Mortgage Lending Increases As Other Borrowing Falls

1st March 2021

The Bank of England report published today (1 March 2021) shows increased activity as lending for house purchase rose significantly.

The mortgage market remained relatively strong in January. Individuals borrowed an additional £5.2 billion secured on their homes, compared to the monthly average of £4.0 billion in the six months to February 2020.

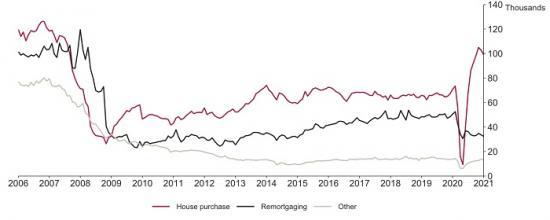

The strength in mortgage borrowing follows a large number of approvals for house purchase. In January, the number of these approvals - an indicator for future lending - was 99,000 (Chart 2). While this was a little lower than in December (102,800) it was well above the monthly average in the six months to February 2020 (67,900). Approvals for remortgage (which only capture remortgaging with a different lender) fell slightly to 32,400.

The effective interest rates on newly drawn mortgages fell 5 basis points to 1.85%. That is in line with the rate in January 2020, and compares with a series low of 1.72% in August 2020. The rate on the outstanding stock of mortgages fell to 2.09%, a new series low.