Store Openings and Closures - 2021 - Record closures as retail and leisure responds to changing consumers

14th March 2021

A comprehensive report from PwC UK one of the big accountancy firms looking at store closures and new starts.

Full pandemic impact yet to show, but choosing the right location may matter more post-COVID-19.

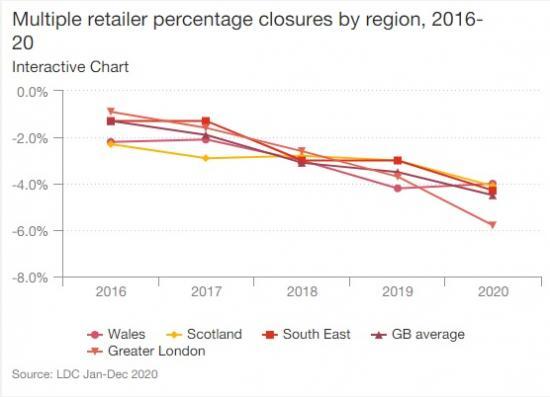

We weren't expecting it to be positive reading this year, and our headline figures confirm that: a record net decline (-9,877), number of closures (17,532), and a new low in the number of store openings (7,655). That's equivalent to an average of 48 chain stores closing every day, and only 21 openings.

And the big concern is that we're still to see the real impact of the pandemic - it's likely to get worse before it gets better. With our primary research methodology assuming "temporarily closed" stores remain open, we expect to see the full effect over the next couple of surveys, as those temporary closures return or disappear.

But this year, record closures aren't the main story. While our Store Openings and Closures survey only looks at multiple operators (stores with 5 or more outlets) it paints a detailed picture of all retail locations in Great Britain. So while we're still waiting to see the full impact of COVID-19 on store closures, we are seeing its effect on consumer behaviours, many of which existed pre the pandemic and have just accelerated but are driving more rapid change in consumer-facing businesses. In fact, our 24th Annual CEO Survey shows that keeping up with customers is a challenge, with 61% of UK CEOs worried about changing consumer behaviours.

We've discussed many of these COVID-accelerated trends before: but we're also seeing new winners emerging as retail parks thrive and small towns enjoying a mini-renaissance. These are becoming locations that consumers now want to shop in, and larger retailers want to be there. Independents are also back in vogue, driven by a desire to shop locally.

Red the full report with more charts and graphs and links to more data HERE