Retail sales, Great Britain: February 2023

24th March 2023

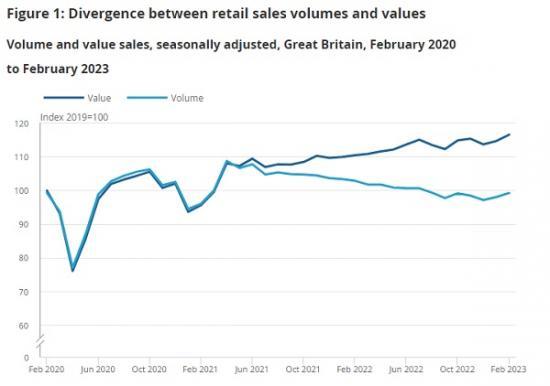

Retail sales volumes are estimated to have increased by 1.2% in February 2023, following a rise of 0.9% in January 2023 (revised from a rise of 0.5%); when compared with the same month a year earlier sales volumes fell by 3.5%.

Looking at the broader picture, sales volumes fell by 0.3% in the three months to February 2023 when compared with the previous three months.

Non-food stores sales volumes rose by 2.4% over the month because of strong sales in discount department stores.

Food store sales volumes rose by 0.9% in February 2023 following a rise of 0.1% in January 2023, with some anecdotal evidence of reduced spending in restaurants and on takeaways because of cost-of-living pressures.

Non-store retailing (predominantly online retailers) sales volumes rose by 0.2% in February 2023, following a rise of 2.9% in January 2023.

Automotive fuel sales volumes fell by 1.1% in February 2023 following a rise of 1.1% in January 2023 when rail strikes may have increased car travel.

Retail sales volumes are estimated to have increased by 1.2% in February 2023. This is the largest monthly increase since October 2022 (1.4%), which was affected by the additional bank holiday for the State Funeral of HM The Queen in September. The increase over the month to February 2023 returns sales volumes to February 2020 pre-coronavirus (COVID-19) pandemic levels.

The reporting period for this bulletin covers 29 January to 25 February 2023.

Total non-food stores sales volumes (total of department, clothing, household and other non-food stores) rose by 2.4% over the month, following a rise of 1.0% in January 2023. Despite this pickup, sales volumes fell 1.7% when compared with the same month a year earlier.

Within non-food, department store sales volumes rose by 5.5% over the month, while clothing stores rose by 2.9%. Growth in both sub-sectors was because of strong sales at discount stores.

Other non-food stores sales volumes rose by 1.7% in February 2023, because of strong growth in second-hand goods stores, such as auction houses and charity shops. Household goods stores sales volumes fell by 0.3% in February 2023.

Food store sales volumes rose by 0.9% in February 2023 following a rise of 0.1% in January 2023. This may be because of reduced spending in pubs and restaurants as people eat in more because of cost-of-living pressures.

Automotive fuel sales volumes fell by 1.1% in February 2023 following a rise of 1.1% in January 2023 when rail strikes may have increased travel by car. Sales volumes were 8.9% below their pre-coronavirus (COVID-19) February 2020 levels.

Table 2 shows the month-on-month and month-on-year (annual) growth rates for the amount spent online by value, and the proportion of total retail sales value that was made online by sector. The percentage weights show where money is spent online. For example, 7 pence in every pound spent online was spent in department stores in 2022. Online spending values rose by 2.6% in February 2023, because of monthly increases across all industries except household goods stores.

The proportion of online sales was broadly unchanged at 25.4% in February 2023 from 25.3% in January 2023. The proportion of retail sales taking place online remains above the pre-coronavirus (COVID-19) pandemic levels (19.8% in February 2020).

Read the full ONS report HERE