Hard Decisions May Lie Ahead As Tax Revenues Fall Below Target

1st June 2022

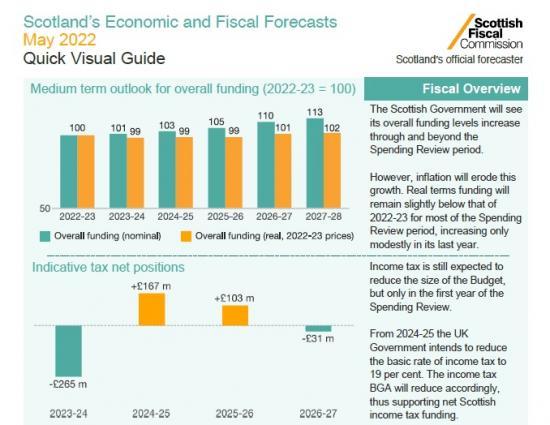

Tax net positions.

2.13 Tax net positions are the difference between the tax revenue devolved to Scotland and the Block Grant Adjustments (BGAs), which are the amounts deducted from the Block Grant to account for tax foregone by the UK Government. We compare our forecasts of income tax, Land and Buildings Transaction Tax (LBTT) and Scottish Landfill Tax (SLfT) to the BGAs which are based on OBR forecasts of corresponding UK Government tax revenues.

2.14 We expect the net position for devolved taxes to be significantly negative in the first year of the RSR (2023-24), as shown in Figure 2.5. Although the net position for LBTT and SLfT is mostly positive throughout the forecast period, the larger negative income tax net position brings the overall position down in the first two years. We expect the overall net position to turn positive in 2024-25 and 2025-26 as the UK Government has committed to introducing a 19 pence basic rate of income tax. The reduction in the income tax rate reduces UK Government income tax revenues, therefore reducing the income tax BGA. The net position returns to negative in 2026-27, but is forecast to have a close to neutral effect on funding.

2.15 We have not included a revised net position for 2022-23 based on our latest forecasts and those of the OBR in March 2022. This is because the net position for income tax, which has the largest impact on funding, was fixed when the 2022-23 Budget was set. The movements in the net position shown by the most recent forecasts for this financial year only give an indication of how future funding levels are likely to be affected through reconciliations.

Read the full report HERE

Or Read the shorter summary HERE

Or Read the quick guide HERE