Public Sector Finances, UK: October 2021

19th November 2021

Public sector net borrowing (excluding public sector banks, PSNB ex) was estimated to have been £18.8 billion in October 2021; this was the second-highest October borrowing since monthly records began in 1993, £0.2 billion less than in October 2020.

PSNB ex was estimated to have been £127.3 billion in the financial year-to-October 2021; this was the second-highest financial year-to-October borrowing since monthly records began in 1993, £103.4 billion less than in the same period last year.

Public sector net debt excluding public sector banks (PSND ex) was £2,277.6 billion at the end of October 2021 or around 95.1% of gross domestic product (GDP), maintaining a level not seen since the early 1960s.

Public sector net debt excluding public sector banks and the Bank of England (PSND ex BoE) was £1,986.7 billion at the end of October 2021 or around 83.0% of GDP.

Provisional October 2021 estimates of central government receipts were £65.5 billion, up £3.8 billion (or 6.2%) compared with October 2020, while central government bodies spent £78.8 billion, up £1.5 billion (or 1.9%) from October 2020.

Central government net cash requirement (excluding UK Asset Resolution Ltd and Network Rail) was £2.6 billion in October 2021, £11.8 billion less than in October 2020, bringing the total for the financial year-to-October 2021 to £101.2 billion.

The impact of coronavirus on the public finances

The coronavirus (COVID-19) pandemic has had a substantial impact on the economy and on public sector borrowing and debt.

!

Although the impact of the coronavirus pandemic on public finances is becoming clearer, its effects are not fully captured in this release meaning that estimates of public sector expenditure and borrowing are subject to greater uncertainty than usual.

Central government tax and National Insurance receipts combined in the financial year ending (FYE) 2021 (April 2020 to March 2021) were £668.2 billion, a fall of £36.7 billion (or 5.2%), compared with the same period a year earlier.

Government support for individuals and businesses during the coronavirus pandemic contributed to an increase of £204.4 billion (or 27.7%) in central government day-to-day (or current) spending, bringing the total to £942.5 billion.

As a result of these low receipts and high expenditure, provisional estimates indicate that in FYE 2021, the public sector borrowed £323.1 billion. This is equivalent to 15.1% of the UK's gross domestic product (GDP), the highest such ratio since the end of World War Two, when it was 15.2% in FYE 1946.

Debt

Revisions

Public sector finances data

Glossary

Measuring the data

Strengths and limitations

Related links

Print this statistical bulletin

Download as PDF

1.Other pages in this release

Other commentary from the latest public sector finances data can be found on the following pages:

Recent and upcoming changes to public sector finance statistics: October 2021

Public sector finances borrowing by sub-sector

UK government debt and deficit: June 2021

Back to table of contents

2.Main points

Public sector net borrowing (excluding public sector banks, PSNB ex) was estimated to have been £18.8 billion in October 2021; this was the second-highest October borrowing since monthly records began in 1993, £0.2 billion less than in October 2020.

PSNB ex was estimated to have been £127.3 billion in the financial year-to-October 2021; this was the second-highest financial year-to-October borrowing since monthly records began in 1993, £103.4 billion less than in the same period last year.

Public sector net debt excluding public sector banks (PSND ex) was £2,277.6 billion at the end of October 2021 or around 95.1% of gross domestic product (GDP), maintaining a level not seen since the early 1960s.

Public sector net debt excluding public sector banks and the Bank of England (PSND ex BoE) was £1,986.7 billion at the end of October 2021 or around 83.0% of GDP.

Provisional October 2021 estimates of central government receipts were £65.5 billion, up £3.8 billion (or 6.2%) compared with October 2020, while central government bodies spent £78.8 billion, up £1.5 billion (or 1.9%) from October 2020.

Central government net cash requirement (excluding UK Asset Resolution Ltd and Network Rail) was £2.6 billion in October 2021, £11.8 billion less than in October 2020, bringing the total for the financial year-to-October 2021 to £101.2 billion.

Back to table of contents

3.The impact of coronavirus on the public finances

The coronavirus (COVID-19) pandemic has had a substantial impact on the economy and on public sector borrowing and debt.

!

Although the impact of the coronavirus pandemic on public finances is becoming clearer, its effects are not fully captured in this release meaning that estimates of public sector expenditure and borrowing are subject to greater uncertainty than usual.

Central government tax and National Insurance receipts combined in the financial year ending (FYE) 2021 (April 2020 to March 2021) were £668.2 billion, a fall of £36.7 billion (or 5.2%), compared with the same period a year earlier.

Government support for individuals and businesses during the coronavirus pandemic contributed to an increase of £204.4 billion (or 27.7%) in central government day-to-day (or current) spending, bringing the total to £942.5 billion.

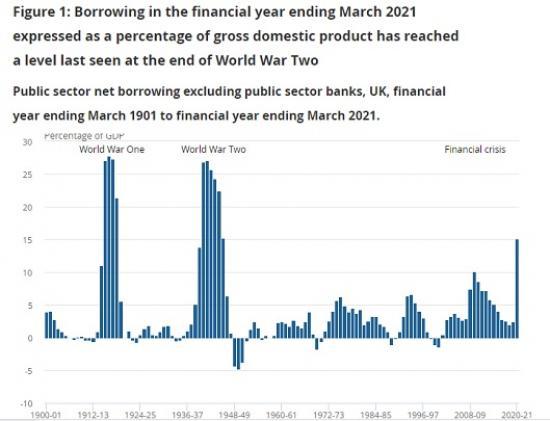

As a result of these low receipts and high expenditure, provisional estimates indicate that in FYE 2021, the public sector borrowed £323.1 billion. This is equivalent to 15.1% of the UK's gross domestic product (GDP), the highest such ratio since the end of World War Two, when it was 15.2% in FYE 1946.

Figure 1: Borrowing in the financial year ending March 2021 expressed as a percentage of gross domestic product has reached a level last seen at the end of World War Two

Public sector net borrowing excluding public sector banks, UK, financial year ending March 1901 to financial year ending March 2021.

World War One

World War Two

Financial crisis

1900-011912-131924-251936-371948-491960-611972-731984-851996-972008-092020-21-10-5051015202530Percentage of GDP

1968-69

● Public sector net borrowing as a % of GDP (PSNB): 0.6

Source: Office for Budget Responsibility and Office for National Statistics - Public sector finances

Notes:

This chart uses historical data published in the Public finances databank 2021 to 2022.

Download this chartFigure 1: Borrowing in the financial year ending March 2021 expressed as a percentage of gross domestic product has reached a level last seen at the end of World War Two

Image .csv .xls

In total, more than 50 schemes have been announced by the UK government and the devolved administrations to support individuals and businesses during the coronavirus pandemic. Our article Recent and upcoming changes to public sector finance statistics: October 2021 and earlier editions of this article discuss the largest of the coronavirus schemes by implementation status within the public sector finances.

The extra funding required by government coronavirus support schemes, combined with reduced cash receipts and a fall in GDP, have all helped to push public sector net debt as a ratio of GDP to levels last seen in the early 1960s. Public sector net debt excluding public sector banks (PSND ex) at the end of October 2021 was equivalent to 95.1% of GDP.

Read the fullreport at https://www.ons.gov.uk/economy/governmentpublicsectorandtaxes/publicsectorfinance/bulletins/publicsectorfinances/october2021