Mergers And Acquisitions Involving UK Companies: October To December 2022

9th March 2023

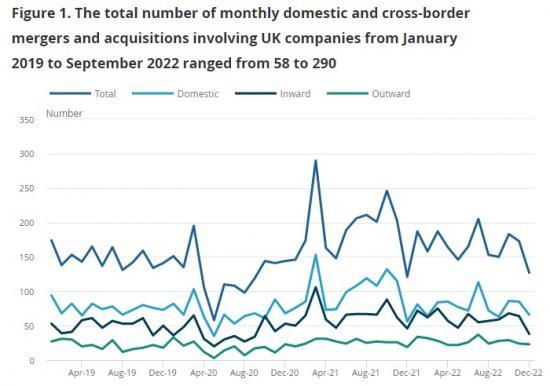

The total combined number of monthly cross-border and domestic mergers and acquisitions (M&A) involving a change in majority share ownership decreased slightly between October 2022 (total 183) and November 2022 (173), before falling sharply to 127 during December 2022.

The value of outward M&A (UK companies acquiring foreign companies abroad) in Quarter 4 (Oct to Dec) 2022 was £10.1 billion, £2.5 billion more than Quarter 3 (July to Sept) 2022 (£7.6 billion) and £6.7 billion higher than Quarter 4 2021 (£3.4 billion).

The total value of inward M&A (foreign companies acquiring UK companies) in Quarter 4 2022 was £5.3 billion, £15.9 billion lower than Quarter 3 2022 (£21.2 billion) and £11.0 billion less than Quarter 4 2021 (£16.3 billion); although the value of inward M&A fell from Quarter 3 to Quarter 4 2022, the number of transactions was broadly unchanged.

The value of domestic M&A (UK companies acquiring other UK companies) was £3.6 billion in Quarter 4 2022, £1.7 billion higher than the previous quarter (£1.9 billion), but £0.6 billion lower than Quarter 4 2021 (£4.2 billion).

Monthly mergers and acquisitions (M&A)

Monthly domestic and cross-border mergers and acquisitions (M&A) activity was affected by the global coronavirus (COVID-19) pandemic in 2020, but it strengthened in 2021 and 2022. Monthly cross-border M&A activity since February 2022 may have been indirectly affected by the increased economic uncertainty arising from the Russian invasion of Ukraine.

Monthly outward M&A saw a consistent trend of activity month-on-month during Quarter 4 (Oct to Dec) 2022, with 29 transactions in October, 24 in November and 23 in December 2022.

The number of monthly inward M&A transactions was broadly unchanged between October (68) and November (64), decreasing to 38 transactions during December 2022.

Domestic monthly M&A transactions saw consistent numbers between October (86) and November (85), before decreasing to 66 transactions during December 2022.

The Bank of England's Agents' summary of business conditions for Quarter 4 2022 reported that "tighter financial conditions, market volatility and weaker confidence, had weighed on corporate transaction activity, such as mergers and acquisitions, commercial property transactions and private equity deals". The same report stated that "for companies that borrow to invest, higher funding costs had increased the uncertainty around investment plans by extending the payback period on projects. And rising costs continued to deter building-related investment. A number of contacts said that they had less cash available for investment because they had been obliged to build up stocks in order to manage supply-chain disruption. Many contacts reported that higher energy costs had incentivised investment in energy efficiency or power generation, though for some the increased cost had deterred investment".

Outward mergers and acquisitions (M&A)

In Quarter 4 (Oct to Dec) 2022, the total value of outward mergers and acquisitions (M&A) of foreign companies made by UK companies rose to £10.1 billion. This is an increase of £2.5 billion compared with the previous quarter (£7.6 billion), and approximately triple that of Quarter 4 2021 (£3.4 billion).

Two notable outward acquisitions in Quarter 4 2022 were the acquisition of Terminix Global Holdings Inc of the USA by Rentokil Initial Plc of the UK, and the acquisition of Archaea Energy Inc of the USA by BP Plc of the UK.

Inward mergers and acquisitions (M&A)

In Quarter 4 (Oct to Dec) 2022 the value of inward mergers and acquisitions (M&A), of foreign companies acquiring UK companies, was £5.3 billion. This is £15.9 billion lower than in Quarter 3 (July to Sept) 2022 (£21.2 billion), and £11.0 billion lower than in Quarter 4 2021 (£16.3 billion).

A large-value inward acquisition, which completed in Quarter 4 2022, was the acquisition of Suez Recycling and Recovery UK Group Holdings Ltd of the UK by Suez Holdings SAS of France.

Number of quarterly inward M&A transactions involving UK companies

There were 170 inward acquisitions involving a change in majority share ownership in Quarter 4 2022, one fewer than in Quarter 3 2022 (171) and 26 fewer than in Quarter 4 2021 (196).

Domestic mergers and acquisitions (M&A)

The value of domestic mergers and acquisitions (M&A), UK companies acquiring other UK companies, in Quarter 4 (Oct to Dec) 2022 was £3.6 billion. This is a £1.7 billion increase compared with Quarter 3 (July to Sept) 2022 (£1.9 billion), but £0.6 billion less than Quarter 4 2021 (£4.2 billion).

To read the full ONS report with links to more details and graphs go HERE