Tax And Spending Policies Of Conservative Leadership Contenders

25th July 2022

Article from the Institute for Fiscal Studies.

We are now down to the final two Conservative Party leadership contenders: Rishi Sunak and Liz Truss. On 5 September we will know which of the two is the next Conservative Party leader - and therefore Prime Minister - so their visions for tax and spending matter. Below we provide some initial analysis of the plans that have been set out so far.

Permanent changes to personal taxes: reversing the NICs rise

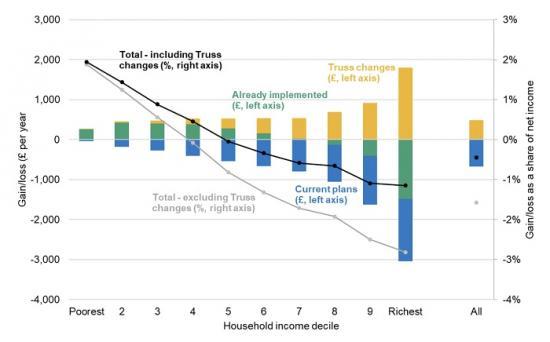

The government has already made a number of permanent changes to personal taxes since the beginning of the Parliament - both tax rises and tax cuts - and on current plans will make several more. So far, the government has raised tax by increasing National Insurance contributions (NICs) and at times freezing income tax thresholds, and cut tax by raising the threshold at which workers begin to pay NICs. It has also cut duties on alcohol and fuel, and has implemented some increases to benefits. Looking forward, under current plans income tax and NICs thresholds will be frozen for a further three years (a tax rise), and the basic rate of income tax will be reduced by one penny in the pound in 2024-25. Figure 1 shows the impact of these reforms once they are fully in place. Those implemented so far are broadly progressive, with the benefit increases boosting incomes among poorer households and the tax rises taking from richer ones. The plans over the next few years are also progressive, though amount to a takeaway across the board - the high-inflation environment means that the freezing of income tax and NICs thresholds is a much bigger tax rise than originally intended.

Mr Sunak has not announced any specific intention to deviate from these plans. Ms Truss, however, has stated that she would reverse the increase in NICs rates, at a cost of £13 billion per year. This boosts incomes across the board, but does so most for higher-income households who have the most income from employment. Nonetheless, taken in the round, the package of policies implemented across the parliament as a whole would remain highly progressive (see the black line).

Read the full article HERE