committed huge sums to treat the infected, control the spread of the virus, and cushion its financial impact on households and businesses. As support has been expanded and extended, including in the wake of the second wave of infections, its total cost this year has risen from £181 billion at the time of the Summer Economic Update, to £218 billion at the time of the Winter Economy Plan, to £280 billion in this forecast.

1.4 In our central forecast, the combined impact of the virus on the economy and the Government's fiscal policy response pushes the deficit this year to £394 billion (19 per cent of GDP), its highest level since 1944-45, and debt to 105 per cent of GDP, its highest level since 1959-60 (Chart 1.1). Borrowing falls back to around £102 billion (3.9 per cent of GDP) by 2025-26, but even on the loosest conventional definition of balancing the books, a fiscal adjustment of £27 billion (1 per cent of GDP) would be required to match day-to-day spending to receipts by the end of the five-year forecast period.

1.5 The support provided to households and businesses has prevented an even more dramatic fall in output and attenuated the likely longer-term adverse effects of the pandemic on the economy's supply capacity. And the Government's furlough scheme has prevented a larger rise in unemployment. Grants, loans, and tax holidays and reliefs to businesses have helped them to hold onto workers, keep up to date with their taxes, and avoid insolvencies. Nonetheless, we anticipate a significant rise in unemployment - to 7.5 per cent in our central forecast - as this support is withdrawn in the spring.

1.6 The economic outlook remains highly uncertain and depends upon the future path of the virus, the stringency of public health restrictions, the timing and effectiveness of vaccines, and the reactions of households and businesses to all of these. It also depends on the outcome of the continuing Brexit negotiations. In such circumstances, the value of a single ‘central' forecast is limited.

1.7 We therefore present three scenarios for the virus: an upside scenario, in which lockdown succeeds in bringing the second wave of infections under control and the rapid rollout of effective vaccines enables output to return to its pre-virus level late next year; a central one, in which restrictive public health measures need to be kept in place until the spring and vaccines are rolled out more slowly, leading to a slower return to pre-virus levels of activity at the end of 2022; and a downside one, in which lockdown has to be extended, vaccines prove ineffective in keeping the virus in check, and a more substantial and lasting economic adjustment is required with economic activity only recovering to its pre-virus level at the end of 2024 (Chart 1.2). In the upside scenario, output eventually returns to its pre-virus trajectory, but output is left permanently scarred by the pandemic in the other two scenarios, by 3 and 6 per cent respectively. All three assume a smooth transition to a free-trade agreement with the EU in the new year. But we also describe an alternative scenario in which the Brexit negotiations end without a deal. This would further reduce output by 2 per cent initially and by 1½ per cent at the forecast horizon.

Read more at OBR