GDP Monthly Estimate UK - November 2022

13th January 2023

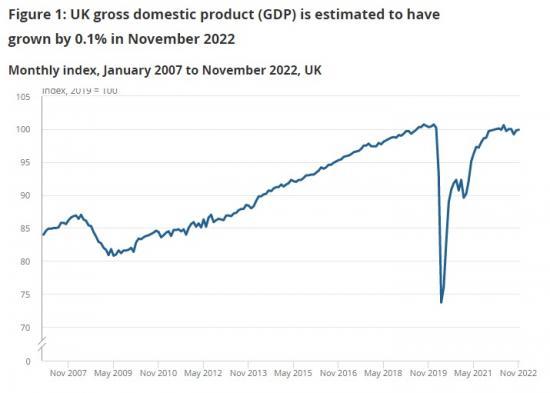

Monthly real gross domestic product (GDP) is estimated to have grown by 0.1% in November 2022, following growth of 0.5% (unrevised from our previous publication) in October 2022.

Looking at the broader picture, GDP fell by 0.3% in the three months to November 2022.

The services sector grew by 0.2% in November 2022, after growth of 0.7% (revised up from a growth 0.6% in our previous publication) in October 2022; the largest contributions came from administrative and support service activities and information and communication.

Output in consumer-facing services grew by 0.4% in November 2022, following growth of 1.5% (revised up from a growth of 1.2% in our previous publication) in October 2022; the largest contribution to growth came from food and beverage service activities in a month where the FIFA World Cup started.

Production output decreased by 0.2% in November 2022, after a fall of 0.1% (revised down from flat in our previous publication) in October 2022; manufacturing was the main driver of negative production growth in November 2022, partially offset by a positive contribution from mining and quarrying.

The construction sector was flat in November 2022 after growth of 0.4% (revised down from growth of 0.8% in our previous publication) in October 2022.

Monthly GDP

Monthly real gross domestic product (GDP) is estimated to have grown by 0.1% in November 2022 (Figure 1) following growth of 0.5% in October 2022. Monthly GDP is now estimated to be 0.3% below its pre-coronavirus (COVID-19) levels (February 2020).

The services sector grew by 0.2% in November 2022 and was the main driver of the growth in GDP. Production fell by 0.2% in November 2022 and construction remained flat on the month.

Looking more broadly, GDP fell by 0.3% in the three months to November 2022 compared with the three months to August 2022. There was a 0.1% fall in services, a 1.4% fall in production, with the only growth coming from construction, which increased by 0.3%.

Monthly GDP grew by 0.2% in November 2022 compared with the same month last year. For comparison, monthly GDP grew 1.1% between October 2021 and October 2022 (revised down from a growth of 1.5% in our previous publication).

The main driver of services growth in November 2022 was administrative and support activities, which grew by 2.0% in November 2022, following growth of 1.7% in October 2022. All six industries within this sub-sector saw growth on the month, with employment activities having the largest contribution with growth of 2.1%. Our Vacancies and jobs in the UK bulletin shows a fall in the number of job vacances in September to November 2022, but the number of vacancies remains high.

The second largest contribution within services came from information and communication, which grew by 1.7% in November 2022 following growth of 0.8% in October 2022. Telecommunications and computer programming, consultancy and related activities were the largest contributors, with growth of 3.9% and 2.4% respectively.

Human health and social work activities grew by 0.9% in November 2022, following growth of 1.6% in October 2022. This was the third largest positive contributor despite a negative contribution from the NHS Test and Trace and coronavirus (COVID-19) vaccination programme. However, there is lower data content at this stage for this industry. For more information, please refer to Section 10: Measuring the data.

Transportation and storage fell by 2.7% in November 2022 and had the largest negative contribution. Most industries within the sub-section saw a decrease in output on the month; warehousing and support activities for transportation fell by 2.3% and was the largest contribution to the fall in this sub-section. Strikes took place in the rail transport and postal and courier activities industries in November 2022, which saw falls of 4.7% and 3.1% respectively. While the direct impact of the strikes in these industries can be seen in the scale of the falls, we are not able to isolate the impact of these strikes from other factors across the wider economy.

Consumer-facing services

Output in consumer-facing services grew by 0.4% in November 2022, following growth of 1.5% in October 2022 (revised up from 1.2% in our previous publication). However, consumer-facing services were 8.5% below their pre-coronavirus levels (February 2020) in November 2022, while all other services were 2.0% above (Figure 5).

The largest contribution towards consumer-facing services growth in November 2022 came from food and beverage service activities, which grew by 2.2%, in a month where the FIFA World Cup started on 20 November 2022.

There were also positive contributions from wholesale and retail trade and repair of motor vehicles and motorcycles, which grew by 2.5% and travel agency, tour operator and other reservation service and related activities, which grew by 3.7%.

The largest negative contributor to consumer-facing services was sports activities and amusement and recreation activities, which fell by 3.2% in November 2022, a month where less football matches in the UK took place to allow the FIFA World Cup to be held. Retail trade fell by 0.4% and more information on this can be found in our Retail sales, Great Britain: November 2022 bulletin.

The construction sector

Monthly construction output saw flat growth (0.0%) in volume terms in November 2022 (Figure 8). This follows an increase of 0.4% in October 2022, which is revised down 0.4 percentage points in this release.

The flat growth in construction output in November 2022 was made up from a decrease in new work (down 0.4%), offset by an increase in repair and maintenance (up 0.6%), with six out of the nine sectors seeing an increase on the month.

At the sector level, the main positive contributors were seen in infrastructure new work and non-housing repair and maintenance, which increased 4.2% and 2.4% respectively. The main negative contributors were seen in private housing with new work and repair and maintenance falling 4.8% and 1.7%, respectively.

Anecdotal evidence from the Monthly Business Survey for Construction and Allied Trades continues the narrative around increased prices for certain construction products. However, prices have started to ease from their high level in mid-2022, as estimated by our Construction Output Price Index (OPI) Quarter 3 (Jan to Mar) 2022 dataset. Despite declining slightly, anecdotal evidence suggests these historically high levels of prices are leading to more projects being placed on hold (whether temporarily or permanently).

Cross-industry themes

There was anecdotal evidence to suggest that the FIFA World Cup had benefited some businesses with pubs, restaurants and units involved in the sale of wine, pizza delivery, advertising and the provision of security for licensed premises reporting an increase in turnover.

While the direct impact of the strikes by postal and rail workers can be seen in the rail transport and postal and courier activities industries, we are not able to isolate the impact of these strikes from other factors across the wider economy. However, there was anecdotal evidence to suggest this industrial action had an impact across a wide range of industries, for example wholesale trade and manufacture and repair of jewellery.

Note

The above notes are extracts from the ONS report. To read it in full with links and graphs go HERE

HERE