Monthly Economic Brief For Scotland - June 2022

4th July 2022

Report from Office of the Chief Economic Adviser of the Scottish government.

This month's economic brief provides an update on data during the second quarter of the year, in which slowing output growth, rising inflation and tight labour market conditions are very much shaping current economic conditions. Furthermore, conditions are forecast to weaken over the coming year, presenting an increasingly challenging economic outlook for households and businesses.

During the first quarter of 2022, Scotland's output growth held up relatively well, growing 1% (UK 0.8%) as the economy transitioned through the Omicron wave and remaining Covid restrictions

were removed.

However monthly data indicates a gradual slowing in growth over this period with output falling 0.5% in April, the first fall in output since December 2021. Business survey data points

to a further easing in business activity growth between April and May.

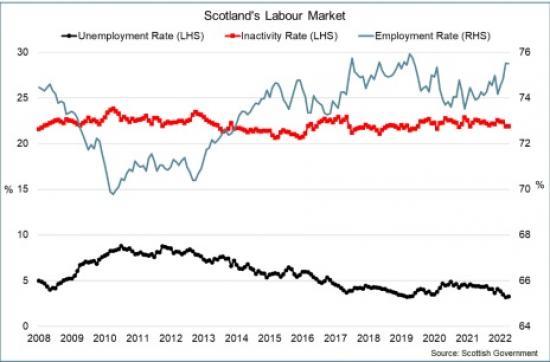

Over the period February to April 2022, Scotland's labour market has remained tight with unemployment at 3.2%, its joint lowest rate in the time series, while the payroll employee level continued to rise in May and is now 37,000 above its pre-pandemic level. Ongoing high vacancy rates however remain a key feature of the labour market with business survey data indicating that 38% of businesses were experiencing a shortage of workers in June.

Inflation has risen to 9.1% in May, the highest UK rate since 1982. The rise in inflation has been broad based with large increases in energy, fuel and food prices and continues to be exacerbated

by the impacts of the war in Ukraine on global energy and commodity markets. Furthermore, latest projections from the Bank of England expect inflation to rise further later in the year to above 11%, largely as a result of rises in energy prices associated with the energy price cap.

This is presenting significant cost of living challenges for households with mean real PAYE earnings falling over the year in April. The impact on household incomes is very much reflected in Scotland's consumer sentiment indicator which has fallen sharply since the start of the year to its lowest level since March 2021 and highlights the risks to consumption growth going forward.

Business trading conditions also continue to be extremely challenging. While business survey data present some indications of improved cash reserves at an aggregate level, turnover continues to be impacted by the increased cost of materials, energy and labour, with 37% of businesses reporting that they are having to pass on increased costs to customers. Business sentiment has eased since the start of the year amid concerns that existing supply side challenges are accompanied by a fall in demand over the coming months.

Looking ahead over the next two year period, forecasters have upgraded their inflation forecasts and downgraded growth forecasts which means that the economic outlook is challenging.

Economic outlook

Latest output growth forecasts continue to be revised down as the inflationary outlook continues to sharpen.

• At a global and domestic level, the economic outlook has weakened significantly since the start of the year as rising inflationary pressures, exacerbated by the war in Ukraine, are expected to weigh on the GDP growth outlook over this year and next.

• At a global level, in June, the OECD revised down their GDP growth projections for 2022 and 2003 with global GDP growth of 3% forecast for 2022 (down from 4.5% forecast in December)

and 2.8% in 2023 (revised down from 3.2%). Inflation projections have been revised up with inflation in OECD countries projected to reach 8.8% in 2022 (revised up from 4.5%), easing to 6.15 in 2023, resulting in intensifying cost of living challenges across countries.

• At a UK level, the average of new independent forecasts in June (published monthly by HMT) highlights the combination of the upgrades to inflation forecasts and downgrades to growth

forecasts. UK GDP is forecast to grow 3.6% in 2022 (down 0.3 percentage points [p.p] over the month) and 0.9% in 2023 (down 0.4 p.p over the month).

• In contrast, the average independent projected CPI inflation rates have been revised up to 9.2% in Q4 2022 (up 1.4 p.p over the month) and 3.1% in Q4 2023 (up 0.3 p.p). This points to current

expectations that as inflation will potentially peak at the end of this year and start to ease back over 2023, the GDP growth outlook for 2023 and 2024 is notably weaker than for 2022. For example, the Bank of England project inflation to rise above 11% in October 2022 and for UK GDP growth to ease from 3.75% in 2022 to around -0.25% growth in 2023 and 0.25% growth in 2024. Similarly the OECD forecast UK growth to remain flat in 2023.

• Forecasts for Scotland's economy have followed a similar pattern. The most recent Scottish Fiscal Commission (SFC) forecasts in May forecast Scotland's economy to grow 4% in 2022, slowing to 1% in 2023. The SFC forecast CPI inflation to peak at 8.7% in Q4 2022 and forecast real average earnings to decrease by 2.7% in 2022-2023.24

• Most recently in June, the Fraser of Allander Institute forecast Scottish GDP growth in 2022 of 3.8%, however in the face of higher and more persistent inflation, have revised down the growth

outlook for 2023 to 0.5% (previously 1.5%) and for 2024 to 1% (previously 1.4%).

Read the full report HERE