Rising cost of living in the UK

13th March 2022

A paper published at the UK House of Commons library on 7th March 2022.

The cost of living has been increasing across the UK since early 2021 and in January 2022, inflation reached its highest recorded level since 1992, affecting the affordability of goods and services for households.

Ukraine conflict pushing energy prices higher

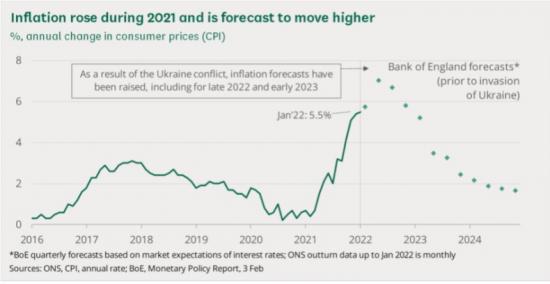

Consumer prices, as measured by the Consumer Prices Index (CPI), were 5.5% higher in January 2022 than a year before. A particularly important driver of inflation is energy prices, with household energy tariffs increasing and petrol costs going up.

In the year to January 2022, domestic gas prices increased by 28% and domestic electricity prices by 19%, due in part to a return of global gas demand as pandemic restrictions are lifted and lower than normal production of natural gas. On 3 February, the regulator Ofgem announced that the domestic energy price cap would increase from its current equivalent annual level of £1,277 per year to £1,971 in April; a 54% increase.

As well as the military, political and humanitarian impact of Russia's invasion of Ukraine, there will also be implications for the world economy. For the UK, the most likely economic effects, at least initially, will come through higher energy prices. Oil and gas prices on international markets have risen sharply since the invasion.

Higher energy prices will first be felt in petrol prices and then potentially energy bills (for businesses, as well as households). There has been much speculation that the domestic price cap will have to be increased substantially later in the year.

Russia and Ukraine are also large producers and exporters of agricultural products, such as wheat, and some metals. Prices for these products have also risen on financial markets, potentially leading to future increases in food and materials prices in the UK.

Inflation forecasts raised after invasion

Prior to the conflict in Ukraine, inflation was expected to peak in April 2022. This is when the new default price cap on household energy bills comes into effect in Great Britain.

In early February, the Bank of England was forecasting the CPI inflation rate to peak at 7¼% in April 2022. The inflation rate had been expected to ease somewhat over the course of 2022.

Since the Russian invasion of Ukraine, price rises in many commodities markets has led economic forecasters to raise their expectations for consumer price inflation, not just in the near term but also that it will be higher for longer.

On 2 March, the National Institute for Economic and Social Research think tank released new forecasts that included an expectation that UK inflation would peak at 8.1% in Q3 2022. Some economists have suggested that the inflation rate could hit 10%. Much will depend on the path of energy and other commodity prices.

Tax and benefit changes

As well as likely higher inflation, household budgets may be squeezed by changes in taxes and benefits in the coming months. This includes an increase in National Insurance Contributions from April 2022 and changes to income tax. Wages are also forecast to rise more slowly than inflation, which will affect household incomes.

On 3 February, the Chancellor announced Government support in relation to rising energy prices, including a £200 energy bills rebate loan, a £150 Council Tax rebate, and an expansion of the Warm Home Discount scheme.

Low-income households

Low-income households spend a larger proportion than average on energy and food so will be more affected by price increases.

Benefits will increase (uprated) in April 2022, based on the figure for inflation in September 2021 (3.1%), so households will see a fall in the value of their benefits in real terms.

Note

To read this release with links to more information go to

https://commonslibrary.parliament.uk/research-briefings/cbp-9428/

Download the full report HERE

Pdf 29 pages