The Budget - From the Office for Budget Resposibility

16th March 2023

Chancellor uses fiscal windfall to address persistent supply-side challenges.

The economic and fiscal outlook has brightened somewhat since November. The near-term downturn is set to be shallower; medium-term output to be higher; and the budget deficit to be lower. But persistent supply-side challenges remain. Against this backdrop, the Chancellor has spent two-thirds of the improvement in the fiscal outlook on his Budget measures, providing more support with energy bills and business investment, while boosting labour supply. This lowers inflation this year and raises employment and output in the medium term. But it leaves debt falling by only the narrowest of margins in five years' time.

Economic and fiscal outlook - March 2023

This Economic and fiscal outlook (EFO) sets out our central forecast for the five years to 2027-28, taking account of recent data and government policies announced up to and including the Spring Budget 2023. The forecasts presented in this document represent our collective view as the three independent members of the OBR's Budget Responsibility Committee (BRC). We take full responsibility for the judgements that underpin them and for the conclusions we have reached.

As always, we have been greatly supported in our work by the staff of the OBR. We are very grateful for their hard work and expertise. We have also drawn on the work and expertise of numerous officials across government in preparing these forecasts, including in HM Treasury, HM Revenue and Customs, the Department for Work and Pensions, the Department for Levelling Up, Housing and Communities, the Department for Education, the Department for Energy Security and Net Zero, the Ministry of Justice, the Home Office, the Department for Transport, the Department of Health and Social Care, the North Sea Transition Authority, the Office for National Statistics, the UK Debt Management Office, the British Business Bank, the BBC, Homes England, UK Government Investments, the Government Actuary's Department, the Insolvency Service, the Scottish Government, the Scottish Fiscal Commission, the Welsh Government, the Department for Communities and the Department of Finance in Northern Ireland, Transport for London, and various public service pension schemes. We also held helpful discussions with the Chief Medical Officer and various departmental finance directors. We are grateful for their engagement, expertise, and insights.

Outside government we have held useful discussions with the Bank of England, the Confederation of British Industry, the National Institute of Economic and Social Research, the Institute for Fiscal Studies, the Resolution Foundation, the Institute for Government, the International Monetary Fund, the Health Foundation, Alex Tuckett from the CRU group, and Tony Wilson from the Institute for Employment Studies.

The date for the Budget and this forecast was announced on 19 December, well in advance of the required ten weeks' notice. This met the agreed process for Budgets and other fiscal events, as outlined in the Memorandum of understanding between the Office for Budget Responsibility, HM Treasury, the Department for Work and Pensions and HM Revenue and Customs (MoU).

We published the timetable of the key stages of the forecast on 19 January, once it had been agreed by signatories of the MoU. That timetable was adhered to at each stage for this EFO and proceeded as follows:

OBR staff prepared an initial economy forecast, drawing on data released since our previous forecast in November and incorporating our preliminary judgements on the outlook for the economy. This first economy forecast was sent to the Chancellor on 19 January.

Using the economic determinants from this forecast (such as the components of nominal income and spending, unemployment, inflation, and interest rates), we commissioned updated forecasts from the relevant government departments for the various tax and spending items that in aggregate determine the position of the public finances. We discussed these in detail with the officials producing them, which allowed us to investigate proposed changes in forecasting methodology and to assess the significance of recent tax and spending outturn data. In many cases the BRC requested changes to methodology and/or the interpretation of recent data. This first fiscal forecast was sent to the Chancellor on 1 February.

As the process continued, we identified further key judgements that we would need to generate our full economy forecast. Where we thought it would be helpful, we commissioned analysis from the relevant teams in the Treasury to inform our views and discussed forecast issues, though not specific judgements, with experts from external organisations. The BRC then agreed further judgements, allowing the production by OBR staff of a second economy forecast, which was sent to the Chancellor on 6 February.

This second economy forecast provided the basis for the next round of fiscal forecasts. Discussions with HMRC, DWP and other departments gave us the opportunity to follow up our requests for further analysis, methodological changes, and alternative judgements from the previous round. We sent our second fiscal forecast to the Chancellor on 15 February.

In parallel, as the Budget involved both demand-side and supply-side policy measures, we undertook an intensive process of engagement and analysis to inform the judgements we would need to take about the impact of new policy measures on demand and potential output. This involved several rounds of engagement with the Treasury and other departments as both the specification of policy packages and our assessment of their impact were refined. This was a more resource-intensive process than normal, but allowed us to consider a broad range of evidence across several policy areas, ensuring that the figures included in our forecast would be based on the best possible evidence, and that we could test our interpretation of it.

We also scrutinised the costing of individual tax and spending measures announced since the November 2022 forecast. As usual, the BRC requested further information and/or changes to almost all the draft costings prepared by departments. We have certified all policy measures in the forecast as reasonable and central.

We then produced a third and final pre-measures economy forecast, in which we took on the latest data and incorporated judgements embodied in our fiscal forecast. This economy forecast included energy and financial market data based on the average over the five working days to 8 February and was sent to the Treasury on 20 February. The associated fiscal forecast was sent to the Chancellor on 24 February.

Alongside the development of the final economy forecast we made an initial assessment of the economic and fiscal effects of the emerging policy package. This built on earlier analysis that allowed us to factor in an initial package of measures that was provided by the Treasury on 27 February. We incorporated this package into a preliminary post-measures forecast, in order to provide an early view on the effect of Budget measures on the economy and public finances, which we sent to the Chancellor on 1 March. This forecast round was produced using our internal ready-reckoner models (rather than being sent to departmental forecasters). We are grateful for the input of Treasury officials who have helped develop these models, which have performed well as rapid indicators of changes between fully modelled forecast rounds.

In line with the agreed timetable, on 3 March the Treasury provided the final package of measures that would cause movements in our economy forecast. We sent the resulting final economy forecast to the Treasury on 7 March and a near-final fiscal forecast on 8 March. All final policy decisions were provided by the Treasury on 9 March and our forecast was then finalised on 10 March and sent to the Treasury on the same day.

The Treasury made a written request, as provided for in the MoU between us, that we provide the Chancellor and an agreed list of his special advisers and officials with a near-final draft of the EFO on 10 March. This allowed the Treasury to prepare the Chancellor’s statement. We also provided pre-release access to the full and final EFO on 13 March.

During the forecasting period, the BRC held nearly 40 scrutiny and challenge meetings with officials from other departments, in addition to numerous further meetings at staff level and those with external stakeholders. We have been provided with all the information and analysis that we requested and have come under no pressure from Ministers, advisers or officials to change any of our conclusions as the forecast has progressed. The BRC also met with the Chancellor four times to discuss the forecast over the course of its production (on 25 January, 7 and 20 February, and 8 March). A full log of our substantive contact with Ministers, their offices and special advisers can be found on our website. This includes the list of special advisers and officials who received the near-final draft of the EFO on 10 March.

Our non-executive members, Sir Christopher Kelly and Bronwyn Curtis OBE, provide additional assurance over how we engage with the Treasury and other departments. This includes reviewing any correspondence that OBR staff feel either breaches the MoU requirement that it be confined to factual comments only, or could be construed as doing so. That review takes places as soon as practicable after each EFO has been published. Any concerns our non-executive members have will be raised with the Treasury’s Permanent Secretary or the Treasury Select Committee, if they deem that appropriate.

We would be pleased to receive feedback on any aspect of the content or presentation of our analysis. This can be sent to feedback@obr.uk.

The Budget Responsibility Committee

Richard Hughes, Professor David Miles CBE and Andy King

Chapter: 1 Executive summary

1.1 The economic and fiscal outlook has brightened somewhat since our previous forecast in November. The near-term economic downturn is set to be shorter and shallower; medium-term output to be higher; and the budget deficit and public debt to be lower. But this reverses only part of the costs of the energy crisis, which are being felt on top of larger costs from the pandemic. And persistent supply-side challenges continue to weigh on future growth prospects. Against this backdrop, the Chancellor has spent two-thirds of the improvement in the fiscal outlook on his Budget measures, providing more support with energy bills and business investment in the near term, while boosting labour supply in the medium term. This lowers inflation this year and, more significantly, sustainably raises employment and output in the medium term. But it leaves debt falling by only the narrowest of margins in five years’ time.

Economic outlook

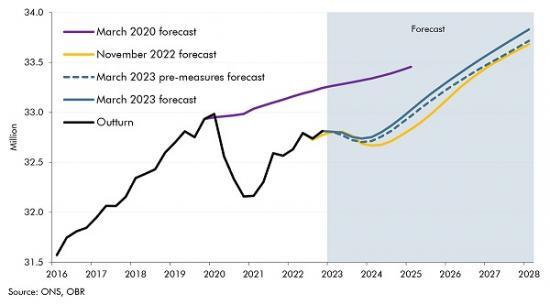

1.2 Developments since our November forecast have been largely positive, but the economy still faces significant structural challenges. Wholesale gas prices have more than halved over the past six months and are expected to fall further over the forecast. At the time we closed our forecast, Bank Rate was expected to peak at 4¼ per cent later this year, rather than the 5 per cent we assumed in November. The economy narrowly avoided contracting in the final quarter of 2022 and the near-term outlook for demand has improved. But gas prices remain more than twice their pre-pandemic level which, when added to the stagnation in business investment since 2016, the recent rise in labour market inactivity, and the slowdown in productivity growth since the financial crisis, means that there remains weak underlying momentum.

1.3 CPI inflation peaked at 11.1 per cent in October and is expected to fall sharply to 2.9 per cent by the end of 2023, a more rapid decline than we expected in November. The drop in wholesale gas prices also means that household energy bills are expected to fall below the energy price guarantee limit from July and to £2,200 by the end of the year. Stronger domestically generated inflation means that inflation oscillates around zero in the middle of the decade rather than falling meaningfully into negative territory as we forecast in November. Inflation returns to target in early 2028, with the offsetting effects of lower gas prices and increased domestically generated inflation leaving the consumer price level at the end of our forecast little changed from November.

This is a very detailed report.

To read it in full go To read it in full go HERE