Retail Sales In Great Britain September 2021

23rd October 2021

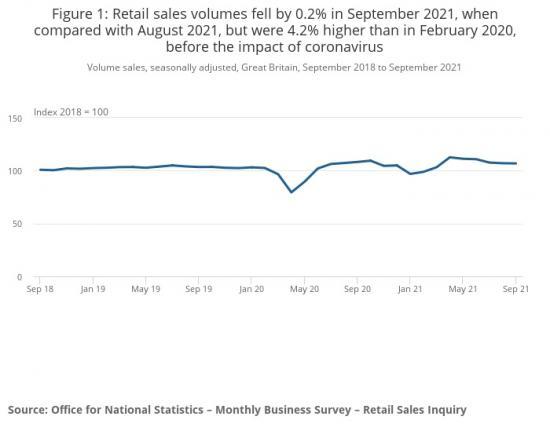

Retail sales volumes fell by 0.2% in September 2021, following an upwardly-revised 0.6% fall in August; despite the fall in September, volumes were 4.2% higher than their pre-coronavirus (COVID-19) pandemic February 2020 levels.

Non-food stores reported a fall of 1.4% in sales volumes in September 2021, because of falls in household goods stores (negative 9.3%), such as furniture and lighting stores, and other non-food stores (negative 1.7%) such as sports equipment stores.

Automotive fuel sales volumes rose by 2.9% in September 2021 as demand towards the end of September increased sales; volumes were 1.8% above their pre-pandemic February 2020 levels.

Food store sales volumes rose by 0.6% in September 2021 and were 3.9% above pre-coronavirus pandemic levels in February 2020.

Despite relaxation of COVID-19 restrictions in summer 2021, in-store retail sales remain subdued; the proportion of retail sales online rose to 28.1% in September 2021 from 27.9% in August, substantially higher than the 19.7% in February 2020 before the pandemic.

Retail sales volumes fell by 0.2% in September 2021, when compared with August 2021, but were 4.2% higher than in February 2020, before the impact of coronavirus.

Retail sales volumes have fallen each month since April 2021 when non-essential retailing re-opened and retail sales reached levels substantially above those before the pandemic. This is the longest period of consecutive monthly falls in the history of this series (which began in February 1996). However, sales remain 4.2% above the level seen before the pandemic (February 2020).

Non-food stores were the largest contributor towards the monthly decrease at 0.5 percentage points. Within this, household goods stores, such as furniture and lighting stores were the main contributor which fell by 9.3% over the month.

However, there was a positive contribution from food stores at 0.2 percentage points. Over the month, food store sales volumes rose by 0.6% following a fall of 1.4% in the previous month.

Fuel stores also reported a positive contribution of 0.2 percentage points as sales volumes increased by 2.9% over the month following increased demand at the end of September.

Aligned with the fall in month-on-month sales, retail sales volumes over the last three months fell by 3.9% when compared to the previous three months, partly because of strong sales in April when non-essential retailing re-opened. This is the first fall in the three-month-on-three-month series since March 2021. Compared to the same period a year earlier, sales volumes over the last three months fell by 1.3%, its lowest rate since February 2021. However, percentage change over the past year should be interpreted with caution given the impact of base effects on growth rates because of the economic impact of the coronavirus pandemic throughout 2020. When compared to the same period two years ago, sales volumes over the last three months rose by 2.9%.

Retail sales values, unadjusted for price changes, fell by 0.2% in September 2021, following a 0.1% decline in August. Over the last three months to September 2021, the value of sales was up 3.2% on the same period a year earlier, reflecting an annual retail sales implied price deflator of 3.4%.

Automotive fuel sales volumes increased by 2.9% over the month to September and were 1.8% above their February 2020 levels. In feedback from retailers, while many noted increased turnover during the last week of September resulting in increased sales over the month, other fuel retailers confirmed issues with deliveries and shortages at sites which had a downward impact on the value of their fuel sold over the month.

Increased fuel sales volumes in the last week of September is also reflected in data on UK spending on debit and credit cards, based on CHAPS payments made by credit and debit card payment processors, which reported a pickup in its "work related" spending category (such as fuel) from 24 September.

Non-food stores as a whole saw monthly sales volumes fall by 1.4% in September 2021 and were 1.7% below their pre-coronavirus pandemic levels in February 2020.

Household goods stores sales volume reported a monthly decline of 9.3% largely due to a fall of 14.8% in furniture and lighting stores. Sales volume for household goods stores have fallen each month since their peak in May 2021, following the re-opening of non-essential retailing in April, and were 1.0% below their levels in February 2020.

Other non-food stores (such as chemists, toy stores and sports equipment stores) reported a monthly fall in sales volumes of 1.7% in September 2021. Sales volumes were 3.7% lower than this time last year but 3.4% above their pre-COVID-19 levels.

Clothing and department stores reported an increase in monthly sales volume of 4.3% and 0.2% respectably. Sales volumes were 5.5% and 5.1% below their pre-pandemic February levels.

Online spending values increased in September 2021 by 0.5% when compared with August 2021, largely because of an increase in department stores sales values (3.8%). The monthly increase in online spending values resulted in a slight increase in the proportion of online sales, which increased to 28.1% in September 2021, from 27.9% in August.

This remains far higher than the proportion of online retail spending in February 2020, before the coronavirus (COVID-19) pandemic, of 19.7%, although it is below the peak pandemic level of 36.6% reached in February 2021.

Read the full article with graphs and links HERE