Business Insights And Impact On The UK Economy

5th July 2022

Report from the Office for National Statistics.

In May 2022, half (50%) of businesses currently trading reported that the prices of goods or services bought had increased from April 2022, while 21% reported that prices sold had increased across the same period; both figures have remained stable since March 2022.

In late June 2022, 35% of businesses reported their production and/or suppliers had been affected by recent increases in energy prices, up from 33% reported in early May 2022.

Among currently trading businesses, 30% expect to increase the price of goods or services they sell in July 2022, with energy prices continuing to be reported as the main factor for considering doing so, at 42%.

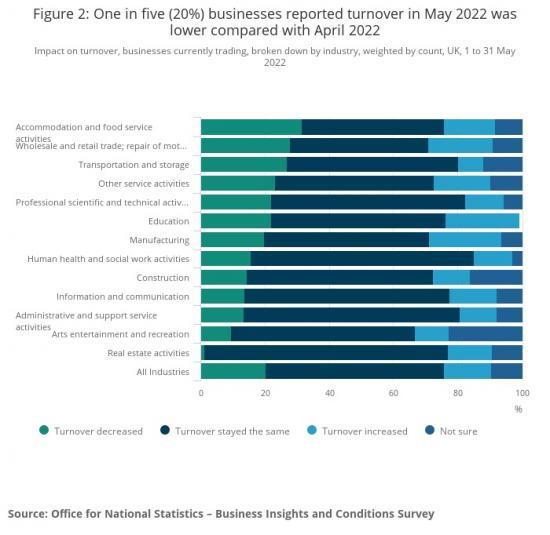

Approximately one in five (20%) trading businesses reported that their turnover in May 2022 was lower than in April 2022; nearly a third (32%) of businesses in the accommodation and food service activities industry reported their turnover was lower across the same period.

Trading businesses in the accommodation and food service activities industry have reported on their expectations for July 2022; nearly half (46%) expect the price of goods or services they sell will increase in July 2022, while a quarter (25%) of businesses expect their turnover to decrease.

Of businesses not permanently stopped trading, 15% reported that domestic demand for goods and services in May 2022 decreased compared with the previous calendar month, broadly stable with April 2022; in contrast half (50%) reported domestic demand stayed the same.

Domestic demand

Business Insights and Conditions Survey data

Glossary

Measuring the data

Strengths and limitations

Related links

Print this statistical bulletin

Download as PDF

1.Main points

In May 2022, half (50%) of businesses currently trading reported that the prices of goods or services bought had increased from April 2022, while 21% reported that prices sold had increased across the same period; both figures have remained stable since March 2022.

In late June 2022, 35% of businesses reported their production and/or suppliers had been affected by recent increases in energy prices, up from 33% reported in early May 2022.

Among currently trading businesses, 30% expect to increase the price of goods or services they sell in July 2022, with energy prices continuing to be reported as the main factor for considering doing so, at 42%.

Approximately one in five (20%) trading businesses reported that their turnover in May 2022 was lower than in April 2022; nearly a third (32%) of businesses in the accommodation and food service activities industry reported their turnover was lower across the same period.

Trading businesses in the accommodation and food service activities industry have reported on their expectations for July 2022; nearly half (46%) expect the price of goods or services they sell will increase in July 2022, while a quarter (25%) of businesses expect their turnover to decrease.

Of businesses not permanently stopped trading, 15% reported that domestic demand for goods and services in May 2022 decreased compared with the previous calendar month, broadly stable with April 2022; in contrast half (50%) reported domestic demand stayed the same.

Back to table of contents

2.Headline figures

The data presented in this bulletin are the final results from Wave 59 of the Business Insights and Conditions Survey (BICS), which was live from 13 to 26 June 2022.

Experimental single-site weighted regional estimates up to Wave 49 (24 January to 6 February 2022), are available in our Understanding the business impacts of local and national restrictions, UK: February 2022 article. An updated publication will be released on 11 July 2022.

Please note that businesses were asked to exclude seasonal changes when answering questions contained within BICS.

More about economy, business and jobs

All ONS analysis, summarised in our economy, business and jobs roundup.

Explore the latest trends in employment, prices and trade in our economic dashboard.

View all economic data.

Figure 1: Headline figures from the Business Insights and Conditions Survey

Embed code

Notes:

For presentational purposes, response options have been combined and/or have been excluded.

Workforce: the data for the equivalent period last year are not available as the question was not asked for this time period.

Prices: for presentational purposes, the data shows an increase to prices bought and sold compared with the previous calendar month.

Data are plotted in the middle of the period of each wave.

Download the data

.xlsx

In late June 2022, 93% of businesses reported they were trading, with 86% fully trading and 8% partially trading (for example, trading with reduced hours or staff numbers). Meanwhile, 4% of businesses reported "temporarily paused trading" and 3% reported "permanently ceased trading", as their business's trading status.

Based on the responses of businesses not permanently stopped trading, the proportion of the workforce that were working as part of a hybrid model in May 2022, was 22%. The remaining proportion of the workforce were:

working from home - 8%

working from a designated workspace - 64%

on sick leave, or not working due to coronavirus (COVID-19) symptoms, self-isolation or quarantine - less than 1%

made permanently redundant - less than 1%

other - 6%

The percentage of businesses currently trading who reported their turnover had decreased compared with the previous month is down 3 percentage points from the 23% reported in April 2022. The accommodation and food service activities industry continued to report the highest percentage of businesses experiencing lower turnover, at 32%.

The manufacturing industry saw the largest movement in the percentage of businesses who reported they experienced lower turnover in May 2022 at 20%, down 10 percentage points from the 30% reported in April 2022. This decrease can be attributed to those businesses who reported their turnover was higher in May 2022, which increased 10 percentage points over the same period.

Businesses that reported their turnover had stayed the same in May 2022, was 56%. This percentage is up 3 percentage points from April 2022.

The transportation and storage industry reported the largest increase in businesses reporting their turnover stayed the same across this period. This increase can be attributed to the percentage of businesses in the transportation and storage industry that reported an increase in turnover falling from 18% to 8% between April and May 2022.

Approximately one in seven (14%) businesses currently trading reported they expect their turnover to decrease in July 2022. This has been broadly stable since March 2022.

A quarter of businesses (25%) in the accommodation and food service activities industry reported they expect their turnover to decrease in July 2022, despite usually being busier in the summer months.

Approximately three in five (59%) businesses currently trading reported that they expect their turnover to stay the same in July 2022. This percentage is up from the 56% of businesses who expected their turnover in April 2022 to stay the same.

Prices

Latest estimates suggest that a number of trading businesses continue to experience an increase each month in the prices of goods or services bought and sold. This has been constant since March 2022.

The accommodation and food service activities industry reported the largest difference in the percentage of businesses reporting the price of goods or services bought versus the price of goods or services sold, with a 42 percentage point difference. This suggests businesses are reporting increased input costs compared with the proportion of businesses reporting increased selling costs for their goods or services.

Price expectations

Of businesses currently trading, 30% expected to increase the price of the goods or services they sell in July 2022. In contrast, less than 1% of businesses expect their prices to decrease.

The most common reason businesses currently trading are considering raising their prices, is energy prices. Approximately two in five (42%) businesses reported this as a factor; up from 38% of businesses reporting this for June 2022. The accommodation and food service activities industry reported the highest proportion of businesses selecting energy prices, at 75%.

Across all industries, other factors reported included:

raw material prices (29%), with the manufacturing industry reporting the highest percentage (59%)

labour costs (22%), with the accommodation and food service activities industry reporting the highest percentage (34%)

Of businesses who reported they are not considering raising their prices (33%), the information and communication industry reported the highest percentage (55%).

The percentage of businesses that reported they were affected by recent increases in energy prices in late June 2022, remained broadly stable with the 33% reported in early May 2022. However, this percentage has seen a steady increase since the first time the question was asked in early March 2022 (25%).

The accommodation and food service activities industry continued to report the highest percentage of businesses affected by recent increases in energy prices, at 61%, closely followed by the manufacturing industry at 59%.

More than 6 in 10 businesses (62%) reported they were affected by general increases in prices in one or more ways in late June 2022. This is the highest percentage reported since this question was introduced in early March 2022.

The following industries reported the greatest percentage for the top two most reported impacts:

had to absorb costs - with the human health and social work activities industry (private sector businesses only) reporting the highest, at 60%, up from 43% in early March 2022

had to pass on price increases to customers - with the manufacturing industry reporting the highest, at 42%, down from 44% in early March 2022

Of businesses not permanently stopped trading, 15% reported domestic demand for goods and services had decreased in May 2022 compared with 17% reported for April 2022.

The manufacturing industry recorded a rise in the proportion of businesses reporting that domestic demand for goods and services had stayed the same in May 2022 compared with the previous month, up from 41% to 54%. This industry also reported a fall in the proportion of businesses reporting an increase or decrease in demand.

To read the full report go to -

https://www.ons.gov.uk/businessindustryandtrade/business/businessservices/bulletins/businessinsightsandimpactontheukeconomy/30june2022