Deloitte Survey Of Chief Financial Officers - The Credit Squeeze Is Here

18th October 2022

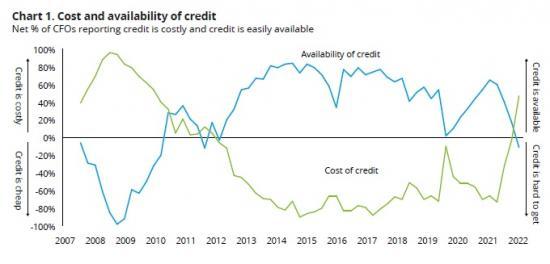

A 12-year period of easy credit conditions is drawing to an end, according to the Chief Financial Officers of the UK's largest corporates. The third quarter CFO survey shows corporates facing a major reset, with CFOs rating credit as being more costly than at any time since 2010.

The financial market impact of the government's mini-Budget on 23 September, which took place roughly halfway through the survey period, has added to the pressures. Those CFOs who responded after the mini-Budget foresaw materially higher interest rates and were more likely to report elevated credit costs than those who responded before. Not since the depth of the credit crunch that unfolded in 2009 have CFOs rated debt, whether bank borrowing or corporate bonds, as a less attractive source of finance for their businesses than they do today.

The dampening effect of tight credit conditions is reinforced by wider concerns. CFOs rate external uncertainties as being at the highest level since the pandemic and see energy supply as the top business risk, followed by geopolitics. On average, CFOs attach a 78% probability to the UK falling into recession in the next 12 months.

Expectations for hiring have fallen sharply, with far more CFOs expecting to reduce hiring in the next 12 months than to increase it.

Despite anticipating a reduction in hiring, persistent recruitment difficulties and high inflation seem to be driving CFO expectations for wage costs. They expect the pace of wage rises in their businesses to accelerate over the next 12 months.

Given rising credit costs and expectations of thinner profit margins, corporates are tilting towards more defensive balance sheet strategies, with cost control by far the top CFO priority. Monetary policy seems to play a role here - in survey responses since the Bank of England started raising rates in December 2021, CFOs expecting rises in financing costs have been much more likely to expect lower capital expenditure or strongly prioritise cost reduction than those expecting no change or a decrease in financing costs. In its latest World Economic Outlook, released on 11 October, the IMF warned that the "worst is yet to come" for the global economy. On the basis of this survey, CFOs expect, and are braced for, just such an outcome.

Read the full report HERE

Pdf 9 pages.