Scottish Tax Take Down But Social Spending Rising

23rd January 2022

The Scottish Fiscal Commission says it expects a strong economic recovery in 2021-22 with Scottish GDP growing by 10.4 per cent and economic activity returning to pre-pandemic levels by the second quarter of 2022.

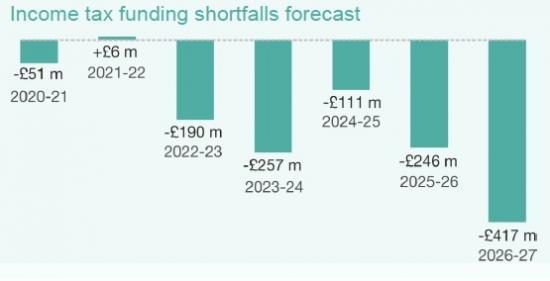

But there is some evidence that the Scottish economy has been lagging behind the rest of the UK. Scottish income tax revenues have fallen behind the Block Grant Adjustment - the amount subtracted from the Scottish Budget to account for the devolution of tax revenues - with a shortfall of £190 million anticipated in 2022‑23. This shortfall is expected to reach £417 million by 2026‑27, driven by slower growth in employment in Scotland compared to the UK.

The Scottish Government continues to make significant reforms to social security. The largest new payment, Adult Disability Payment, launches in 2022, while Scottish Child Payment will be doubled to £20 per child each week from April 2022 and extended to children under 16 by the end of 2022.

As a result the Commission expects spending on the Scottish Government's largest social security payments and completely new payments to be £750 million more than the social security funding received as part of the Block Grant by 2024-25, reducing the funding available for other spending priorities.

The Commission's chair, Dame Susan Rice, said:"After taking account of inflation we expect the Scottish Budget to increase by 1 per cent in total over the remainder of this Parliament, largely because of increases in UK Government funding.

"Behind this headline increase, the Scottish Government faces slightly slower growth in income tax revenue than the rest of the UK but faster growth in social security spending. These will create pressures over the next five years which the Scottish Government must manage carefully."