Scottish Income Tax: Distributional Analysis 2022-2023

10th December 2021

A note on the distributional impact of the Scottish Government's Income Tax policy for 2022-2023.

Income Tax: Cumulative Impacts on Income Levels and Equality

Summary

This note sets out the distributional impact of the Scottish Government's Income Tax policy choices on Scottish taxpayers since 2016-17, when the Scottish Parliament was first able to set a different rate of Income Tax in Scotland. The analysis shows that the Scottish Government's decisions over this period, combined with changes in the UK-wide Personal Allowance, have been highly redistributive and have protected low income taxpayers.

The note considers the effect of Income Tax policy on taxpayers in 2022-23 compared to a counterfactual scenario where Income Tax policies announced at and since April 2016-17 were not introduced, and all thresholds and the Personal Allowance were uprated with CPI inflation instead. Compared to this scenario:

62% of taxpayers will pay less tax in 2022-23 than they would have done if the Income Tax policy had followed default inflationary uprating (‘the counterfactual'). On average, lower earners, women, older and younger taxpayers particularly benefit. In 2022-23, the taxpayers who are better off than they would be under inflationary uprating include:

The lowest earning 60% of taxpayers. The lowest earning 20% will see the largest decrease in tax relative to their gross income (0.3%).

92% of taxpayers aged under 25 years and 83% of taxpayers aged over 75 years.

72% of female taxpayers, compared to 54% of male taxpayers. However, this is due to the fact that women's earnings are, on average, lower.

Taxpayers in the middle of the income distribution (deciles 3 to 5) will pay on average £56 less in tax in 2022-23 than they would have under the counterfactual. This is due to the introduction of the 19p Starter Rate in Scotland from 2018-19, as well as above-inflation increases in the UK-wide Personal Allowance over the period.

The highest earning 10% of taxpayers will see the largest increase in tax, both in cash terms (£1,490) and relative to their gross income (1.6%). This is largely due to the Scottish Government's decisions to uprate the Higher Rate threshold by less than inflation in five out of six years, and to increase the Higher Rate and Top Rate by 1p, respectively, from 2018-19.

At a household level, taxpayers in the lowest 10% of households by income will see little change in the amount of tax paid in 2022-23, in large part because there are fewer taxpayers in the lower income deciles. Households in the top decile will see the largest decrease in income (£1,185).

Overall, 46% of households will pay less tax, 30% of households will pay the same amount of tax and 24% of households will pay more tax in 2022-23.

The 2022-23 policy proposal broadly maintains the positive distributional implications of the policy changes since 2016-17, which improved the progressivity of the tax system in Scotland.

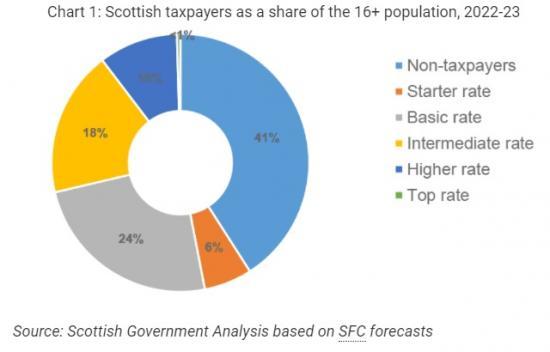

The analysis does not consider the 1.9 million individuals, or 41% of adults in Scotland, who will not pay Income Tax in 2022-23 because they earn less than the Personal Allowance, or for example they are in full-time education, have full-time caring responsibilities or are retired. These individuals are not directly affected by the Scottish Government’s Income Tax policy decisions.

Policy changes since 2016-17

Since the Scotland Act 2012 and Scotland Act 2016 gave the Scottish Parliament the power to set (respectively) Income Tax rates and thresholds, the Scottish Government has implemented a series of policy changes on non-savings non dividend (NSND) Income Tax. These have sought to enhance the level of public service provision in Scotland, make the tax system more progressive, protect lower earning taxpayers and support economic growth. These significant policy changes included:

A cash freeze of the Higher Rate threshold at £43,000 in 2017-18;

The introduction of a new five-band system in 2018-19, and a below-inflation uplift (of 1%) of the Higher Rate threshold to £43,430;

A cash freeze of the Higher Rate threshold at £43,430 in 2019-20;

A cash freeze of the Higher Rate threshold at £43,430 in 2020-21;

Inflationary uprating (0.5%) of all bands and the Higher Rate threshold in 2021-22;

A cash freeze of the Higher Rate threshold at £43,662 in 2022-23.

As a result of these changes, there are now differences between the tax systems in Scotland and the rest of the UK. However, as Income Tax is not a fully devolved tax, any distributional impacts of the Scottish Government’s policy decisions need to be considered alongside changes to UK Government tax policy, particularly with regard to the UK-wide Personal Allowance. Over this period, the Personal Allowance increased by more than inflation, from £11,000 in 2016-17 to £12,570 in 2021-22. In the UK Autumn Budget (October 2021), the UK Government confirmed that the Personal Allowance would be frozen at £12,570 from 2022-23 until 2025-2026.

Key facts about Scottish taxpayers in 2022-23

We estimate that there will be around 4.6 million adults living in Scotland in 2022-23 and around 2.7 million Scottish Income taxpayers. This means that a significant proportion, around 41% or 1.9 million adults, will not pay Income Tax. This could be because they in work, but earning less than the Personal Allowance, or they are in full-time education, have full-time caring responsibilities or are retired.

The UK Government’s decision to increase the Personal Allowance by more than inflation over the period 2016-17 to 2021-22 narrowed Scotland’s Income Tax base, compared to inflationary uprating. However, the UK Government’s decision to freeze the Personal Allowance from 2022-23 until 2025-26 will reverse this, widening the tax base in the future.

As illustrated in Chart 1, the majority of Scottish taxpayers pay either the Starter Rate (19p), Basic Rate (20p), or the Intermediate Rate (21p) of Income Tax. Only 9.9% of Scottish adults pay the Higher Rate (41p), and less than 1% of the Scottish adult population pay the Top Rate (46p).

The threshold at which taxpayers start paying the Intermediate Rate is broadly aligned with the median income of Scottish taxpayers, which is expected to reach around £25,800 in 2022-23. This means that half of all taxpayers in Scotland earn below this level, and half above. Table 1 shows the estimated income distribution of Scottish taxpayers for 2022-23, split into quarters. For example, someone earning between the Personal Allowance (£12,570) and £18,200 would be among the lowest earning 25% of taxpayers in Scotland.

Note

The above is part of a much larger item.

To read it in full go HERE