The Jobs Market Is Healthy And Doesn't Have A Temperature, But Pay Packets Are Shrinking Not Surging

22nd December 2021

Today's labour market stats release should have marked a turning point in the post-pandemic labour market, as furlough came to an end and the economy adjusted to a period without restrictions. Instead, the data out this morning - which covers October and November - covers two months of relative normality between the end of furlough and the emergence of the Omicron variant. So how was the labour market faring as the UK headed into a new wave of Covid-19?

First, the good news: there has been little sign of a weakening labour market at the end of the furlough scheme. We now have the headline unemployment rate for October - Figure 1 shows that unemployment ticked up very slightly on the single-month measure (from 3.9 per cent in September to 4.2 per cent in October), but remains close to pre-crisis levels. And timely payroll data shows that the number of employee jobs continued its rise in November, while vacancies remain close to record highs.

However, the labour market is far from fully recovered. Total hours worked were still 2.2 per cent lower than pre-Covid even in October, when furlough had ended. And economic inactivity, rather than high unemployment, is likely to be the lasting labour market legacy of the pandemic: inactivity has risen by 1.1 percentage points since the start of 2020 (Figure 1). But it is very welcome news that the end of the furlough scheme does not seem to have led to a spike in unemployment, as previously feared.

Instead, the immediate issue for living standards from today's data is what's happening to pay growth. Nominal pay growth is falling quickly from artificially high levels over the summer: after reaching a peak of 7.4 per cent in May (which includes a ‘base effect': comparing pay to May 2020, when lots of people were furloughed), earnings in the year to October rose by just 3.8 per cent. After adjusting for CPIH inflation - which was also 3.8 per cent in October - this means pay packets have been flat over the past year in real terms.

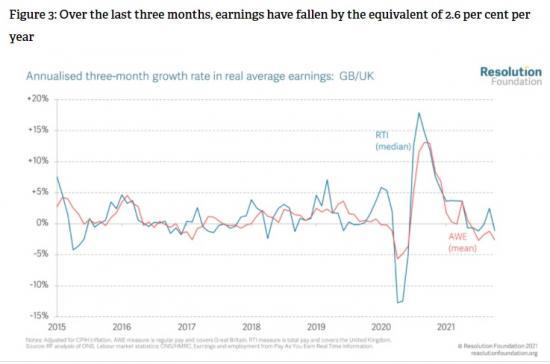

There are still some base effects in the latest data. But we can remove some of this by looking at changes over a shorter time period. In Figure 3, we look at real pay growth over the past three months, and then convert it to an annual equivalent. On this measure, pay has been falling in real terms since June, and real earnings fell by 2.6 per cent in the three months to October (equivalent to a 2.6 per cent fall per year).

Alternatively, we can look at the change in pay since just before the start of the pandemic. The final data point in Figure 4 shows that earnings have fallen by the equivalent of 1.7 per cent a year over the crisis as a whole. The rest of the time series shows annualised growth over the equivalent period (20 months) since 2016: on this measure, the growth in real pay since the start of the pandemic has been similar to its rate just before the crisis.

Far from the overheating labour market feared earlier in the year, then, the UK is facing its third real wage squeeze in a decade. And the gloomy outlook for living standards looks set to continue well into next year. The Bank of England expects inflation to peak next May; with no evidence yet of pay rises responding to higher prices, pay packets are likely to be shrinking in real terms for at least the first half of 2022.

The economy needs a level of wage growth that is high enough to improve workers' living standards, but not so high as to push up firms' costs and raise inflation above target. But today's data makes clear that after months of worrying about the latter, the challenge facing the labour market is one of falling incomes. With the next wave of Covid-19 already underway, policy makers will need to shift their focus to supporting living standards through a tough winter.

This article by Hannah slaughter an economist at the Resolution Foundation can be read with graphics HERE