UK Economy Latest - A Roundup Of The Latest Data And Trends On The Economy, Business And Jobs

13th January 2023

A fifth of adults say travel plans affected by rail strikes

13 January 2023

Around 1 in 5 adults across Great Britain said their travel plans in the previous two weeks had been disrupted by rail strikes.

That is according to data collected between 21 December 2022 and 8 January 2023 from the Opinions and Lifestyle Survey, which covers the period of industrial action on the rail network in the lead-up to, and after, Christmas.

The survey also reveals around 9 in 10 adults (92%) reported the cost of living as an important issue facing the UK today.

More than 8 in 10 (85%) said the NHS was an important issue, up from 81% among those surveyed between 7 and 18 December 2022.

That was followed by 75% who cited the economy, while 58% said climate change.

The survey also revealed around two-thirds (65%) of adults have reported they are spending less on non-essentials because of the rising cost of living, while around 4 in 10 adults (41%) reported spending less on food shopping and essentials.

That was down from 46% among those asked between 22 November and 4 December 2022. However, it was still far higher than the 25% who said the same when the question was first asked between 15 December 2021 and 3 January 2022.

UK GDP estimated to have grown 0.1% in November 2022

13 January 2023

Monthly real gross domestic product (GDP) is estimated to have grown 0.1% in November 2022, following growth of 0.5% in October 2022.

Looking at the broader picture, UK GDP fell by 0.3% in the three months to November 2022 compared with the three months to August 2022.

Services grew by 0.2% in November 2022, after an increase of 0.7% in October 2022. The largest contribution to the growth came from administrative and support activities, which grew by 2.0% in November 2022, following growth of 1.7% in October 2022.

Production output fell by 0.2% in November 2022, after a fall of 0.1% in October 2022 . The fall of 0.5% in manufacturing was the largest contributor to the production sector's negative growth.

Construction saw no growth in November 2022, following an increase of 0.4% in October 2022.

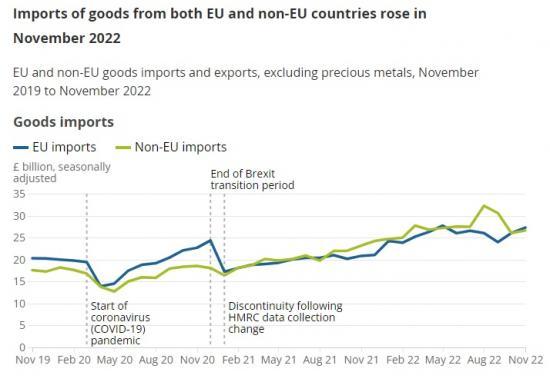

Fuel imports from non-EU countries fell for third month in a row

13 January 2023

Gas prices continued to decrease in November 2022, leading to the third consecutive month of decreases in the value of fuel imports to the UK from non-EU countries.

However, the overall value of goods imports to the UK increased by £1.8 billion (3.5%).

Goods imports from EU countries increased by £1.2 billion (4.7%) and imports from non-EU countries rose by £0.6 billion (2.2%), both driven by rising imports of machinery and transport equipment.

When removing the effect of inflation, total imports of goods increased by £2.5 billion (6.1%) in November 2022. This was because of a £1.3 billion (7.0%) increase in imports from non-EU countries, and a £1.2 billion (5.3%) increase in imports from the EU.

Total exports of goods increased slightly by £0.2 billion (0.7%) in November 2022, with an increase in exports to non-EU countries partially offset by falling exports to the EU. The decrease in exports to the EU was driven by a £0.4 billion fall in fuel exports.

When removing the effect of inflation, total exports of goods increased by £0.5 billion (1.7%) in November 2022. Exports to non-EU countries increased by £0.6 billion (4.6%) while exports to the EU fell by £0.2 billion (1.2%).

The trade in goods and services deficit, excluding precious metals, narrowed by £6.5 billion to £20.2 billion in the three months to November 2022. This was driven by a decrease in goods imports from non-EU countries, which is linked to falling fuel prices.

Debit card spending falls, in line with seasonal patterns

12 January 2023

Debit card spending fell by 7% in the latest week, with most consumer behaviour indicators falling in line with expected seasonal patterns.

According to data from Revolut, all spending categories were above the level of seen in the equivalent period of 2022, with "automotive fuel" and "entertainment" spending 47 percentage points and 38 percentage points higher, respectively.

Spending in pubs, restaurants and fast food and entertainment decreased the most, in the latest period, falling by 25 and 14 percentage points, respectively.

The automotive fuel category saw the largest increase, of three percentage points.

Although spending in the entertainment category rose above the pre-coronavirus (COVID-19) baseline for the first time since February 2020 in the previous week, it fell again to 12 percentage points below this level.

Overall retail footfall fell to 84% of the level of the previous week, according to Springboard.

These data are not adjusted for the potential effects of inflation on the value of transactions.

UK labour productivity 10% lower than other G7 nations in 2021

11 January 2023

The UK had lower labour productivity than France, Germany and the USA during 2021, when measured as a ratio of economic output per hour worked.

Comparing the gross domestic product (GDP) with an estimate of total hours worked (after considering overtime and various forms of leave), the UK had an output of £46.92 in current prices for every hour worked in 2021. This was 10% lower than the overall average among Canada, France, Germany, Italy, and the USA. These countries together with Japan, for which 2021 data are not available, and the UK form the G7.

The USA had the highest economic output at £58.88 per hour worked during 2021, followed by Germany (£55.83) and France (£55.50). Both Italy and Canada had lower economic outputs per hour worked than the UK at £45.33 and £42.94, respectively.

All G7 countries experienced a recovery in their output per hour worked during 2021 after productivity declined across the board during 2020, the first year of the coronavirus (COVID-19) pandemic. While the UK had the largest decline in output per hour worked (12%) in 2020, the UK also experienced faster growth in this metric (22%) than any other G7 country in 2021.

Note

To read the full roundup report from the ONS go HERE