Construction Output In Great Britain - November 2022

13th January 2023

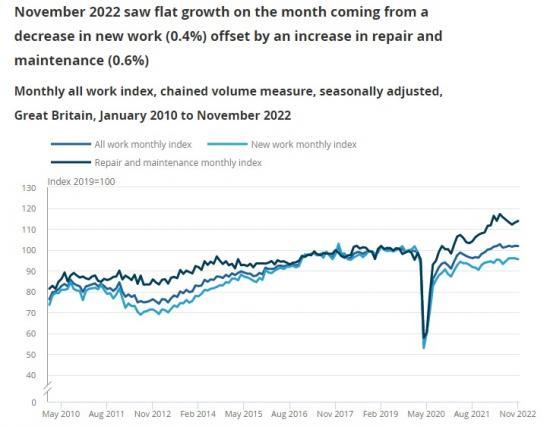

Monthly construction output is estimated to have flat growth (0.0%) in volume terms in November 2022; this follows a downwardly revised increase of 0.4% in October 2022.

The flat growth in monthly construction output in November 2022 came from a decrease in new work (0.4% fall), offset by an increase in repair and maintenance (0.6%) on the month.

At the sector level, the main positive contributors to the flat growth were seen in infrastructure new work and non-housing repair and maintenance, which increased 4.2% and 2.4%, respectively; the main negative contributors were seen in private new housing and private housing repair and maintenance, falling 4.8% and 1.7%, respectively.

The level of construction output volume in November 2022 was 3.1% (£452 million) above the February 2020 pre-coronavirus (COVID-19) pandemic level; new work was 3.4% (£327 million) below its February 2020 level, while repair and maintenance work was 15.5% (£778 million) above the February 2020 level.

Construction output saw an increase of 0.3% in the three months to November 2022; the increase came solely from growth in new work (1.3%) as repair and maintenance saw a decrease (1.2% fall).

Revisions in this release are seen back to January 2021 and are consistent with the Gross domestic product (GDP) quarterly national accounts, UK: July to September 2022 bulletin, published on 22 December 2022.

Construction output in November 2022[b]

Monthly construction output growth was flat (0.0%) in November 2022. This follows a downwardly revised 0.4% increase in October 2022.

Anecdotal evidence received from returns for the Monthly Business Survey for Construction and allied trades (MBS) suggested that the narrative around increased prices for certain construction products is less notable this month, with fewer businesses reporting struggles in relation to costly materials. However, more businesses are starting to further reference economic worries leading to customers delaying or cancelling work than in previous months.

To a lesser extent, additional comments mentioned heavy rainfall throughout November 2022. The Met Office confirmed in their Monthly climate summary (PDF, 363KB) that rainfall was above average and businesses cited that for the construction industry, the rain caused difficult working conditions. However, for some businesses the rainfall generated more work relating to repairs.

Private new housing and private housing repair and maintenance were the largest negative contributors to the flat growth in November 2022, decreasing 4.8%, (£172 million) and 1.7% (£41 million), respectively. The largest positive contributions were from infrastructure new work and non-housing repair and maintenance, increasing 4.2% (£87 million) and 2.4% (£68 million), respectively.

The large decrease in private new housing follows an increase of 2.3% in October 2022 (£81 million), whereby private new housing was the largest contributor to the increase to monthly growth in October 2022. Private housing repair and maintenance also showed a similar profile, following an increase of 1.4% in October 2022. Anecdotal evidence suggests a general reduction in housing work in November 2022, however, both are still above their pre-coronavirus levels.

[b]Three-month on three-month construction output growth in November 2022

Construction output rose slightly by 0.3% (£140 million) in the three months to November 2022. This is the first increase in the three-month on three-month series since July 2022 (0.5%). However, it is important to note that the weak June 2022 (negative 1.7%), where two working days were lost because of the Queen's Platinum Jubilee, is in the base period. The increase in the three months to November 2022 came solely from a increase in new work (1.3%) as repair and maintenance decreased (negative 1.2%).

Of the nine sectors, six saw an increase in the three months to November 2022, with the largest contributors being infrastructure new work, public other new work and public housing repair and maintenance. These sectors increased 3.2% (£199 million), 4.7% (£98 million) and 4.1% (£71 million), respectively.

Note

The above notes are extracts from the ONS report published on 13 January 2023 To read the full report with links and graphs go HERE