Big Businesses Clear Borrowing While SMEs Borrow More

1st March 2021

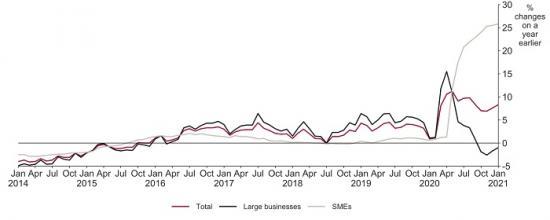

Businesses borrowing from banks.

Overall, non-financial corporates repaid £1.0 billion of bank loans in January. The average cost of new borrowing from banks by all PNFCs fell by 11 basis points, to 1.70%. The rate compares with 2.68% in January 2020.

Within overall corporate borrowing, small and medium sized non-financial businesses' (PNFCs and public corporations) net borrowing from banks was little changed. In January, they drew down an extra £0.5 billion in loans. The annual growth rate continued to rise, reaching 25.8%, a new series high (Chart 4). Interest rates on new loans to SMEs fell back to 2.09% in January, following the increase to 2.32% in December. This remains well below the rate of 3.37% in January 2020.

Large non-financial businesses continued making net repayments in January (£1.5 billion). The annual growth rate of borrowing by all large businesses was -1.0%.

Businesses deposits with banks:

UK businesses' deposits fell by £9.0 billion in January (Chart 5). This net outflow was very similar to previous years: in January 2020 deposits fell by £13.1 billion. This similarity contrasts with much of 2020. Between March and December 2020, businesses’ deposits increased by an average of £17.3 billion, much stronger than in previous years. The effective rates on new time deposits and stock sight deposits for PNFCs remained broadly unchanged in January, at 0.08% and 0.06%, respectively.

From the Bank of England report out today (1March 2021).