Inflation Dips Slightly To 10.7 Percent From 11.01

14th December 2022

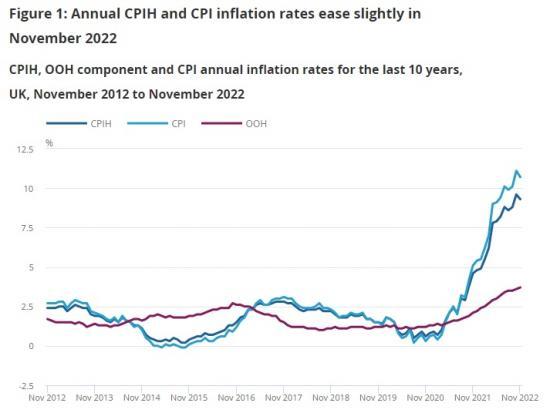

The Consumer Prices Index including owner occupiers' housing costs (CPIH) rose by 9.3% in the 12 months to November 2022, down from 9.6% in October.

The largest upward contributions to the annual CPIH inflation rate in November 2022 came from housing and household services (principally from electricity, gas, and other fuels), and food and non-alcoholic beverages.

On a monthly basis, CPIH rose by 0.4% in November 2022, compared with a rise of 0.6% in November 2021.

The Consumer Prices Index (CPI) rose by 10.7% in the 12 months to November 2022, down from 11.1% in October.

On a monthly basis, CPI rose by 0.4% in November 2022, compared with a rise of 0.7% in November 2021.

The largest downward contribution to the change in both the CPIH and CPI annual inflation rates between October and November 2022 came from transport, particularly motor fuels, with rising prices in restaurants, cafes and pubs making the largest, partially offsetting, upward contribution.

Notable movements in prices

The easing in the annual inflation rate in November 2022 reflected, principally, price changes in the transport division, particularly for motor fuels and second-hand cars. There were also downward effects from tobacco, accommodation services, clothing and footwear, and games, toys and hobbies. The largest, partially offsetting, upward effect came from price rises for alcohol in restaurants, cafes and pubs.

Transport

The annual inflation rate for transport was 7.6% in November 2022, down for a fifth consecutive month from a peak of 15.2% in June 2022, and the lowest rate since June 2021. The main drivers behind the easing in the rate between October and November 2022 came from motor fuels and second-hand cars.

Overall, fuel prices rose by 17.2% in the year to November 2022, down from 22.2% in the year to October. This is principally a base effect with petrol prices unchanged between October and November this year, but rising by 7.2 pence per litre between the same two months of 2021. Diesel prices also contributed to the change in the rate, rising by 4.0 pence per litre this year, compared with a larger rise of 7.4 pence per litre a year ago. Average petrol and diesel prices stood at 163.6 and 187.9 pence per litre in November 2022, compared with 145.8 and 149.6 pence per litre in November 2021.

Second-hand car prices fell by 5.8% in the year to November 2022, compared with a fall of 2.7% in the year to October. The annual rate has eased for the eighth consecutive month since March 2022, when it was 31.0%. Although prices have fallen (by just under 6%) between March and November this year, much of the change in the annual rate is a base effect as prices rose by over 31% between March and November 2021. During that period, there were reports of increased demand following the coronavirus (COVID-19) pandemic, with a global semiconductor microchip shortage affecting new car production and resulting in some customers switching to the second-hand car market.

Alcohol and tobacco

The annual rate for alcohol and tobacco was 4.2% in November 2022, down from 6.2% in October. The easing in the annual rate was caused by price movements for tobacco. This year, tobacco prices rose by 0.1% on the month, compared with a larger rise of 4.2% a year ago, when duty rates increased as announced in the Autumn 2021 Budget.

Clothing and footwear

Prices of clothing and footwear rose, overall, by 7.5% in the year to November 2022, down from 8.5% in October. On a monthly basis, prices rose by 0.1% between October and November 2022, compared with a larger rise of 1.1% between the same two months a year ago. Prices usually rise into November each year but the increase in 2022 was less than in most recent years, the exception being 2020, when prices fell amid tougher national restrictions on movement because of the coronavirus pandemic.

The downward effect in 2022 was principally from women's clothing, where prices rose by less this year than a year ago. There was also a small downward effect from footwear, with prices falling into November 2022 compared with rises in 2021.

Recreation and culture

The annual rate for recreation and culture was 5.3% in November 2022, down from 5.9% in October. The easing in the rate came almost entirely from games, toys and hobbies, where prices were down by 0.5% in the year to November, compared with a rise of 1.5% in the year to October. The movements in this category largely reflect price changes for computer games, which can sometimes be large, in part depending on the composition of bestseller charts.

Restaurants and hotels

Partially offsetting some of the easing inflation rates previously noted, the annual rate for restaurants and hotels was 10.2% in November 2022, up from 9.6% in October and the highest rate since the constructed historical estimate of 10.5% in December 1991.

The increase in the annual rate reflects price rises between October and November this year, compared with price falls between the same two months in 2021. The upward pressure came from price increases for alcohol served in restaurants, cafes and pubs, particularly for whisky, wine and gin.

Partly offsetting this, prices for accommodation fell between October and November 2022, compared with a rise a year ago, particularly for overnight hotel accommodation.

Food and non-alcoholic beverages

Food and non-alcoholic beverage prices rose by 16.5% in the 12 months to November 2022, slightly up from 16.4% in October. The annual rate of inflation for this category has risen for 16 consecutive months, from minus 0.6% in July 2021. Indicative modelled estimates suggest that the rate would have last been higher in September 1977, when it was estimated to be 17.6%.

The increase in the annual rate for food and non-alcoholic beverages between October and November 2022 was driven by price movements from 4 of the 11 detailed classes. The largest upward effect came from bread and cereals, where prices for bread, overall, rose between October and November 2022 but fell between the same two months in 2021. This was partially offset by a small downward effect from fruit, where prices rose by less this year than a year ago.

Note

Read the full report at https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/november2022