GDP Monthly Estimate UK September 2022

11th November 2022

Gross domestic product (GDP) is estimated to have fallen by 0.6% in September 2022, after a fall of 0.1% in August 2022 (revised from a fall of 0.3% in our previous publication) driven by a fall in the services sector.

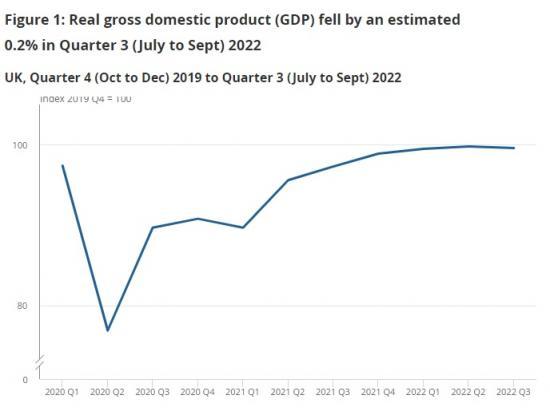

Looking at the quarterly picture, GDP fell by 0.2% in the three months to September 2022 compared with the three months to June 2022.

Services fell by 0.8% in September 2022 after growth of 0.1% in August 2022 (revised from a fall of 0.1% in our previous publication); the largest contribution to the fall came from a 3.2% fall in information and communication activity, and a 2.0% fall in wholesale and retail trade, and repair of motor vehicles and motorcycles.

Output in consumer-facing services fell by 1.7% in September 2022, after a fall of 1.6% in August 2022 (revised from a fall of 1.8% in our previous publication).

Production grew by 0.2% in September 2022, after a fall of 1.4% in August 2022 (revised from a 1.8% fall in our previous publication); electricity, gas, steam and air conditioning supply grew by 1.5% and was the largest contributor to growth in production in September 2022.

Construction grew by 0.4% in September 2022, after growth of 0.6% in August 2022 (revised from growth of 0.4% in our previous publication); the monthly increase came from increases in both new work (0.6%), and repair and maintenance (0.2%).

Estimates for September 2022 are affected by the bank holiday for the State Funeral of Her Majesty Queen Elizabeth II, where some businesses may have closed or operated differently on this day.

Monthly GDP

Monthly real gross domestic product (GDP) is estimated to have fallen by 0.6% in September 2022 (Figure 1) following a fall of 0.1% in August 2022 (revised up from a fall of 0.3% in our previous publication). It is now estimated to be 0.2% below its pre-coronavirus (COVID-19) levels (February 2020).

There was an additional bank holiday on 19 September 2022 for the State Funeral of Her Majesty Queen Elizabeth II and many businesses closed or operated differently on this day. As this was a one-off event, its impact does not get removed from our seasonally adjusted estimates. This should be considered when interpreting the seasonally adjusted movements in September 2022. Unlike normal bank holidays, there was not a shift to leisure and tourism activities because of the widespread nature of business closures. Therefore, while it is very difficult to separate the bank holiday impact from other factors affecting the economy, we estimate that at least half of this month's fall in GDP is because of this bank holiday. More information on our seasonal adjustment approach is available in Section 10: Measuring the data.

The services sector

Services fell by 0.8% in September 2022, following growth of 0.1% in August 2022 (revised up from a 0.1% fall in our previous publication). Figure 3 shows the contributions from the services sector to gross domestic product (GDP) in September 2022.

Information and communication fell by 3.2% in September 2022 and was the biggest contributor to the fall in services on the month. Computer programming, consultancy and related activities fell by 3.9% in September 2022. It was the main driver of the fall in information and communication, followed closely by motion picture, video & tv programme production, sound recording and music publishing activities, which fell by 18.0%.

The second-largest negative contribution within services came from wholesale and retail trade; repair of motor vehicles and motorcycles, which fell by 2.0% in September 2022. All three industries contributed negatively. Wholesale and retail trade, and repair of motor vehicles and motorcycles fell by 3.3%, with the Society of Motor Manufacturers and Traders (SMMT) September 2022 reporting new registrations were only 4.6% above last September, which was the weakest since 1998. Wholesale and retail trade, except motor vehicles and motorcycles, fell by 2.2% and 1.4%, respectively.

These falls were partially offset by a rise in human health and social work activities, which grew by 0.9% in September 2022. The growth in this sub-sector was entirely driven by human health activities industry, which grew by 1.5% on the month. There were rises in GPs and critical care volumes in the month, as well as the first growth in the NHS Test and Trace and Vaccine programme since March 2022.

NHS Test and Trace services and vaccine programmes

NHS Test and Trace and COVID-19 vaccination programme activity grew by 71% in September 2022 (Figure 4). This was driven by an increase in vaccine activity because of the autumn booster campaign, partially offset by a fall in testing volumes. Despite this growth on the month, levels remain significantly below the highs seen at the end of 2021 as shown in Figure 4. More specifically in September 2022:

testing volumes fell by 58% from August 2022; laboratory-processed testing and lateral flow devise (LFD) testing volumes both fell strongly and so both contributed to this fall

tracing volumes fell to zero in March 2022 for England and remain there; all contact tracing within the UK stopped as of June 2022

vaccine volumes grew by 251% in September 2022, this growth was driven by the autumn booster programme

Overall, NHS Test and Trace and the COVID-19 vaccination programme contributed 0.1 percentage points to monthly GDP growth.

Consumer-facing services

Output in consumer-facing services fell by 1.7% in September 2022, following a fall of 1.6% in August 2022 (revised up from 1.8% in previous publication). Consumer-facing services were 10.0% below their pre-coronavirus (COVID-19) levels (February 2020) in September 2022, while all other services were 1.9% above (Figure 4).

The largest negative contributing industry was retail trade, except for motor vehicles and motorcycles, which fell by 1.4% in the month. This follows a contraction of 1.7% in August 2022 (revised down from negative 1.6% in previous publication) and this industry has now fallen 10 times in the last 11 months. Our Retail sales, Great Britain: September 2022 bulletin notes that retailers continue to mention the effect of rising prices and the cost of living on sales volumes, data for September 2022 are also affected by the bank holiday for the State Funeral of Her Majesty Queen Elizabeth II, when many retailers closed.

The second-largest contributor to the fall in consumer-facing services was buying and selling, renting and operating of own or leased real estate, excluding imputed rent, which fell by 0.9% in September 2022.

The production sector

Production output grew by 0.2% in September 2022, with positive growth in three of the four sub-sectors. This is the sector's first growth since May 2022.

Electricity, gas, steam and air conditioning supply was the main driver of production growth, rising by 1.5% on the month. Electric power generation, transmission and distribution saw growth of 4.4%, the largest since December 2020. According to anecdotal evidence from the Department for Business, Energy and Industrial Strategy (BEIS) demand was up 10.6% in September 2022 from August 2022, also noting that the number of heating days in September 2022 was 1.7 compared to 0.6 in September 2021. Manufacture of gas, distribution of gaseous fuels through mains, and steam and aircon supply saw a notable fall of 3.6%, though not enough to offset growth in electric power generation, transmission, and distribution.

Mining and quarrying was the second-largest contributor to positive production growth in September 2022, growing by 0.7%. This was wholly driven by extraction of crude petroleum and natural gas, which increased by 1.0% on the month.

Manufacturing was broadly flat on the month (Figure 6) with the largest negative contributor, manufacture of basic metals and metal products, falling by 3.4%. Notable falls were also seen in the manufacture of chemicals and chemical products (down 3.0%) and manufacturing of computer, electronic & optical products (down 2.7%).

The largest positive contributors to manufacturing were the manufacture of basic pharmaceutical products and pharmaceutical preparations, which saw growth of 9.3% in September 2022. Also contributing positively was manufacture of transport equipment, which rose by 2.7% on the month, Society of Motor Manufacturers and Traders (SMMT) September 2022 comments on the strongest September for commercial vehicle production since September 2011.

Water supply and sewerage fell by 0.3% in September 2022, with a growth in sewerage of 3.5% cancelled out by 2.4% fall in water collection, treatment and supply.

Overall, production decreased by 1.5% in the three months to September 2022, compared with the three months to June 2022, driven primarily by manufacturing, which fell by 2.3%. There has been a downward trend in manufacturing, since its last three-month on three-month growth in July 2021. There were also declines in mining and quarrying, and water supply and sewerage, which fell by 1.0% and 1.4%, respectively. Electricity, gas, steam and air conditioning supply was the only sector that saw growth, up by 2.6% over the same period.

The construction sector

Monthly construction output increased by 0.4% in September 2022. This is the third consecutive monthly growth following the small, upwardly revised increases to 0.6% and 0.2% in August 2022 and July 2022, respectively.

The 0.4% growth in construction output in September 2022 represents an increase of £66 million in monetary terms compared with August 2022, with five out of the nine sectors seeing an increase on the month.

The increase came from rises in both new work (0.6%), and repair and maintenance (0.2%) on the month (Figure 7). At the sector level, the main contributors were infrastructure, and public housing repair and maintenance, which increased 2.8% and 11.3%, respectively.

Anecdotal evidence gathered from businesses over the month to the Monthly Business Survey for Construction and Allied Trades suggested there has been increased narrative around the cost of living crisis. This is as it continues to be a major factor as businesses and households are spending particularly less on repair and maintenance work. Many firms suggested that the high prices for construction materials meant some repair and maintenance projects were being put on hold (whether temporarily or permanently). In contrast, some new projects were continuing as costings were agreed prior to the recent price increases, and as such the construction firms were having to absorb these.

Cross-industry themes

There were some common themes that were anecdotally reported (as part of the Monthly Business Survey) to have played a part in performance across different industries. However, it is often difficult to quantify these effects.

Some businesses reported challenging conditions, with the price of energy and the price of fuel continuing to be cited as particular difficulties. Others reported an impact on their turnover following industrial action with strikes being carried out across various sectors. Many businesses also reported currency exchange as an issue that affected them, with a weaker pound making it less affordable to import inputs. Finally, many businesses reported that the additional bank holiday led to a drop in their turnover because there were fewer trading days in the month.

Read the full ONS report HERE