Monthly Economic Brief - February 2021 - Business Activity

9th February 2021

Extract from the Monthly Economic Brief of Scottish Government

Office of the Chief Economic Adviser - Gary Gillespie - Chief Economist.

Business Activity

Business activity weakened in the final quarter of 2020 and into the start of 2021 as tighter restrictions were introduced to suppress the second wave and new variant of the virus.

Proportion of business trading

The easing of national lockdown restrictions during the second and third quarters of 2020 enabled many businesses to gradually reopen, and by the start of October, the proportion of business reporting as currently trading had risen to 97%, up from 79% in June.

However, this proportion fell over the fourth quarter as regional restrictions were introduced, with a notably sharper drop at the start of the new year as Level 4 restrictions were introduced across mainland Scotland.

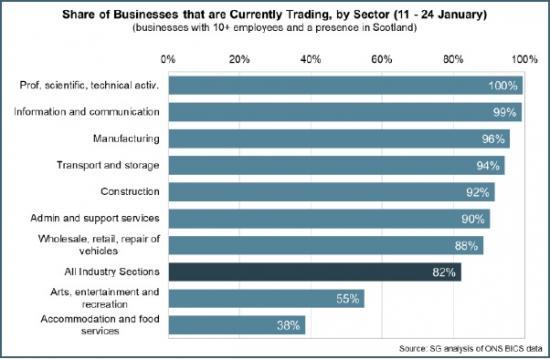

Latest data for mid-January shows the proportion of businesses currently trading fell to 82% (down from c. 90% in December), its lowest rate since the start of July 2020.

The sectors with the lowest shares of businesses trading continue to be those in the consumer facing services sectors most directly impacted by the restrictions such as Accommodation and Food services (38%) and Arts, Entertainment and Recreation services (55%). However there were falls across other sectors such as Manufacturing (96%, down from 99% in December). Construction (92%, down from 98% in December) and Wholesale, Retail and Repair of Vehicles (88%, down from 98% in December) signalling that the latest restrictions have had a broad impact across the economy.

Business output

The fall in businesses trading over the final quarter of 2020 has partly been reflected in the RBS Purchasing Managers Index (PMI)3 business survey which has reported that business activity in Scotland fell in each month in the final quarter of the year.

Latest PMI data for December show business activity fell at a similar pace to November (47.3) having fallen more sharply in October (43.2), and reflects a further fall in new orders.

In that regard, there continued to be a notable difference in December between Manufacturing activity (56.1), which continued to grow strongly over the month (supported by a strong pick-up in new order growth) and Services activity, which fell for the fourth consecutive month (45.5), reflecting the impacts of restrictions on sector activity.

Looking ahead, business output expectations for the next 12-months remained positive, and optimism strengthened to its highest level since February 2020 (64.8, up from 64.0), reflecting positive developments on the roll out of a vaccine. However, the introduction of tighter restrictions at the end of the year, means the short term outlook has weakened.

The UK PMI for January4 signalled a renewed downturn in UK business activity as lockdown restrictions were reintroduced across the UK. Overall, output fell at its sharpest rate since May 2020 (41.2) driven by a sharp fall in services activity (39.5), and a slowdown to marginal growth in manufacturing output (50.7).

Read the full report HERE