Big Cost Of Living Increase Predicted By Research

1st December 2021

UK inflation: Rising costs could push family spend up £1,700 a year

A typical UK family will spend £1,700 more per year on household costs in 2022, according to a forecast for BBC Panorama.

The analysis, conducted by the Centre for Economics and Business Research (CEBR), projected the inflation rate would rise to 4.6% by Christmas.

This rise is mainly due to higher fuel and energy prices.

Analysts say the full extent of rising costs is not yet being passed on to customers by supermarkets.

They say supermarkets are trying to keep prices constant over the festive period, even if this means absorbing some of the costs, because they don't want to risk losing customers at their busiest time of the year.

Compared with December 2020, the typical UK family of two adults and two children is predicted to spend £33.60 more per week, due to inflation, adding up to £1,700 per year.

Why is the cost of living going up?

The forecast is based on the prices of commonly bought items, including food and drink, clothing and household goods. It also includes spending on utility bills, such as fuel and power; transport costs; and money spent on recreation and days out.

It assumes that spending patterns will remain the same as in previous years and that inflation will remain at the projected 4.6% (up from the current 4.2%). However, experts expect it could rise higher in spring 2022, putting further pressure on household spending.

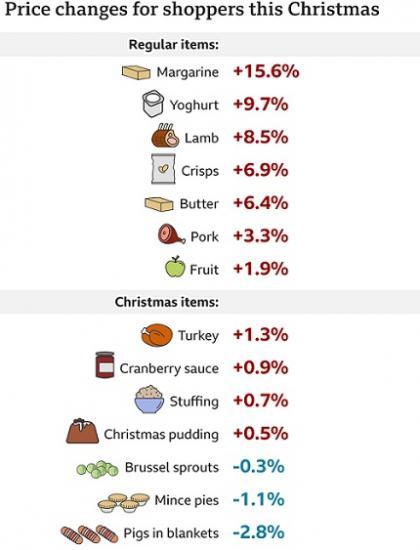

Panorama and CEBR, an independent economic consultancy, also compiled data for common food products to look at the price difference between this year and last.

BBC Article

Rising costs could push family spend up 1700 pounds a year

The BBC will run a Panorama Special

You can watch Panorama's Delivering Christmas: What's In Store? on BBC One on Wednesday 1 December 2021 at 7:30pm and on iPlayer afterwards.

Note :From Caithness Business index

Not mention in the above about inflation on prices is the hit on incomes caused by the rise in National Insurance contributions to b paid by both employees and employers. Less in pay packets and increased costs for employers. This will add to the problems.

Potentially also it looks like an interest rise will finally be coming after several years of very low rates and this will affect loans, mortgages and credit cards. Time to clear some debts and pay down credit cards before it happens.

National Insurance increase from April 2022

From 6 April 2022 to 5 April 2023 National Insurance contributions will increase by 1.25%. This will be spent on the NHS and social care in the UK.

The increase will apply to:

Class 1 (paid by employees)

Class 4 (paid by self-employed)

secondary Class 1, 1A and 1B (paid by employers)

The increase will not apply if you are over the State Pension age.