Income Tax Policy Proposal: Scottish Budget 2023-24

16th December 2022

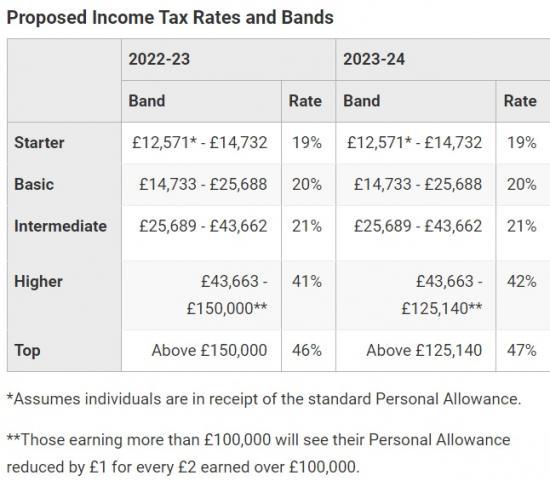

Maintain the Starter and Basic Rate bands at the same level, in cash terms, as 2022-23.

No changes to the Starter, Basic and Intermediate Rates.

Maintain the Higher Rate threshold at the same level, in cash terms, as 2022-23.

Reduce the Top Rate threshold from £150,000 to £125,140.

Add 1 pence to the Higher and Top Rates of tax to 42 pence and 47 pence respectively.

The UK Government confirmed in the 2022 Autumn Statement that the UK-wide Personal Allowance will remain frozen at £12,570.

The Scottish Fiscal Commission have forecast that Income Tax will raise £15,810 million in 2023-24 in Scotland.

Impact on individual taxpayers of changes to Scottish Income Tax

39% of Scottish adults (1.8 million individuals) are not affected by the 2023-24 policy changes as their income is below the UK-wide Personal Allowance.

The policy changes also have no effect on the lowest earning 9% of taxpayers (or 5% of adults) who earn less than £14,732 (and pay the 19p Starter Rate).

Those earning less than £27,850 - which is 52% of Scottish taxpayers (1.47 million people) - will continue to pay slightly less Income Tax in 2023-24 than if they lived elsewhere in the UK.

The table below compares the impact on take home pay for individuals earning different levels of income.[1] Three different comparisons are provided:

The second column sets out the impact of the proposed changes to Scottish Income Tax in 2023-24, compared to 2022-23, assuming no change in their income;

For example, a Scottish taxpayer earning £50,000 will see a £63 reduction in their take home pay in 2023-24 compared with 2022-23.

The third column sets out the difference in take home pay resulting from Scottish Income Tax policy compared to the rest of the UK in 2023-24.

The fourth column shows the impact on take home pay in 2023-24, compared to a baseline where all thresholds and bands are increased in line with inflation, bar the Top Rate Threshold which would be frozen at £150k. This provides a truer real terms measure of the changes that income taxpayers will experience in their income tax contributions.

BBC

How will the changes affect you