Mind The (credibility) Gap Autumn Statement Preview From The Resolution Foundation

1st November 2022

In our Autumn statement preview slidepack, we present new analysis that explores the economic outlook ahead of the Autumn Statement on November 17th, and the crucial financial decisions that the new Prime Minister and Chancellor must make.

With the latest political turmoil triggered by attempts to completely rewrite economic policy, Rishi Sunak is under intense pressure to demonstrate his economic credibility, calm the markets and reduce the pressure for faster interest rate hikes.

Key Findings

Sunak faces a gloomier economic outlook as the new PM than he left as Chancellor:

GDP set to be 2-4% weaker by end-2024 with OBR likely to forecast a recession

Unemployment expected to rise by 500k, peaking above pandemic levels

The weaker outlook increases borrowing by over £20bn

Despite U-turns, the mini-budget's legacy is higher borrowing:

£17bn of tax cuts remain and the costs of energy support remain large and uncertain

Interest rates are rising around the world (increase since mini-budget costs HMT around £10bn)

Relative rise in UK borrowing costs since mini-budget has unwound but the increase over the summer has not and costs around a further £10bn

Government will need to reduce borrowing by at least £40bn to hit likely fiscal rules with minimal headroom

The menu of spending cuts and tax rises is long, if unappetising:

Around £10bn in easy-to-announce but bad-for-growth investment cuts likely

More than £20bn in day-to-day spending cuts beyond the current spending review would usher in a new period of austerity given around £20bn in real-terms cuts in the coming years

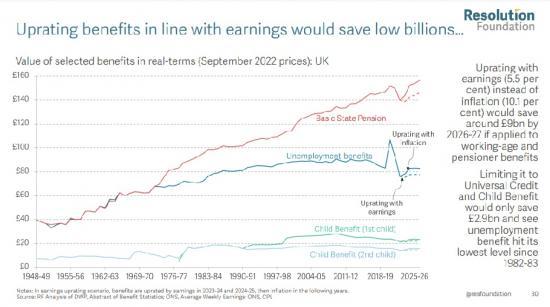

Cuts to working-age benefits and pensions would save around £9bn but would be disastrous in the context of the cost of living crisis

So further tax rises, not just spending cuts, should be expected

To read more details and see graphs go

HERE