How Increases In Housing Costs Impact Households Mortgage Payers And Renters

11th January 2023

From the Office for National Statistics.

Mortgage interest rates started to increase during 2022, this is likely to make borrowing more expensive for those with fixed rates deals coming to an end in 2023. Those with variable rate mortgages and private renters are also facing higher housing costs.

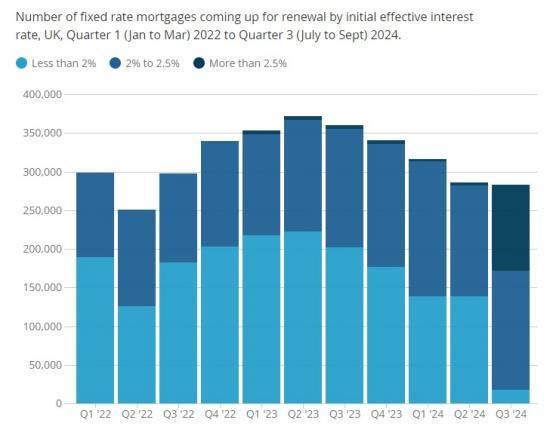

More than 1.4 million households in the UK are facing the prospect of interest rate rises when they renew their fixed rate mortgages in 2023.

The majority of fixed rate mortgages in the UK (57%) coming up for renewal in 2023 were fixed at interest rates below 2%. Those deals that are due to mature through the course of 2024 will be from two-year fixed rate deals made in 2022 and five-year fixed rate deals made in 2019, when mortgage rates were generally higher than 2%.

Most fixed rate mortgage deals coming to an end in the next 12 months were set at interest rates below 2%.

In the first quarter of this year (Jan to Mar 2023), 353,000 fixed rate mortgages will have to be renewed. Our calculations, based on Bank of England (BoE) transactions data, suggest that the number of fixed rate mortgage deals coming to an end in 2023 will peak in Quarter 2 (Apr to June) 2023 at 371,000.

BoE data also show that most mortgages are agreed at a fixed interest rate, where the interest rates stay the same for the duration of the mortgage deal, with 86% of outstanding UK mortgages being repaid at fixed interest rates in Quarter 3 (July to Sept) 2022. This is up from 51% in Quarter 1 (Jan to Mar) 2016.

While interest rates have been increasing since the start of 2022, most fixed rate borrowers have been insulated from those increases, as the majority were fixed at interest rates below 2% and are still within their fixed-rate period.

Those on a variable rate mortgage, where the interest rate varies over the course of the repayment term, will have already seen higher interest rates as a result of market conditions including rises in the BoE base rate (the "Bank Rate").

When borrowers remortgage in the near future it is likely to be at a higher rate of interest.

This can be seen in the Office of Budgetary Responsibility (OBR) expectations of the future path of the Bank Rate, which is expected to peak at 4.8% by the end of 2023.

The Bank Rate is the rate at which the BoE pays the commercial banks that hold deposits with it. The Bank Rate in turn impacts the rates that lenders use to set mortgage rates.

In its fiscal forecast, published in November 2022, the OBR predicted that the Bank Rate would rise from 1.6% in Quarter 3 2022 to 4.8% in Quarter 3 2023 and 4.5% in Quarter 3 2024.

The BoE has been increasing the Bank Rate since the start of 2022 as part of its efforts to return inflation to its 2% target level. This has meant the Bank Rate increasing from 0.25% at the beginning of 2022 to 3.5% in December 2022, the highest this rate has been since October 2008.

As the Bank Rate increases, so have the rates at which borrowers repay their mortgages. This can be seen in the effective interest rate on variable rate mortgages which have increased over 2022 to rates not seen in more than a decade.

The additional costs facing those refixing their mortgages

The effective interest rate on outstanding mortgages with a fixed rate was 2.08% in November 2022, according to the BoE. This contrasts with an average interest rate of 4.41% on variable rate mortgages and quoted household interest rates on new fixed rate mortgages around 6%.

When mortgage rates increase, the cost of repayment increases. Looking at different indicative amounts left to repay on mortgages - from £100,000 to £500,000 - we can see the monthly costs that households may face in different scenarios with varying interest rates on the mortgage.

Should the interest rate on a £100,000 mortgage increase from 2% to 6%, assuming a 25-year capital and repayment mortgage, then the monthly mortgage repayment on the same mortgage would increase by £220 (from £424 to £644). However, assuming the same increase on a £300,000 mortgage, monthly repayments would rise by £661 (from £1,272 to £1,933).

The BoE's Financial Stability Report - December 2022 suggests that mortgagors on fixed rates set to expire by the end of 2023 are facing monthly repayment increases of around £250 upon refinancing to a new fixed rate.

Private renters are paying more in housing costs

Private renters are also facing an increase to their housing costs, with rental price growth at its highest rate in the UK since records began in 2016.

Around a quarter (26%) of all renters surveyed between 7 and 18 December 2022, reported their rent payments had gone up in the last six months, according to data from the Opinions and Lifestyle Survey (OPN).

Private rental prices paid by tenants in the UK rose by 4% in the 12 months to November 2022, up from 3.8% in the 12 months to October 2022, according to data from the Index of Private Housing Rental Prices.

In November 2022, UK private rental prices saw the largest annual percentage increase since records began in January 2016.

Renters spend almost a quarter of their median weekly expenditure on rent

Increases in housing costs can be expected to affect households differently, depending on whether they rent or own their own home. In the year to March 2021, renters in the UK spent a total of £106.50 per week on rent once housing benefit, rebates and other allowances received were accounted for.

This is equivalent to 24% of their median weekly expenditure. Meanwhile, mortgage holders spent a total of £140.80 per week on mortgage repayments, equal to 16% of their median weekly expenditure.

While rising housing costs will affect households across the income distribution, they are more likely to disproportionately affect those who already spend a greater proportion of their household spending on housing costs.

Weekly expenditure on housing is highest for renters in the ninth income decile at £196.20 per week, while mortgage holders in this decile paid £161.50 per week.

When we look at this as a proportion of expenditure, renters in the second income decile spend on average the greatest proportion (30%) of their expenditure on rent. While for mortgage holders, those in the second income decile, spend a comparably smaller proportion of their total expenditure on mortgage repayments (18%).

We avoid using the first (lowest 10%) and tenth (highest 10%) income deciles as these can include, for example, households with low income but high wealth, which distorts the picture. Using the second and ninth decile provides a reliable picture of the financial experience of households at the lower and higher end of the income distribution.

Around 4 in 10 of those with a mortgage are worried about changes in interest rates on their mortgage

While the method of securing accommodation differs, in these times of increased cost, both rent and mortgage payers have found them increasingly difficult to service, according to people asked in our latest OPN survey.

There has been a slight increase in the percentage of people surveyed who, when asked how easy or difficult it was to afford their rent or mortgage payments, said they found it somewhat difficult or very difficult, from 27% in the period 14 to 25 September 2022 to 31% in the period from 7 to 18 December 2022.

Additionally, around 4 in 10 (45%) adults with mortgages reported being very or somewhat worried about the changes in mortgage interest rates during the period 7 to 18 December 2022.

Note

To read the full report with more notes and graphs go

HERE