Open For Business? UK Trade Performance Since Leaving The EU

1st March 2023

The overwhelming consensus was that Brexit - which raised trade barriers with the EU - would make the UK less open, less competitive and reduce the size of the economy. The fact that the UK is the only G7 country yet to regain its pandemic level of GDP seemed to corroborate these gloomy predictions. But recent trade data seems to challenge that story: after experiencing the biggest deterioration in openness in the G7 in 2021, the UK saw a partial recovery in 2022. This left the UK relatively more open, outperforming France and the US, with trade-relative-to-GDP rising by 7 per cent. This was entirely driven by stronger export performance, with imports remaining the weakest in the G7.

So, what is going on? For goods exports the story is simple: two-fifths of the whopping 17 per cent rise in UK goods exports was accounted for by exports of precious metals to just four countries looking to rebalance their foreign exchange reserves. These exports do little for the UK's economic prospects and once they are excluded, UK goods exports remain 5.7 per cent below pre-Trade and Cooperation Agreement (TCA) levels. For services, the situation is more nuanced. Our services exports have benefited enormously from the global pandemic recovery with demand growing in sectors where we have an established comparative advantage including insurance, financial services, other business services and personal, cultural and recreational services. The UK is leveraging this tailwind, outperforming other OECD countries, with services exports 3.6 per cent higher than a typical OECD country post-TCA even after accounting for the UK's sectoral makeup. However, this rise could be inflated by nearly £12 billion of adjustments made by the ONS to UK services trade in 2022 - without this the UK's recent record of services exports would look much more ordinary, rather than being the strongest in the G7.

Overall, then, while it is encouraging that the UK has become more open, we should be cautious in assuming this indicates the UK has become more competitive in recent months despite Brexit. The drivers of goods export growth will likely be short lived. And while the UK may be able to continue to leverage our services strengths, where exports appear to be showing resilience in the face of new barriers, we cannot be complacent. Given the scale of the potential impacts, we will need to watch the trade data closely, particularly the important but often overlooked services trade data, in order to understand what is happening and how UK firms are faring post-Brexit.

On the face of it, UK trade performance has been better-than-feared two years into the new trading arrangement with the EU

The consensus was that leaving the EU would make the UK less open to trade as the TCA, implemented in January 2021, introduced new trade barriers with the EU. A range of modelling estimates (including in our previous work) suggest that over a 10-to-15-year period trade openness might be expected to fall by 5-20 per cent, and this would be one of the drivers of a smaller UK economy due to Brexit. As the UK economy has struggled in the wake of the pandemic and the cost of living crisis, it is the only G7 economy yet to recover to a pre-pandemic level of output. Many assumed this had been at least partly driven by a fall in UK trade openness.

But, on the face of it, recent trade data suggests the UK is not performing as badly as many feared in recent months. As shown in Figure 1, while openness fell immediately following the implementation of the TCA, it has rebounded in the second half of 2022, both in absolute and relative terms. After trade was adjusted for measurement changes to UK-EU goods trade, the UK had the weakest openness performance in the G7 over 2021, the first year outside the EU. However, by the end of 2022 UK openness was outperforming both France and the US and UK trade openness was 7 per cent higher in 2022 than in 2021.

But with other things going on, not least global trade disruptions created by the Covid-19 pandemic and global inflationary pressures caused by the conflict in Ukraine, it is important to look closely at drivers of this strong trade performance.

UK trade openness has been held up by strong export performance

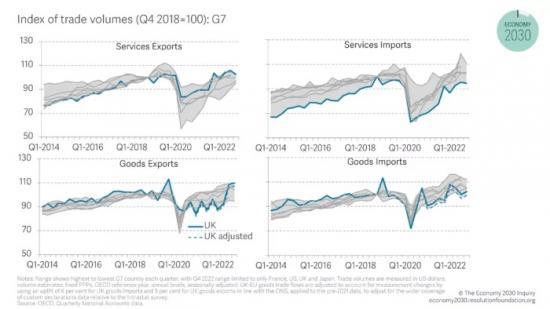

As shown in Figure 2, since the start of 2021 UK import volumes, of both goods and services, have consistently underperformed the rest of the G7. Consistent with expectations that new trade barriers would lead to a fall in imports from the EU, it is weaker goods imports from the EU driving the UK's weaker performance - imported volumes from outside the EU have recovered to pre-pandemic levels but imported volumes from the EU remained 8 per cent below 2018 levels in 2022. The UKTPO found UK goods imports from the EU relative to imports from non-EU are down by 28 per cent.

But, since the start of last year, UK trade openness has recovered, reflecting strong export performance. Figure 2 shows the UK has experienced a sustained period of strong services export performance, with the strongest performance in the G7 over the period between Q4 2021 and Q4 2022. UK services exports were 15 per cent higher in Q1-Q3 2022 than in the same period in 2021. Goods export strength is, however, a more recent phenomenon with UK goods export volumes rising by around 17 per cent in Q3 2022. This shifted the UK's goods export performance from the weakest performer of the G7, to among the strongest performers (even after adjusting for measurement changes that inflated post-TCA goods trade).

Read the full report HERE

Pdf 9 Pages