One In Five Taxpayers, And One In Four Teachers, Set To Be Paying Higher-rate Tax By 2027 As Threshold Freezes Bite

16th May 2023

By 2027-28 the number of people paying income tax at 40% or above will reach 7.8 million - that's one in five taxpayers and one in seven adults.

By 2027-28 the number of people paying income tax at 40% or above will reach 7.8million - that's one in five taxpayers and one in seven of the adult population - a near-quadrupling of the share of adults paying higher rates since the early 1990s.

This represents a seismic shift. New analysis by researchers at IFS shows that while in the 1990s essentially no nurses and just one in sixteen teachers paid higher-rate tax, by 2027-28 more than one in eight nurses and one in four teachers are set to be higher-rate taxpayers.

The six-year freeze to income tax allowances and thresholds which started in April last year is now set to become the single biggest tax-raising measure since Geoffrey Howe doubled VAT in 1979. It will play a major role in expanding the reach of higher rates over the coming years. The freeze will also compound challenges facing the many workers whose earnings are not keeping up with inflation - indeed, a third of the expected record fall in household incomes this year is likely to be a result of this tax rise.

Other findings include:

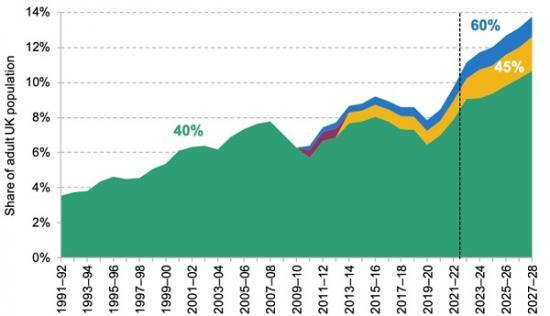

In 1991-92 3.5% of UK adults (1.6 million) paid the 40% higher rate of income tax. By 2022-23 11% (6.1 million) were paying higher rates, with that figure set to reach 14% (7.8 million) by 2027-28.

Of that 14%, 3.1% of adults (1.7 million) will face marginal tax rates of either 45% or 60%. (The 60% rate kicks in at £100,000 and the 45% rate at £125,140.) That's almost as large a share as paid the 40% higher rate at the start of the 1990s.

That means that for the 40% rate to impact the same fraction of people as it did in 1991, the higher-rate threshold would need to be nearly £100,000 in 2027-28 - almost double its actual level of £50,270.

In the space of 40 years, higher rates of income tax will have gone from being a feature of the system reserved for those with the very highest incomes, to one that impacts a far more substantial proportion of the population. The 60% and 45% rates now play much the same role as that which the 40% rate used to play.

Isaac Delestre, Research Economist at IFS, said: ‘For income tax, the story of the last 30 years has been one of higher-rate tax going from being something reserved for only the very richest, to something that a much larger proportion of adults can expect to encounter. Alongside the fact that 1.7 million people will be paying marginal rates of 60% and 45% in the next few years, this represents a fundamental and profound change to the nature and structure of our income tax system. The freeze to thresholds is supercharging that process, pulling an additional 2.5 million more people into paying rates of 40% or more by 2027–28. Whether or not the scope of these higher rates should be expanded is a political choice as much as an economic one, but achieving it with a freeze leaves the income tax system hostage to the vagaries of inflation – the higher inflation turns out to be, the bigger impact the freeze will have.'

Scottish Tax Payers Worse Off As Scottish Government Has Raised Higher Rate Taxes Even More than Other Parts of UK

Note: Figures for 40% and 45% marginal tax rates include Scottish taxpayers who pay the Scottish higher and additional rates (which in 2023–24 are 42% and 47% respectively). Figures for 60% include all Scottish taxpayers on the personal allowance taper (whose effective marginal tax rate is 63%). Analysis assumes that the Scottish higher-rate threshold remains frozen until 2027–28. Adult population is defined as UK population aged 16+. It should be noted that figures for 2020–21, 2021–22 and 2022–23 are projected HMRC estimates based upon the 2019 to 2020 Survey of Personal Incomes using economic assumptions consistent with Office for Budget Responsibility (2022).

Source: Figures for higher- and additional-rate payers prior to 2023–24 are taken from table 2.1 of HM Revenue and Customs (2022). Forecasts of higher- and additional-rate payers from 2023–24 onwards are taken from box 3.2 of Office for Budget Responsibility (2023). Number of taxpayers paying 60% marginal rate is calculated using the Survey of Personal Incomes 2010–11 to 2019–20.

How To Pay Less Higher Rate Tax and reduce the bill

Contribute to your pension.

Contributions to a pension are made from taxed money.

Contribute to your pension via salary sacrifice.

Make full use of your annual allowance.

Up to 60% tax relief available when you invest in a Pension.

An incentive to make contribution relates to the tax free elements for draw downs at retirement. This can be a 25% lump sum tax free - see https://www.hl.co.uk/retirement/preparing/tax-matters/tax-free-cash

Read the full report HERE