Monthly Economic Brief: July 2022

1st August 2022

The monthly economic brief provides a summary of latest key economic statistics, forecasts and analysis on the Scottish economy.

Overview

This month's economic brief provides an update on the latest economic data during the second quarter, providing further insights on the current headwinds facing Scottish households and businesses as the economic outlook continues to weaken.

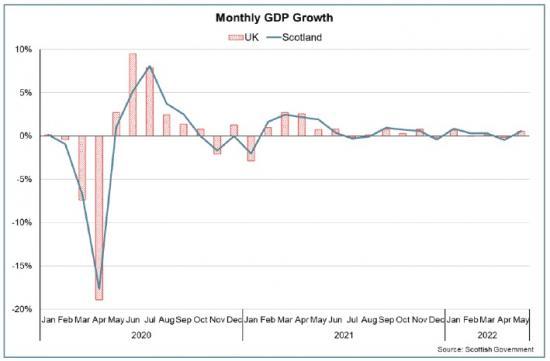

Following a fall of 0.5% in April, Scotland's output grew by 0.6% in May and although the economy has returned to growth, over the latest two months there has been cumulative growth of just 0.1%, with business survey data pointing to further slowing in June across sectors. However, this is currently most evident in the manufacturing sector which is facing a range of challenges, largely driven by high input costs and a slowing of new orders. Following a fourth consecutive monthly fall in manufacturing output in May, businesses surveys currently point to a further fall in June.

Over the period March to May, Scotland's labour market remained tight with unemployment at 3.5%, near record lows, while the payroll employee level continued to rise in June and there has been further falls in the claimant count. High vacancy rates remain a key feature of the labour market with labour and skills shortages continuing to affect Scottish businesses in June.

Inflation rose to 9.4% in June, the highest UK rate since 1982. Although driven by large increases in energy, fuel and food prices, inflation has become increasingly broad-based, with 80% of items seeing annual price growth above 3%, and continues to be exacerbated by the impacts of the war in Ukraine on global energy and commodity markets. The Bank of England forecast inflation to gradually decline back to its 2% target rate at the end of 2024, as price increases slow. However many of the recent price increases will not be reversed, with prices for many goods and services permanently higher.

The combination of supply shortages and rising inflation is presenting significant cost challenges for businesses and cost of living pressures for households. Although labour market tightness is contributing to rising nominal wages, earnings growth is still well short of inflation, with mean real PAYE earnings falling over the year in May. The impact on household incomes is reflected in Scotland's consumer sentiment indicator which has fallen sharply since the start of the year. Household attitude to spend indictor in particular has fallen to its lowest level since December 2020 and further raises the likelihood that current supply side challenges in the economy are soon to be accompanied by a notable weakening in demand.

That said, annual GDP growth in 2022 as a whole is expected to be relatively strong, primarily reflecting the impact of the pandemic in 2021, but growth in the second half of the year is expected to weaken sharply going into 2023. The full extent of the forecasts for high inflation and slow growth over the coming period are yet to emerge, however, the recent downgrading of the latest IMF forecasts further highlight the global nature of the challenge that lies ahead. Output

Scottish GDP growth picked up in May, however has generally slowed from the first quarter with growth of just 0.1% over April and May.

In May, Scottish output grew by 0.6% (UK: 0.5%), and GDP is now 1.1% above its pre-pandemic level in February 2020 (UK: 1.7%).

Although the economy returned to growth in May after the fall in April, over the two months there has been cumulative growth of just 0.1%.

In the three months to May, GDP is estimated to have grown by 0.7% compared to the previous three month period, with the pace of growth slowing compared to the first quarter of the year. This slowing of growth is consistent with the results for the UK as a whole.

At a sectoral level, GDP growth was broad based in May. Services output grew by 0.4%, while construction grew by 1.7% and production grew by 1.1%.

Within the services sector, output in consumer facing services grew by 1.6% and has surpassed the pre-pandemic level of February 2020 for the first time. Growth in sectors such as professional, scientific and technical services (+4.2%) outweighed the slowing in retail (+0.2%) and hospitality growth (0.5%) observed over recent months. Health, education and public services output fell by 0.4%, and output in all other services grew by 0.5%.

Within the production sector, growth over the month was largely driven by growth of 8.9% in the electricity and gas supply industry due to record levels of wind power generation during May, while manufacturing output fell by 0.3%, its fourth consecutive monthly decline in output. Overall output in production, construction and agriculture grew by 1.1% compared to the previous month.

Recovery in output back to pre-pandemic levels continues to vary by sector. Output in the production, construction and agriculture group is 0.6% above its pre-pandemic level, however this is driven by the construction sector (4.7 above) while production output remains 1.2% below. In the services sector, despite contracting in the most recent months (mostly due to the reductions in NHS test and trace activities throughout April), health, education and public services remains 2.7% above while consumer facing services is 0.3% above and output in all other services was 3.2% above its pre-pandemic level.

See more HERE