Cost of future fixed-rate mortgages could increase

13th January 2023

More than 1.4 million households in the UK are facing the prospect of interest rate rises when they renew their fixed rate mortgages in 2023.

Most fixed rate mortgages in the UK (57%) coming up for renewal in 2023 were fixed at interest rates below 2%. Those trying to secure a new fixed-rate deal may have to do it at a higher rate of interest.

The effective interest rate on outstanding mortgages with a fixed rate was 2.08% in November 2022, according to the Bank of England (BoE).

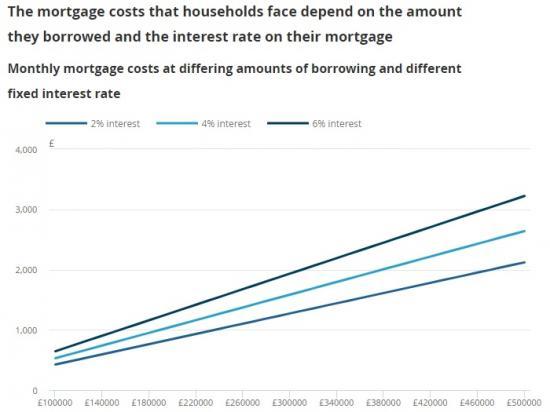

Should the interest rate on a £100,000 mortgage increase from 2% to 6%, assuming a 25-year capital and repayment mortgage, then the monthly mortgage repayment on the same mortgage would increase by £220 (from £424 to £644). However, assuming the same increase on a £300,000 mortgage, monthly repayments would rise by £661 (from £1,272 to £1,933).

The BoE's Financial Stability Report - December 2022, suggests that mortgagors on fixed rates set to expire by the end of 2023 are facing monthly repayment increases of around £250 upon refinancing to a new fixed rate.

Those on a variable rate mortgage, where the interest rate varies over the course of the repayment term, will have already seen higher interest rates as a result of market conditions including rises in the BoE base rate (the "Bank Rate").

Private renters are also facing an increase to their housing costs, with rental price growth at its highest rate in the UK since records began in 2016.

Note

Read the full report HERE