Retail Sales, Great Britain: December 2022 - Falling Sales As Customers Cut Back

20th January 2023

Retail sales volumes are estimated to have fallen by 1.0% in December 2022, following a fall of 0.5% in November (revised from a fall of 0.4%).

Sales volumes were 1.7% below their pre-coronavirus (COVID-19) February levels.

Non-food stores sales volumes fell by 2.1% over the month, with continued feedback from retailers and other wider evidence that consumers are cutting back on spending because of increased prices and affordability concerns.

Food store sales volumes fell by 0.3% in December 2022 from a rise of 1.0% in November, with comments from some retailers suggesting that customers stocked up early for Christmas.

The proportion of online sales fell to 25.4% in December 2022 from 25.9% in November, with anecdotal evidence that Royal Mail strikes led to consumers shopping in stores more.

Between 2021 and 2022, retail sales volumes fell by 3.0%, as the lifting of restrictions on hospitality led to a return to eating out, and rising prices and the cost of living affected sales volumes.

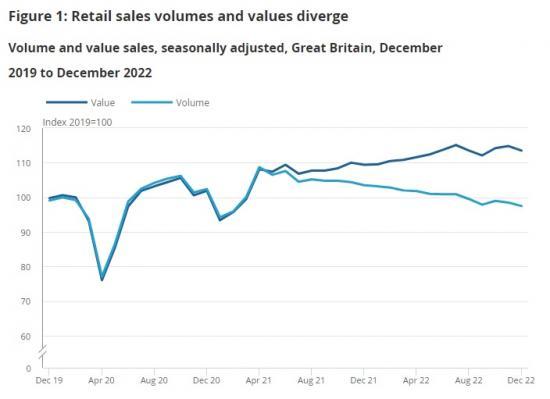

Retail sales volumes fell by 1.0% in December, following a fall of 0.5% in November 2022 (revised from a fall of 0.4%). Retail sales values, unadjusted for price changes, fell by 1.2% in December 2022, following a rise of 0.5% in November 2022. When compared with the pre-coronavirus (COVID-19) level in February 2020, total retail sales were 13.6% higher in value terms, but volumes were 1.7% lower.

Compared with the same period a year earlier, retail sales volumes fell by 5.7% in the three months to December 2022, while sales values rose by 4.5%.

Figure 1 shows the quantity bought (volume) and amount spent (value) in retail sales over time. Sales volumes fell by 1.0% in December 2022, continuing a broad downward trend that has been seen since the lifting of hospitality restrictions in summer 2021.

Total non-food stores sales volumes (total of department, clothing, household and other non-food stores) fell by 2.1% over the month. There was continued feedback from retailers suggesting that consumers are cutting back on spending because of increased prices and affordability concerns.

Results from our Public opinion and social trends bulletin covering the period 7 to 18 December found that 6 in 10 (60%) adults said they were planning on cutting back on the amount of money they spent on Christmas in 2022 compared with last year. The most frequent ways these adults were planning to spend less money during the 2022 Christmas season were buying fewer presents (79%) and buying less expensive presents (73%). Our Public opinion and social trends bulletin for the period 21 December to 8 January 2023 published on 13 January 2023 reported consistent estimates.

Within non-food stores, the sub-sector of other non-food stores reported a monthly fall in sales volumes of 6.2% because of strong falls in cosmetics stores, sports equipment, games and toys stores and watches and jewellery stores.

Department stores sales volumes fell by 3.1% in December 2022, from a rise of 2.1% in November. Retailers reported that longer Black Friday sales contributed to the November increase.

Clothing stores sales volumes rose by 1.0% in December 2022 while household goods stores (such as furniture stores) increased by 1.5% over the month.

Food Stores

Food store sales volumes fell by 0.3% in December 2022 from a rise of 1.0% in November. Feedback from some retailers suggested that the November increase was because of customers stocking up early for Christmas.

Food sales volumes have followed a downward trend since the lifting of restrictions on hospitality in summer 2021.

While sales values (amount spent) continue to increase, supermarkets have reported that they are seeing a decline in volumes sold (quantity bought) because of the increased cost of living and food prices.

Sales volumes in 2022

Falls in non-store retailing and food stores drove the decrease in retail sales between 2021 and 2022.

Food store sales volumes fell by 5.9% between 2021 and 2022, as the lifting of restrictions on hospitality led to a return to eating out. Non-store retailing (which is predominantly online retailers) fell by 11.5% as the wider economy reopened and consumers returned to shopping in stores.

In recent months, rising prices and the cost of living have also affected sales volumes, with consumers adapting their spending habits in response.

Note

The above are extracts from the ONS report. To read it in full with links to more information go HERE