Highland Council Ensures No Child Goes Hungry at School

28th November 2020

A report considered at the Highland Council, Audit & Scrutiny Committee today on school meals income reported that there was significant level of historic debt regarding payment for school meals and that given the age of the debt further management action is required in order to reduce or write off the outstanding amounts due.

However, the amounts due are also reflective of the Council's proactive approach in ensuring that no child goes hungry at school. The Council's policy is that no primary school pupil should be refused a meal due to insufficient funds being available or no other arrangement being in place for a lunchtime meal.

The Council understands that there will be occasions where payment is not made in advance and a process exists to support pupils and subsequently collect monies due.

Highland Council currently provides approximately 18,000 lunches per day at 173 primary schools and 29 secondary schools.

Councillor Graham MacKenzie, Chair of the Audit & Scrutiny Committee said: "While further work is need to reduce still high level of debt owed for unpaid school meals the Council's policy to ensure that no child goes hungry is an essential component of the Council's social role.

"Our Revenues & Business Support Section play a pivotal role in ensuring all entitlement including free school meals are promoted and claimed. As part of the debt recovery process they are reviewing entitlement to free school meals to provide support and maximise family incomes."

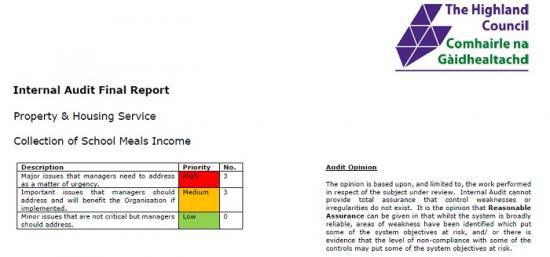

From the Audit Report

1. Introduction

1.1 Highland Council currently provides approximately 18,000 lunches per day at 173 primary schools and 29 secondary schools. School meals for P1-3 are free, P4-7 are £2.30 and secondary meals are £2.55. Income generated from school meals in 2018/19 was £3.654m, 88% of which was paid for in cash and 12% collected online.

1.2 The audit reviewed the systems in place for the collection, recording and monitoring of school meals income, including the collection of income for unpaid school meals. Questionnaires were issued to catering staff at all schools and 112 responses were received. The following 5 schools were visited (current system used in brackets), and questionnaires completed at the time of the visit:

− Crown Primary School (Cashless)

− Dalneigh Primary School (iPayImpact)

− Milton of Leys Primary School (Conventional Cashless with iPay payment module add-on)

− Drakies Primary School (Non-cashless i.e. cash and cheque only)

− Millburn Academy (Cashless)

1.3 The audit field work was completed prior to the coronavirus (COVID-19) lockdown at the end of March.

2. Main Findings

2.1 School meal income collection, recording and banking procedures

This objective was partially achieved. The School Meals Financial Procedures Guide (the guidance) provides clear guidance for school based catering staff. This is updated as required and changes are communicated to staff either by way of a newsletter or annual training day. 113 out of 117 survey respondents said that they were aware of the guidance and 110 of these found it clear and easy to understand. 97% of those respondents who were aware of the guidance followed it and for the 3 that stated they did not, the variations would not preclude income from being collected effectively. 80% of respondents stated that they had received some sort of training, either on the job or in some other form in relation to their income collection, recording and banking duties.

The questionnaire responses received, and schools visited, demonstrate a good understanding of the processes for the ordering, collection and recording of payments for school meals. The main issues identified related to the secure storage of cash on school premises. The guidance states that monies ‘must be stored in a locked cash box and stored in a locked cabinet or safe'. 56 respondents stated that they stored cash in either a locked cash box or locked cabinet/safe but not both. 2 schools said that members of staff had had to provide lockable money boxes from home. 22 respondents said that access to the key for the lockable money box or locked cabinet/safe was not restricted, with all kitchen staff having access to the key in some cases. 2 stated that there was no secure place to store cash within the school that kitchen staff had access to (See action plan H1).

88 respondents said that a member of school staff either walked or drove to the bank/post office to deposit school meal income, and 24 schools specifically mentioned that they used their own car. In order to comply with the Council's Personal Accident Insurance Policy, an employee must hold personal motor insurance with business cover if they use their own car for business purposes. 1 cook questioned whether their insurance was adequate as she was only covered for ‘travel to place of work'. This suggests that the appropriate insurance cover may not be in place for all of those relied upon to transport school meal income to the bank/post office. The guidance states that car users must complete an Essential and Casual Users Insurance Declaration on an annual basis, but this is not monitored (See action plan M1). For the remaining schools, cash was either collected from the school by a Council van driver and transported to Catering HQ (Ruthven House, Inverness) or dropped off there by school staff, and then subsequently collected and banked by G4S. There were appropriate controls in place for these arrangements.

All schools must submit a catering return to Business Support (BS) at Catering HQ on a weekly basis along with relevant banking paperwork. Questionnaire responses demonstrate that there is a good understanding of the process for the completion and submission of weekly catering returns amongst school catering staff. Checks are carried out by BS to ensure that a return is received from each school and the banking paperwork corresponds with the amount of expected income as stated on the return. A sample of returns for 20 schools covering 4 weekly periods was examined and a catering return had been received by BS in all cases apart from 1. This had been identified by BS and was followed up by the cook who said that they had posted the return, but it had not been received. For 2 schools, a bank pay-in slip had been attached to the return but had not been stamped and there was no bank/post office receipt attached and 1 school had switched to using the quick deposit facility. However, this had not been picked up by BS and therefore the required checks to ensure that income had reached the Council's bank account were not carried out (See action plan H2).

The guidance states that catering returns must be signed by a catering staff member and a school representative. The returns for 6 schools had not been countersigned by a school representative and for those that were, the role of the person signing it varied from Head Teacher to another cook (See action plan M2).

Information from the catering return is manually input into Saffron by BS and this enables the provision of school meal performance and management information. Out of the 80 catering returns examined, information had been entered incorrectly or omitted on 16 occasions. Checks are carried out by BS in the form of various reports run before each weekly period is finalised but as the reports did not cover the areas where the errors had occurred, these were not identified.

All banking transactions examined as part of the audit had been completed successfully with all income deposited in the Council's bank account in a timely manner.

2.2 Unpaid school meals

This objective was partially achieved. There is a documented process in place for the recording of unpaid school meals in primary schools and from the questionnaire responses received, there appears to be a good understanding of it amongst school catering staff. The 4 primary schools visited demonstrated that they complied with the process whereby, for balances of up to £20, reminders were issued to parents through the school office/school bag mail at the end of each week. Letters are issued to parents by Catering HQ for balances of between £20-£40 and for balances of over £40 an invoice would be issued plus a £15 surcharge. The guidance states that debt reports should be reviewed on a weekly basis, and letters / invoices are issued from Catering HQ once or twice a month.

Secondary school pupils are advised that they must have money in their school meals account to be able to use the school meals service, and debt is not permitted in the same way as a primary school would. There is a digital voucher system in place which can be installed in secondary schools, but to date only 2 headteachers have chosen to introduce this system. Survey responses indicated that there are a variety of approaches taken by secondary schools where a pupil is unable to pay for a school lunch.

As at the 02/12/19, the current value of invoices raised for unpaid school meal debt in primary schools was £65,250, which reflects 1.8% of usual annual income collected - 33% of which had been outstanding for 361 days or more. On the 09/02/19, £122,429 of previously written off debt, which the Sheriff Officer had been unable to collect, was put back onto the ledger. This means that at the time of writing this report, the current level of debt is £206,220. 73% of this debt has been outstanding for 361 days or over and some of the invoices date back to the 2012/13 financial year. The treatment of this older debt is part of a larger exercise being undertaken by Revenues and Customer Services to further increase the levels of sundry debt collection (See action plan M3).

2.3 Systems used by schools

This objective was not achieved. The same system is not used in all schools to record school income with some schools using a cashless (online) system and some using a non-cashless (manual) system. Cashless catering systems are in operation in all 29 secondary schools, 39 primary schools and 1 special school, whilst the remainder operate a non-cashless system. Where a cashless system is in place, school meals can be paid for online, but all schools accept cash payments. The catering return format differs depending on whether the school is cashless or non-cashless and this creates more work for BS when processing them.

There are further variations in terms of the cashless systems operated in schools. 59 out of 69 schools have the traditional cashless catering system, 5 have the traditional cashless catering system with an additional payment module bolt-on and 5 have the iPayImpact system. All systems enable school meal orders and payments to be recorded electronically by catering staff and parents are able to pay for school meals online. The main difference between the systems is that with the payment module bolt-on or iPayImpact system, payments appear more quickly on pupil accounts and parents are able to view the account balance and meal choices made by children.

A 2017 Online School Payments System Corporate Improvement Project and a 2019 Cashless Catering Rapid Review both supported the introduction of a standard online system within schools in order to reduce the amount of cash handled. Another advantage of introducing a standard online system in all schools is that the data could eventually feed directly into Saffron, thus reducing the requirement for manual data input. In order to facilitate this, an upgrade to Saffron would be required but the current ICT infrastructure would not be able to support this. This type of standard online system is ultimately what the service is aiming for but there have been delays in its implementation due to cost and lack of staff resources and a change in ICT provider also complicating matters further (See action plan H3).

3. Conclusion

3.1 There is documented guidance in place for the collection, recording and banking of school meal income by catering staff and there is good awareness of this amongst staff. There is generally a high level of compliance with the guidance, but some issues were identified around the secure storage of cash on school premises.

The Council's policy is that no primary school pupil should be refused a meal if they have insufficient funds and there are no other arrangements in place for a meal at lunchtime. Therefore, there will always be occasions where school meals are not paid for in advance and a process has been put in place to collect monies owed. Despite a reminder, letter, invoice and contact from the Sheriff Officer, there is still a high level of debt owed to the Council for unpaid school meals.

Not all schools in the Highland Council operate the same system for the collection and recording of school meal income with a high number still using a manual, cash only system. There are undoubted efficiencies and benefits to be achieved from the introduction of a standard online system, not just for the Council but also for parents/carers who may wish to pay for school meals online. The introduction of such a system would also reduce the risk of fraud which is higher with a cash based system as highlighted by previous fraud investigations in respect of school meals income. The Service has confirmed that budget has now been approved this Financial year to support the installation of an online payments system across all schools and a roll out of this system has now commenced.

To read the full audit reports from the meeting held on 26th November go to https://www.highland.gov.uk/meetings/meeting/4351/audit_and_scrutiny_committee Choose Item 4 Internal audit Reports